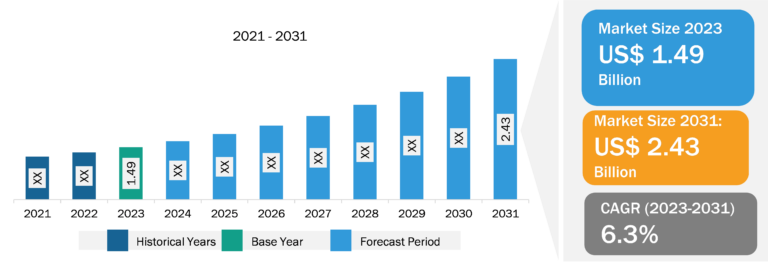

AR Waveguide Market

Increasing Demand for AR-based Devices Fuels AR Waveguide Market

The demand for AR-based devices is rapidly increasing across various industries, including healthcare, automobile, and entertainment, among others. According to Three Kit Inc., a visual commerce firm, it is estimated that the AR market will reach US$ 50 billion by the end of 2024. Advancements in AR content development and software tools have enabled the creation of compelling and interactive AR experiences, driving consumer engagement and brand recognition. Businesses are leveraging AR to deliver immersive product demonstrations, virtual try-on experiences, interactive training modules, and enhanced customer support services, thereby offering consumers an enhanced customer experience. As big tech invests more in augmented reality, AR-based devices are anticipated to become an integrated part of everyday life. In February 2020, Facebook (now Meta) acquired Scape, an augmented reality business that is creating a digital 3D representation of the physical world. Therefore, the growing demand for AR-based devices across various industries fuels the need for advanced waveguide technology, which drives the AR waveguide market.

AR Waveguide Market: Industry Overview

The report includes AR waveguide market forecast by type, application, and geography. Based on type, the market is segmented into geometric waveguide, holographic waveguide, and diffractive waveguide. Based on end user, the board management software market is segmented into consumer electronics, industrial, military, and others. Geographically, the market is categorized into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

In terms of revenue, North America dominated the AR waveguide market share in 2023. The North America AR waveguide market is segmented into the US, Canada, and Mexico. Augmented reality (AR) is becoming popular in North America across various sectors, including gaming & entertainment, industrial applications, and healthcare. This demand creates a requirement for key components that enable AR glasses to function, for example, waveguides. Further, North America is home to a few of the world’s largest technology giants, such as Google and Facebook, which are actively developing AR products. As a result, these companies are increasingly investing in research and development associated with AR, which fuels the expansion of the AR waveguide market.

The Asia Pacific AR waveguide market is experiencing significant growth, with countries such as Japan, South Korea, and China actively incorporating AR waveguide technology into their military operations. This adoption is driven by the potential of AR waveguides to enhance situational awareness, precision, and real-time tactical intelligence for soldiers. To meet the increasing demand for AR waveguides, key market players in the region are collaborating to scale up manufacturing capabilities. For example, in January 2024, DigiLens Inc. partnered with Kaynes Technology India Limited to expand waveguide manufacturing. Kaynes Technology, a provider of electronic component manufacturing for various sectors, including defense and aerospace, is strategically positioned as a DigiLens licensee to aid in the delivery of DigiLens’ flagship AR device—the DigiLens ARGO—in India. The collaboration will take place at Kaynes Semicon Pvt Ltd, a subsidiary of Kaynes Technology, in their Green Field plant in Hyderabad.

In SAM, there is a growing inclination toward AR technologies, and various players are taking initiatives to increase the adoption of AR and VR technologies. For instance, in April 2023, Meta announced the AR and VR Africa Metathon program in partnership with BlackRhino VR and Imisi 3D. The program aims to support African XR talents to build advanced solutions that demonstrate various use cases of the metaverse in Africa. Similarly, in the MEA, a few of the key players are launching products that utilize AR waveguides. For instance, AMS has partnered with Lochn Optronics, an AR optical module supplier, to drive the development of lightweight smart glasses with its newly released LBS diffraction waveguide AR module and prototype glasses featuring AMS’ new Vegalas RGB laser module. Thus, the rise in the number of such programs and initiatives across SAM and the MEA is creating favorable conditions for the growth of the AR waveguide market.

AR Waveguide Market: Competitive Landscape and Key Developments

The AR waveguide market analysis is carried out by identifying and evaluating key players in the market across different regions. Crystal Optech; DigiLens Inc.; Dispelix; Goertek; LetinAR; Lumus; NIL TECHNOLOGY; Optinvent; Shenzhen Lochn Optics Technology Co., Ltd; and WaveOptics Ltd are among the prominent players profiled in the AR waveguide market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. As per the company press releases, below are a few key developments:

- In 2023, NIL Technology launched NTLight Projector & Illuminator Solutions, our state-of-the-art technology for projection and illumination needs. NTLight is diffusers, custom-built dot-projectors, and integrated multiple-functionality optics.

- In 2023, Lumus, the pioneering developer of reflective waveguide technology for augmented reality (AR) eyewear, announced the introduction of its 2nd generation Z-Lens 2D waveguide architecture that builds upon 2D Maximus. It enables the development of smaller, lighter AR eyeglasses with high-resolution image quality, outdoor-compatible brightness, and seamless Rx integration. The new technology will be demoed publicly for the first time at CES 2023.

- In 2023, Mojo Vision, the high-performance micro-LED company, has partnered with DigiLens Inc., an innovator in head-worn holographic display and waveguide technology, to integrate its micro-LED technology with DigiLens’ breakthrough surface relief gratings (SRG) technology and waveguides for peak optimization. The partnership will accelerate the development of products associated with Augmented Reality (AR)/Extended Reality (XR), combining the capabilities of each company’s high-performance, cost-effective technology.

- In 2022, Dispelix, a see-through waveguide developer for extended reality (XR), made separate agreements with two leading electronics manufacturing companies, Foxconn Industrial Internet and Pegatron, to develop reference designs for AR glasses.