Proteomics Market

Proteomics, the detailed analysis of proteins, has become a significant field to study drug development, therapy, prognosis, and disease characterization. Proteomics technologies help with both infectious and noninfectious disease detection and therapy. The current proteomic methodologies are being made more reliable, biocompatible, specific, and reproducible through the use of nanotechnology as a technological platform. The shortcomings of conventional proteomic techniques are greatly assessed with the use of nanomaterials to enhance the quality of proteomic techniques by protein manipulation. These benefits are expected to impact market growth positively during the forecast period.

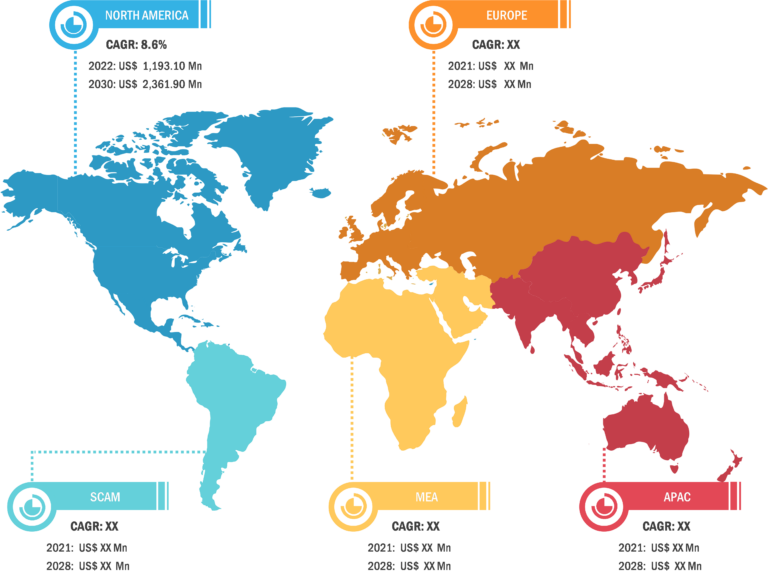

The market in North America was valued at US$ 11.95 billion in 2022 and is projected to reach US$ 33.56 billion by 2030; it is expected to register a CAGR of 13.8% during 2022–2030. This is due to the increasing investments in the development of structure-based drug design, demand for high-quality research tools for data reproducibility, growth in omics research, etc. Attention is being paid to the development of tailor-made treatments. Partnerships and collaborations between major regional companies also contribute to the market expansion in the region. For example, Thermo Fisher Scientific Inc. and Symphogen have collaborated to develop verified platform processes for optimized characterization and quality monitoring of complex therapeutic proteins. Additionally, proteomics research is at its peak in countries such as the US.

