Nebulizers Market

Factors Driving Nebulizers Market Growth

Home healthcare devices have become increasingly popular in recent years, owing to advancements in technology and miniaturization of products. This has led to a rise in adoption of home healthcare devices. Additionally, the growing number of elderly people, the high incidence of CRD diseases, and rising cost of healthcare services and hospital stays have resulted in a growing preference for treating patients in home care settings. Home healthcare is an affordable alternative to expensive hospital stays due to the availability of compact, portable and patient-friendly nebulizers that are ideal for home use, coupled with technological innovations to reduce noise and improve functionality. Additionally, there is a wide range of drugs available in nebulized formulations, including long-acting beta2-agonists (LABAs), long-acting muscarinic receptor antagonists, steroids, antibiotics, and mucolytics. A few products recently launched in the market for home use are as follows:

• In January 2023, Synergy Life Science, Inc. launched Nebi, a pocket-sized nebulizer that runs on batteries and is suitable for various applications.

• In July 2021, HCmed Innovations received US Food and Drug Administration (FDA) approval for Pulmogine Vibrating Mesh Nebulizer. The device is portable and easy to use, making it a convenient solution for patients who require inhalation treatment.

• In June 2020, Respira Technologies, Inc. launched its RespiRx drug delivery device platform. This novel platform is an ultra-portable handheld vibrating mesh nebulizer (VMN) for local and systemic treatment for various target indications, including asthma and COPD.

These developments have expanded the use of nebulizers beyond acute care settings in clinics or hospitals to home care settings.

Market Restraints-

The safety profile of breathing devices for infection transmission has raised concerns among patients. Healthcare professionals are limiting their recommendations for using nebulizers due to the risk of infection transmission. This can occur through the tubing of the nebulizers, which can transfer the infection to the patient’s lungs or from unsterile chambers within the device. For instance, in an article published by CHEST Journal in November 2023, studies conducted before the COVID-19 pandemic, frequently involving coronaviruses such as SARS-CoV-1 and MERS-CoV, suggested that nebulized therapy was associated with an increased risk of infection. Thus, due to the risk of disease transmission with the frequent use of nebulizers, a few medical centers switched from using nebulizers to metered dose inhalers with valved holding chambers. Additionally, the increasing availability of cost-effective alternative treatment options are further limiting the growth of the nebulizer market.

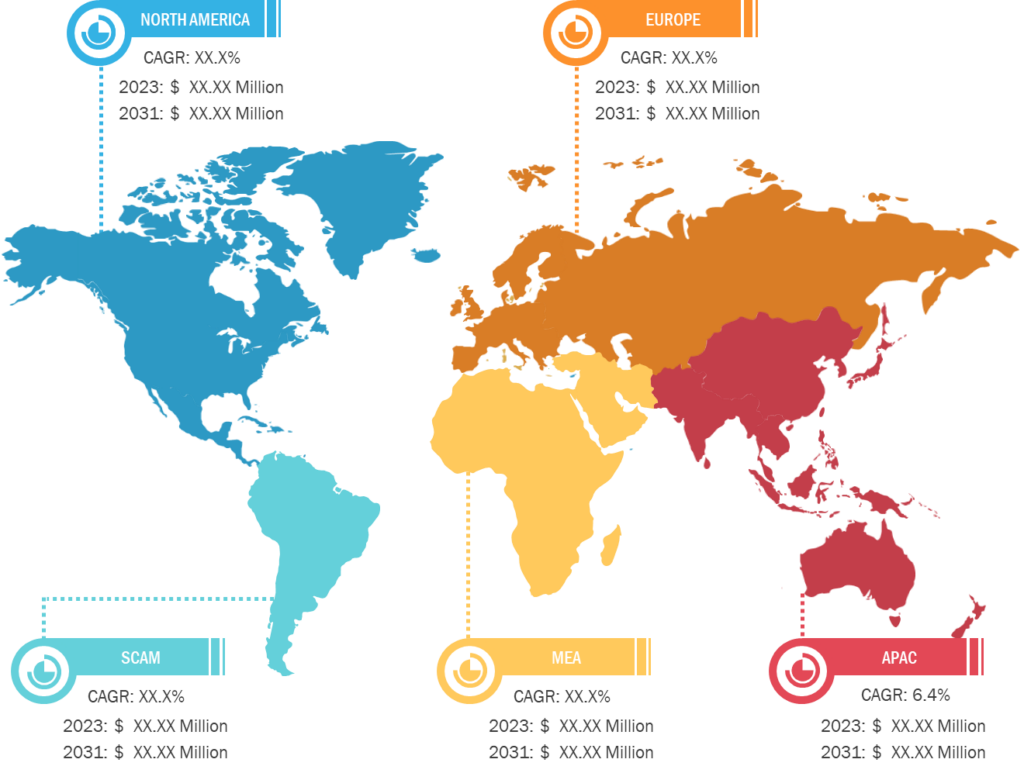

In terms of geography, the nebulizers market is primarily divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Asia Pacific is expected to register the fastest CAGR in the nebulizers market during the forecast period.

North America held the largest nebulizers market share in 2023. The US held the largest market share in this region in 2023, followed by Canada, owing to the rising incidences of COPD and asthma among people in the region. According to an article published in Merck Sharp & Dohme (MSD) Manual, ~16 million people suffer from COPD, which is a leading cause of death, claiming over 150,000 lives annually in the US. Other factors propelling the growth of the nebulizers market in North America include the introduction of advanced equipment in healthcare, increasing healthcare expenditures, and the presence of leading market players, including OMRON Healthcare, BD, and GE Healthcare in the region.

Nebulizers Market: Segmental Overview

Based on end- user, the nebulizers market is segmented into hospitals and clinics, emergency centers, and home care settings. The hospitals and clinics segment held the largest share of the market in 2023 and is expected to register the highest CAGR from 2023 to 2031.

The nebulizers market is segmented on the basis of type, application, and end- user. By type, the market is segmented into jet nebulizers, ultrasonic nebulizers, and mesh nebulizers. The jet nebulizers segment held the largest market share in 2023 and is projected to register the highest CAGR during 2023–2031.

The market, by application, is segmented into COPD, asthma, cystic fibrosis, and others. The COPD segment is anticipated to hold the largest nebulizers market share in 2023.

Nebulizers Market: Competitive Landscape and Key Developments

Baxter; B. Braun Medical Inc.; BD; Cantel Medical; DaVita Inc.; Fresenius Medical Care; Medtronic; Nikkiso Co., Ltd.; Asahi Kasei Corporation; and Terumo Corporation are among the prominent companies profiled in nebulizers market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The players adopt product innovation strategies to meet evolving customer demands, maintaining their brand image.

As per company press releases, a few recent developments by players operating in the nebulizers market are mentioned below:

- In December 2021, Cipla Limited introduced an initiative to improve access to nebulization therapy for managing acute asthma in India’s rural primary healthcare centers with its vast presence throughout the care continuum and a broad range of drug-device combinations and treatments.

- In March 2021, PARI Pharma GmbH launched its LAMIRA Nebulizer System, which has been authorized to deliver ARIKAYCE (amikacin liposome inhalation suspension) in Japan. This system uses advanced aerosol delivery systems based on eFlow Technology and features a customized medication reservoir that can hold a full dose of 8.4 ml.

- In March 2021, OMRON Healthcare, Inc. and Asthma and Allergy Foundation of America (AAFA) collaborated to provide medical-grade nebulizers to support AAFA’s advocacy and initiatives to spread awareness that aid the most vulnerable members of the asthma community.