Dust Control or Suppression Chemicals Market

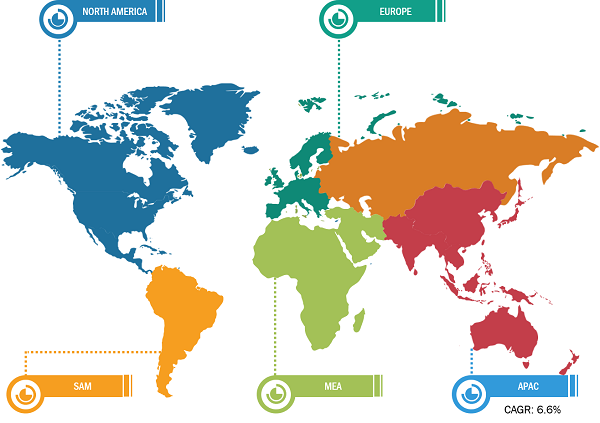

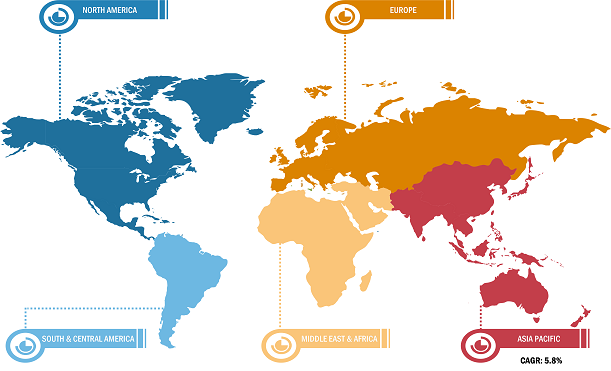

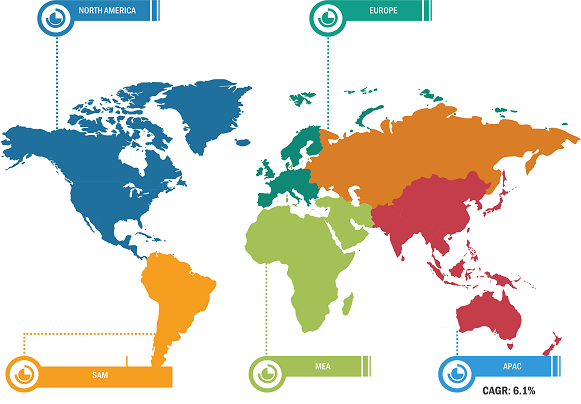

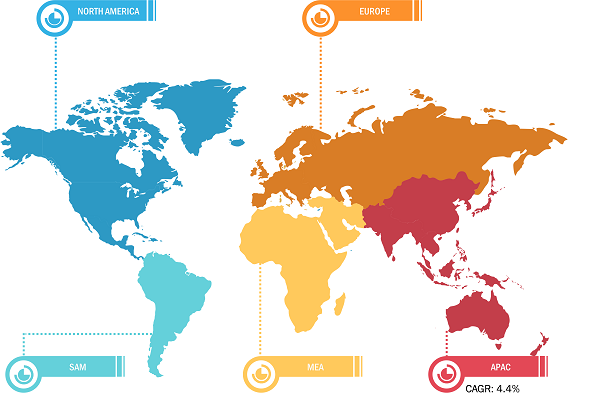

In 2022, Asia Pacific held the largest global dust control or suppression chemicals market share. Asia Pacific dominated the market worldwide, with the largest consumption coming from China and India. The Government of India launched an infrastructure project to build 66,100 km of economic corridors, expressways, and border and coastal roads to boost the highway network. China’s urbanization rate is among the highest in the world. Thus, with the huge investment in roads and highway construction in India and the growing construction industry in China, the dust suppressant chemicals market is estimated to grow considerably during the forecast period. Asia Pacific is also home to leading mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminium Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, and BHP. According to the World Mining Data 2022 report released by the Federal Ministry of the Republic of Australia, Australia witnessed a rise of 142.2% in the mining production rate for minerals from 2000 to 2020. Thus, the growing number of mining companies in the region and the significant mining industry is expected to boost the demand for dust suppressant chemicals.

