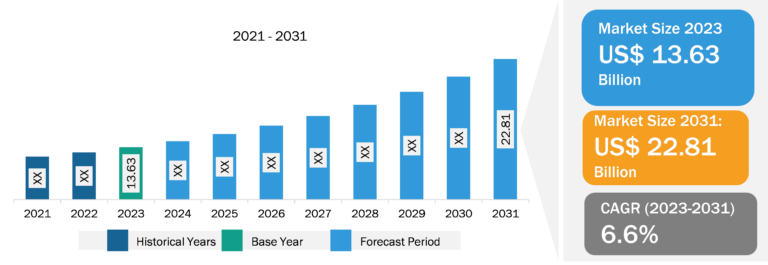

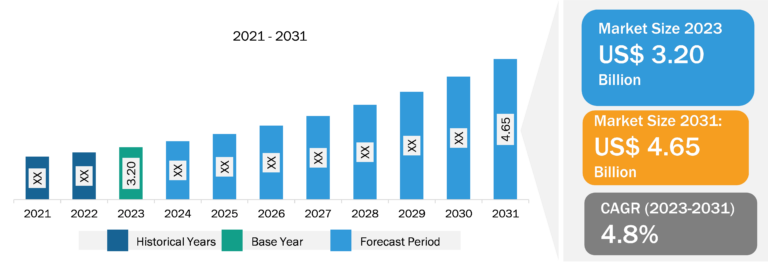

5G Base Station Market

Increased Demand for Low Latency and High-Speed Data Drives 5G Base Station Market Growth

Low latency 5G networks create new possibilities for services that demand nearly instant response time. These services include telemedicine, augmented reality headsets, and communications between autonomous vehicles that support linking into efficient platoons. Less latency means reducing the time between sending and receiving the signal. 5G network brings the network range to at least under ten milliseconds and, in best cases, approximately one millisecond delay, meaning data will be transferred in real-time. The advancement of 5G-based mobile networks achieves low delays, which creates completely new opportunities, including virtual reality experiences, multiplayer mobile gaming, factory robots, and self-driving car applications for which a speedy response is considered a strong criterion.

Focusing on self-driving vehicles, existing cellular networks already offer a wide variety of tools that address business requirements. C-vehicle-to-everything (V2X) and its evolution to 5G V2X will foster synergies between the automotive industry and other verticals moving towards 5G. Its extreme throughput, low latency, and enhanced reliability will allow vehicles to share rich, real-time data, supporting autonomous and connected driving experiences. For example, LTE Cat-M and Narrow Internet of Things (NB-IoT) are excellent low-power sensor communication technologies. In order to determine and recommend individual actions to enable complex vehicle maneuvering, e.g., deceleration, lane changes, or route modifications, acceleration, the vehicles must be able to receive and share information about their driving intentions in real time. This low-latency demand can be fulfilled with the development of an overall 5G system architecture to provide optimized end-to-end V2X connectivity.

With the increasing use of cloud-based services, big data analytics, and the Internet of Things (IoT), there is an increased demand for high-speed data transmission and low latency. The growing need for real-time interactions and the increasing use of data-intensive applications across various sectors drive the demand for low-latency and high-speed data. 5G base stations are essential in meeting these demands by providing the necessary infrastructure for high-speed, low-latency, and reliable connectivity, making them a crucial component of the evolving telecommunications landscape. Thus, increased demand for low latency and high-speed data drives the 5G base station market.

