Sharps Containers Market

Sharps containers are made from rigid puncture-resistant plastic or metal with leak-resistant sides and bottom and a tight-fitting, puncture-resistant lid with an opening to accommodate depositing a sharp but not large enough for a hand to enter. “Sharps” refers to objects with sharp points or edges that can puncture or cut skin, such as needles, syringes, lancets, auto injectors, infusion sets, and connection needles. Generally, sharps disposal containers are regulated by the FDA as class II devices subject to premarket notification [510(k)] requirements. The increase in the generation of medical waste and the rise in hospitalizations in private and public hospitals across the globe are driving the sharps containers market size. However, the lack of awareness about proper methods of sharps waste containment & disposal hinders the sharps containers market growth.

Increasing Initiatives and Guidelines by Regulatory Agencies for Safe Sharps Disposal to Offer Opportunities for Sharps Containers Market Growth

Today, safe practices related to the handling and disposal of sharp healthcare instruments are being implemented to protect staff, patients, and visitors from exposure to bloodborne infections. In addition, concerned authorities, such as National Health Service (NHS) and Food and Drug Administration (FDA), have taken sharps disposal initiatives to reduce the risks involved. The waste is classified as biomedical waste, which includes items that can pierce the skin, such as blades, needles, syringes, lancets, knives, scissors, broken glass, and sharp plastic. The ultimate goal of sharps waste management is to carefully handle and treat sharp materials until disposal.

Government agencies make the necessary efforts to implement guidelines for the effective disposal of medical waste. The U.S. Food and Drug Administration (FDA) recommends that used needles and other medical sharps should be immediately placed in FDA-approved sharps disposal containers. The World Health Organization (WHO) and other regulatory agencies worldwide have established standard guidelines for the disposal and management of biomedical waste. All pharmaceutical companies, research institutes, hospitals, and other healthcare providers must comply with governing body guidelines. Manufacturers are also required to follow certain guidelines when manufacturing sharps containers.

Therefore, the increase in initiatives and guidelines by regulatory agencies for the safe disposal of sharps is expected to provide growth opportunities for the sharps containers market.

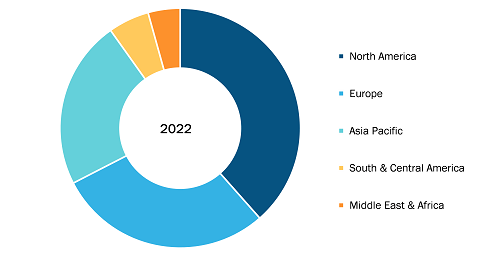

North America accounted for the largest share of the global sharps containers market in 2022. In the region, the US held the largest sharps containers market share and is anticipated to register the highest CAGR during the forecast period. In the US, there is a standard practice for patients to deposit their needles, syringes, and other medical waste products with their curbside trash. Medical waste from hospitals and healthcare organizations is highly regulated in the US. Medical waste is collected only by certified medical waste hauling and disposal companies; the waste is then autoclaved and placed in a landfill. Moreover, the prevalence of chronic illnesses such as Crohn’s disease and diabetes, which can be treated with self-injectable medication, is rising across the US. For instance, according to the CDC 2022 National Diabetes Statistics Report estimates, more than 130 million adults are suffering from diabetes or prediabetes in the US. Due to their significance during the administration of medications and tests, syringes are necessary for most diagnostic and therapeutic techniques for the treatment of chronic diseases, which is boosting the demand for sharps containers. Major corporations such as BD and Smiths Medical are also making syringes, such as BD’s Hypak SCF PRTC glass pre-fillable syringe, specifically for the treatment of chronic diseases to strengthen their market positions. Additionally, in May 2021, BD stated that it plans to expand its Diabetes Care division into a distinct, publicly traded company. BD Diabetes Care, which supports ~30 million patients annually and produces approximately 8 billion injection devices, has been a significant driver of the adoption of insulin syringes and other products in the country.

Therefore, the rising cases of diabetes and growing government initiatives are expected to boost the sharps containers market growth in the US during the forecast period.

Sharps Containers Market: Competitive Landscape and Key Developments

Sanypick Plastic SA, Bondtech Corp, Mauser Group NV, EnviroTain LLC, Stericycle Inc, Dailymag Magnetic Technology Ltd, GPC Medical Ltd, Bemis Co Inc, Becton Dickinson and Co, and The Harloff Co are among the key companies operating in the sharps containers market. Market players adopt product innovation strategies to meet evolving customer demands, which allows them to maintain their brand name in the sharps containers market.