Research Related to Bio-Based Dust Suppression Agents

Research and development related to innovative and bio-based dust suppressants is growing rapidly. Researchers and manufacturers are evaluating the environmental impact of dust control or suppression chemicals. Several studies are also being conducted to develop dust control solutions from biodegradable feedstock. This includes organic polymers, biodegradable surfactants, or plant-based compounds. In 2021, BioBlend Renewable Resources developed EPIC EL dust suppressant, funded by the United Soybean Board and the North Dakota Soybean Council. EPIC EL dust suppressant is a soy-based dust suppressant that contains glycerin, a co-product of biodiesel production. Several government authorities also evaluate the effectiveness of bio-based dust suppression chemicals. Therefore, research related to bio-based dust suppression agents is expected to drive the dust control or suppression chemicals market.

Dust Control or Suppression Chemicals Market: Segmental Overview

Based on chemical type, the dust control or suppression chemicals market is segmented into lignin sulfonate, calcium chloride, magnesium chloride, asphalt emulsions, oil emulsions, polymeric emulsions, and others. The calcium chloride segment held the largest share of the market in 2022. Calcium chloride is extensively used to control dust on unpaved roads and construction sites.

The market, based on the end-use industry, is segmented into mining, construction, oil and gas, food and beverage, textile, glass and ceramics, pharmaceuticals, and others. The mining segment held the largest share of the dust control or suppression chemicals market in 2022. Dust suppression chemicals are used in mining to reduce the amount of dust formation. Dust control or suppression chemicals are used on a variety of surfaces in mining operations, such as haul roads, stockpiles, blasting sites, and conveyor belts.

Impact of COVID-19 Pandemic on Dust Control or Suppression Chemicals Market

Before the COVID-19 pandemic, the market was mainly driven by their increasing use in food processing, construction, and other applications. However, due to the pandemic, governments of various countries across the globe imposed country-wide lockdowns that directly impacted the growth of the industrial sector. The shutdown of production facilities negatively impacted the dust control or suppression chemicals market growth in 2020. The negative impact of the pandemic on food, construction, mining, and many other industries has reduced the demand for dust control or suppression chemicals.

Various industries regained momentum with the ease of lockdown measures, which increased the demand for dust control or suppression chemicals. Further, various economies began reviving with the resumption of operations in different sectors in 2021. The dust control or suppression chemicals market is growing with increasing demand from various end-use industries.

Dust Control or Suppression Chemicals Market: Competitive Landscape and Key Developments

Beneficent Technology Inc., Veolia Environnement SA, Ecolab Inc., Quaker Chemical Corp, Dow Inc., BASF SE, Solenis LLC, Borregaard ASA, LignoStar, and Cargill Incorporated are among the key players operating in the global dust control or suppression chemicals market. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansion, partnership, and collaboration in order to stay competitive in the market.

Key Developments

- In March 2021, Dow Inc. signed an agreement with the Zhanjiang Economic and Technological Development Zone Administrative Committee to establish the Dow South China Specialties Hub. This multi-year project will provide customers with local access to Dow’s portfolio of high-value products and innovative technologies.

- In October 2023, Solenis LLC acquired CedarChem LLC. The acquisition is consistent with Solenis’ direct go-to-market strategy of improving chemical and wastewater treatment product and service offerings for clients.

- In July 2023, Solenis LLC acquired Diversey Holdings Ltd. Solenis has expanded to a global corporation with 71 manufacturing facilities and over 15,000 people after the acquisition. With this acquisition, Solenis is now a more diversified firm with a much-enhanced scale, a broader worldwide reach, and the capacity to offer a “one-stop shop” suite of solutions that match client demand while also addressing global water management, cleaning, and hygiene challenges.

- In 2020, Midwest Industrial Supply launched a synthetic fluid plus polymeric binder system to improve dust control in hard-rock underground mines.

- In 2021, BioBlend launched a high-performance, environmentally responsible product—EPIC EL Dust Suppressant. The product is a premier soy-based dust control product designed with their powerful proprietary Ester Link technology, providing superior fugitive particle (dust) control while also being friendly to the environment, including waterways, agriculture, wildlife, and humans.