5G Base Station Market: Segment Overview

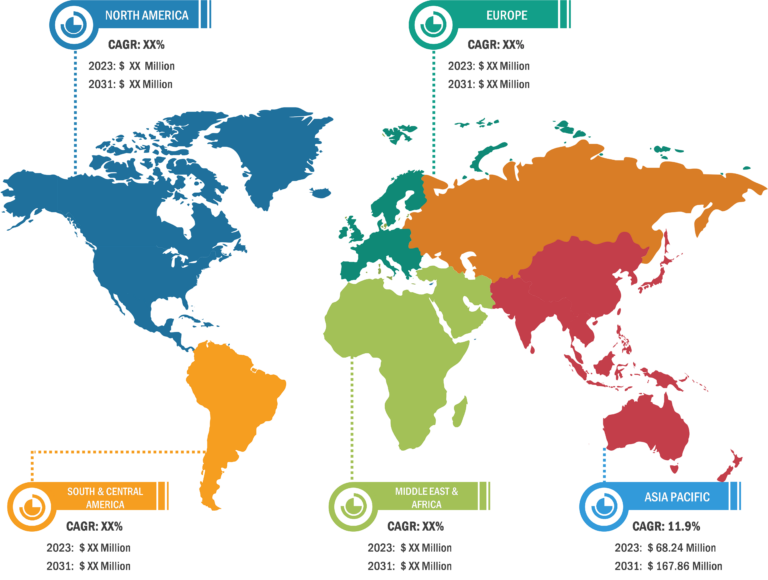

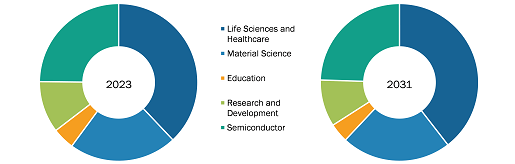

The 5G base station market is segmented on the basis of component, frequency band, cell type, end user, and geography. Based on component, the 5G base station market is bifurcated into hardware and service. Based on frequency band, the 5G base station market is categorized into less than 2.5 GHz, 2.5–8 GHz, 8–25 GHz, and more than 25 GHz. Based on cell type, the 5G base station market is bifurcated into macrocell and small cell. The small cell segment is further segmented into microcell, picocell, and femtocell. Based on end user, the 5G base station market is categorized into industrial, commercial, and residential. Geographically, the 5G base station market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

In 2022, APAC held the largest share of the global 5G base station market, followed by Europe and North America. The demand for 5G base stations in Asia Pacific (APAC) has been on the rise. APAC is home to a few of the world’s most populous countries, and there has been a surge in smartphone adoption. For example, China, the world’s most populous country, has a massive and growing smartphone user base. According to the GSM Association, nearly 1.3 billion users in China subscribed to a mobile service by the end of 2022. By 2025, China will become the first market with 1 billion 5G connections. 5G connections in the country will reach 1.6 billion by 2030, accounting for almost a third of the global total. In 2022, mobile services and technologies generated 5.5% of China’s GDP—a contribution that amounted to US$ 1.1 trillion. Furthermore, governments of various countries across the region are investing in 5G infrastructure. For instance, in October 2023, the Prime Minister of India inaugurated the 7th Edition of the India Mobile Congress 2023 (IMC) at Bharat Mandapam in New Delhi. IMC is the largest telecom, media, and technology forum in APAC. The 5G lab equipment would include 5G SA infrastructure (mid-band), 5G SIMs, dongles, IoT gateway, router, and application server to meet lab needs, along with a management dashboard. Similarly, there is a significant need for fiberization and additional telecom tower deployment in India. The Digital Infrastructure Providers Association (DI PA) highlighted non-compliance with Right of Way (ROW) rules by certain Indian states. DIPA stressed the importance of fiberization for 65% of towers and the deployment of an additional 1,200,000 towers between 2023 and 2024. Thus, the demand for 5G base stations in APAC is growing due to significant investments and deployments of 5G by both governments and telecommunications companies.

5G Base Station Market: Competitive Landscape and Key Developments

Alpha Networks Inc, Airspan Networks Holdings Inc, Baicells Technologies North America Inc, CommScope Holding Co Inc, Huawei Technologies Co Ltd, NEC Corp, Nokia Corp, Samsung Electronics Co Ltd, Telefonaktiebolaget LM Ericsson, and ZTE Corp are among the key 5G base station market players profiled during the 5G base station market study. Various other companies are introducing new product offerings to contribute to the 5G base station market size proliferation. Numerous other important 5G base station market players were also analyzed during this market research to get a holistic view of the global 5G base station market and its ecosystem. The leading 5G base station market players focus on feature upgrades, expansion and diversification, collaboration, and acquisition strategies, which enable them to grab new business opportunities.

- In November 2023, Samsung Electro-Mechanics announced that it had developed a high-capacitance, high-voltage MLCC for 5G communication base stations. Samsung Electro-Mechanics’ new MLCC is the size 3225 (3.2mm in width, 2.5mm in height) with a high capacitance of 10uF (microfarad) and a high rated voltage (highest voltage that equipment can withstand without being damaged by voltage) of 100V (volt).

- In October 2023, China Telecom, ZTE, and SpaceIoT achieved the first deployment of a 5G non-terrestrial network (NTN) in a marine setting. The successful deployment took place in Zhoushan, Zhejiang Province, an archipelago of islands at the southern mouth of Hangzhou Bay.

- In August 2023, Telefonica reportedly won six contracts with the Spanish Ministry of Defense, including the provision of two private 5G SA networks for the army’s weapons systems maintenance parks. The contract included the supply of hardware, installation, commissioning, and testing of a private, secure, approved, and certified 5G network.