Electronic Shelf Label Market

Emergence of Battery-Free Solutions to Fuel Electronic Shelf Label Market Growth During Forecast Period

Wireless data transmission helps ESLs to improve efficiency and speed while also reducing errors caused by changing prices. The application of ESLs can also be extended to factory/warehouse logistics and smart inventory management. Therefore, for ESL applications in several locations, besides its common black & white dual-color ePaper, many companies such as E Ink have created a low-temperature ePaper and triple-color ePaper. The low-temperature ePaper is appropriate for freezers, whereas the triple-color ePaper is designed for promotional or concessional markings. The triple-color ePaper has a combination of black, white & yellow, and black, white & red.

In addition to recent launches, low voltage-driven ESL solutions are also included. In comparison to wireless transmission, which is required in large-scale malls, the new battery-free solution does not require any interior decoration to be modified or any hardware installation, which makes it ideal for small shops. Only a single mobile phone equipped with the NFC feature is required to update label content anytime.

In the current market scenario, demand for better connectivity and battery-free solutions in the logistics and retail sectors is high. Therefore, developers of ESLs aim to continue to invest in more Energy Harvesting technology for ePaper. Such investment would magnify the applications of ESL and fuel its market growth. A few of the battery-free ESL product launches are mentioned below.

- In June 2023, Ambient Photonics partnered with E Ink to develop next-generation electronic shelf labels (ESLs) that will transform ESLs from programmable price displays into connected battery-free devices with expanded functionality.

- In January 2020, Ossia Inc. launched the first ever wirelessly powered, battery-free, wire-free electronic shelf label (ESL) system to eliminate the maintenance of battery replacements and the environmental impact of battery disposal.

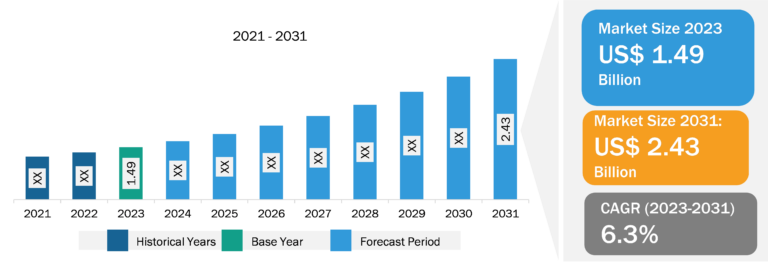

Electronic Shelf Label Market: Industry Overview

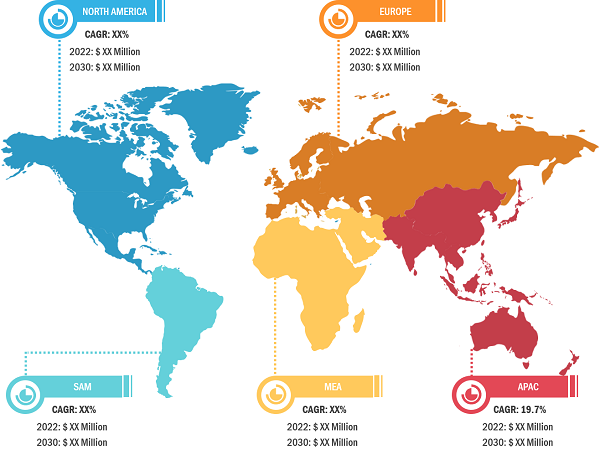

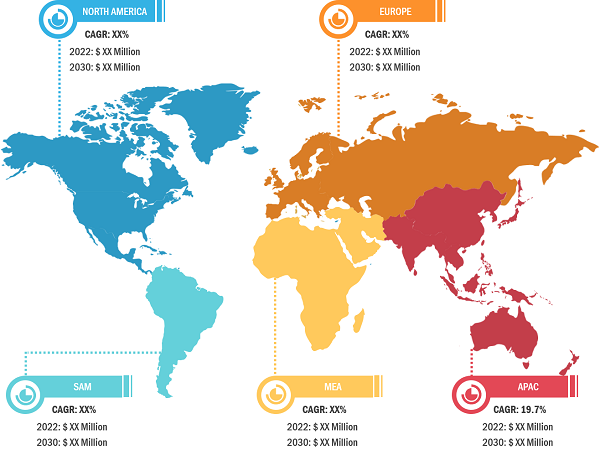

The electronic shelf label market is segmented on the basis of component, store type, product type, technology, and geography. Based on component, the global electronic shelf label market is segmented into hardware, software, and services. Based on store type, the electronic shelf label market is categorized into hypermarkets, supermarkets, non-food retail stores, and specialty stores. Based on product type, the global electronic shelf label market is bifurcated into LCD ESL and E-Paper-based ESL. Based on technology, the global electronic shelf label market is segmented into radio frequency, infrared, near-field communication, and others. By geography, the electronic shelf label market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The global electronic shelf label market is segmented into five major regions—North America, Europe, APAC, the Middle East & Africa, and South America. In 2022, North America led the global electronic shelf label market with a substantial revenue share, followed by Europe and APAC. The electronic shelf label market in North America is segmented into the US, Canada, and Mexico. The US holds the largest global electronic shelf label market share in terms of revenue and is experiencing a steady growth pace. As the US is one of the most developed nations across the globe in terms of modern technology, standard of living, and infrastructure, among others, it is witnessing massive growth in the field of commercialization. In the US, there is increasing interest in the non-food retail sector, in particular, retail of home improvement and decoration products and electronic goods. This movement of development is mainly due to significant competition from Amazon and retail websites. Thus, using electronic labels guarantee the price agility of products, which enables store owners to stay competitive. In May 2023, Walmart Inc. announced its plan to expand electronic shelf pricing technology in the next 18 months across the US to an additional 500 stores for 60 million shelf labels through a partnership with Vusion. Thus, the rising demand for smart labeling devices is expected to positively favor the electronic shelf label market growth in the US.

Electronic Shelf Label Market: Competitive Landscape and Key Developments

LabelNest, Diebold Nixdorf Incorporated, Displaydata Limited, M2Communication, E Ink Holdings Inc, NZ Electronic Shelf Labelling, Pricer, Opticon Sensors Europe BV, Samsung Electro-Mechanics, Ses-Imagotag, and Teraoka Seiko are among the leading players profiled in the electronic shelf label market report. Several other essential electronic shelf label market players were also analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help the key players strategize their market growth. A few developments are mentioned below:

- In July 2023, Ikea teamed up with SES-imagotag to introduce its innovative VUSION IoT Cloud platform and smart electronic shelf labels across its European stores. The partnership between the two companies has flourished over the years, culminating in this latest strategic move.

- In February 2023, Qualcomm Technologies, Inc. announced that it has collaborated with SES-imagotag to develop technology that enables new electronic shelf labels (ESLs) based on the recently announced ESL wireless standards from the Bluetooth Special Interest Group (SIG).

- In April 2023, the retail group Carrefour renewed its trust in Pricer as its exclusive supplier of electronic shelf label (ESL) solutions for three years. The agreement covered new installations and replacements to optimize their store automation and communication solution.

- In September 2021, Opticon and Nowi collaborated on new Electronic Shelf Label solutions for improved in-store customer experience and as a sustainable alternative to traditional smart retail systems.