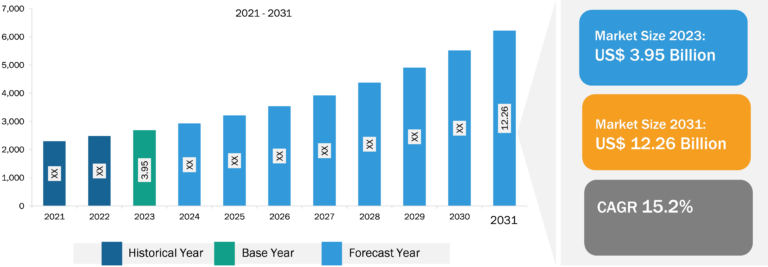

Europe Data Center Construction Market

Constant Growth in Data Center Construction to Fuel Data Center Construction Market Growth During Forecast Period

A constant growth in the number of data centers can be a significant driver for the data center construction market. The world’s data generation and consumption are increasing exponentially, driven by big data analytics, artificial intelligence, cloud computing, and the Internet of Things (IoT). This necessitates more data centers to store, process, and distribute this data, leading to a rising demand for construction services in Europe. Additionally, as cloud adoption and digital services spread globally, the need for data centers extends beyond established hubs. This opens up new markets and opportunities for construction companies in Europe.

Therefore, several major cloud providers plan to construct their data centers in European countries. For instance,

• In December 2023, Penta Infra started constructing a 4.4 MW data center in Hamburg, Germany. The colocation facility will go live by early 2025. The data center facility will cover an area of 2500 square meters of cleanroom space.

• In June 2023, Dutch developer Van Caem announced that a 100 MW data center, 9 km from the center of Berlin, Germany, is scheduled to open in 2026. The US$ 1 billion project, on a brownfield site in Berlin-Lichtenberg, will be the largest data center in Berlin and the fifth largest in Germany.

• In October 2023, Telehouse began constructing a new data center at its TH3 Paris Magny campus in France. The new data center will provide 12,000 square meters of IT floor space and 18 MW of electrical power.

Therefore, the constant growth in data center construction drives the market.

Moreover, the rapid expansion of IoT services and constant growth in data center construction are among the factors contributing to the growing Europe data center construction market size. The Europe data center construction market report emphasizes the key factors driving the market and prominent players’ developments.

Data Center Construction Market: Industry Overview

The data center construction market analysis has been carried out by considering the following segments: type of construction, tier design, and industry vertical. Based on the type of construction, the Europe data center construction market is segmented into general construction, electrical design, and mechanical design. Based on tier design, the Europe data center construction market is segmented into Tier 1 and Tier 2, Tier 3, and Tier 4. Based on industry vertical, the Europe data center construction market is segmented into IT and Telecommunication, BFSI, government, manufacturing, retail, transportation, media & entertainment, and others. Based on country, the Europe data center construction market is segmented in to Germany, the UK, France, Sweden, and the Rest of Europe. In terms of revenue, Germany dominated the Europe data center construction market share.

The UK held a significant data center construction market share of 14.24% in 2022. In the UK data center construction market, the data center construction process encompasses essential stages such as planning, designing, and actual construction. This market offers a diverse range of data centers, including small, medium, and large-scale facilities, ensuring they can meet various sizes and specific requirements. Moreover, the implementation of tier standards plays a vital role in guaranteeing the reliability and availability of data center services. Mercury Engineering has played a significant role in the development of data center facilities in the UK, including notable projects such as Equinix’s LD10 Data Center in London. In October 2023, CGG announced the inauguration of its latest UK HPC (High-Performance Computing) Hub in Southeast England. The data center construction market in France is a thriving and progressive sector featuring a variety of local and international construction contractors who cater to the needs of major players in the field. This market provides a wide range of data center sizes, tier standards, and industry verticals to meet the diverse requirements of businesses effectively. With the presence of prominent colocation providers and ongoing construction projects, the data center market in France is experiencing continuous growth. For instance, in June 2022, Orange, a telecommunications company, inaugurated two new data centers in France, marking a significant expansion of its infrastructure. These new data centers are part of Orange’s strategic plan to consolidate its existing 17 data centers into a more streamlined and efficient network, with a target of operating just three data centers by 2030.

This consolidation effort aims to optimize resource allocation, enhance operational efficiency, and improve the overall performance of Orange’s data center infrastructure. By opening these new data centers and implementing its consolidation plan, Orange is positioning itself to meet the growing demand for data storage and processing while ensuring a more sustainable and resilient data center ecosystem in France.

Data Center Construction Market: Competitive Landscape and Key Developments

Rittal GmbH & Co KG, Schneider Electric SE, DPR Construction Inc, INFINITI IT Ltd, blu-3 (UK) Ltd, Datalec Power Installations Ltd, Coromatic AB Sweden, Winthrop Technologies Ltd, Mercury Engineering Ltd, and STO Building Group Inc are among the key players profiles in the data center construction market report. The strategic presence of key players positions Germany as a key region for the Europe data center construction market growth. The report provides detailed market insights, which help the key players strategize their market growth. The number of new players is expected to emerge and bring new data center construction market trends in the coming years. A few developments are mentioned below:

- In February 2023, Mercury announced that it is working as the prime contractor on Global Technical Realty’s (GTR) G.B. One data center campus near London, UK. Located on the Slough Trading Estate – one of Greater London’s data center hotbeds – this 40.5MW facility will be the largest of its kind in the area upon full build-out. Designed with sustainability in mind, Mercury’s team is working to deliver G.B. One to Leadership in Energy and Environmental Design (LEED) certification.

- In June 2023, Datalec Precision Installations (DPI), one of the providers of world-class data center design, supply, build, and managed services to deliver seamless, integrated, and unified end-to-end solutions for data center operators, incorporated a United Arab Emirates (UAE) subsidiary as a part of its continued international expansion. Headquartered in the UK, Datalec has subsidiaries in 15 other countries.