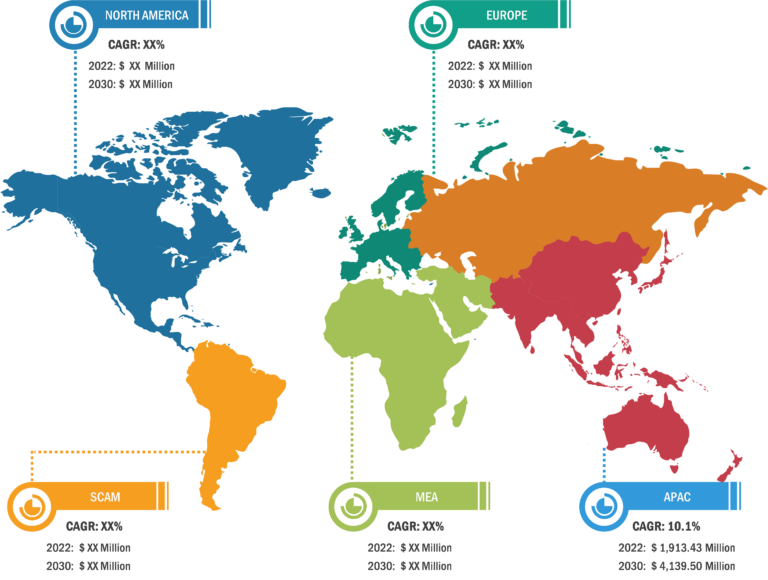

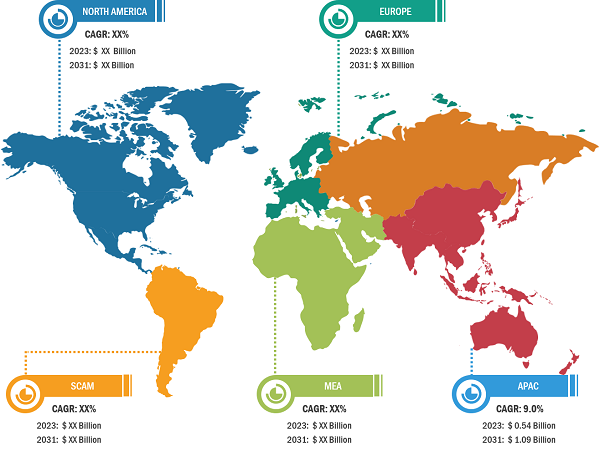

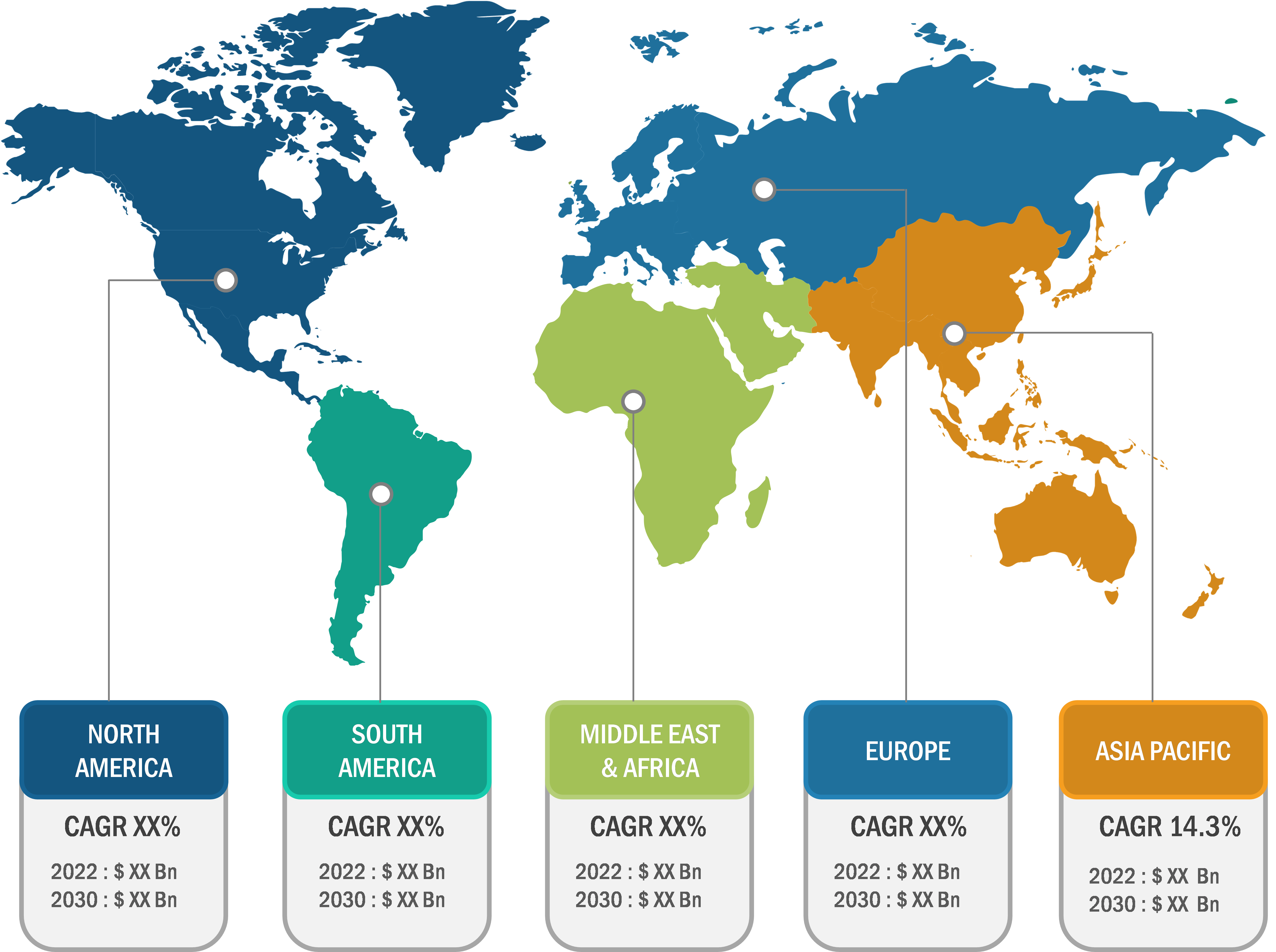

The Asia Pacific proteomics market is expected to record the fastest CAGR due to increasing public and private funding for research and development for proteomics studies, outsourcing of proteomics-based projects, favorable government regulations, and increasing prevalence of target diseases in an aging population. In November 2021, the University of Hyderabad received USD 60 million as funds from the Department of Biotechnology of the Government of India to study the proteome of tomatoes.

In terms of application, the proteomics market is segmented into clinical diagnostics, drug discovery & development, and others. The clinical diagnostics segment held the largest market share in 2022. However, the drug discovery segment is estimated to grow at the fastest CAGR of 14.4% during 2022–2030. This is due to researchers and clinicians’ widespread use of protein analysis to identify disease biomarkers for early detection and detection of individual risk factors. This is expected to open up new opportunities for early detection and prevention of diseases. It is possible to discover potential biomarkers and protein transcription regulation that can be used to identify and predict malignancies and evaluate their prognosis using proteomics-based diagnosis that would further help in promoting the market growth for the segment.

Growing Technological Advancements and R&D Expenditure to Provide Market Opportunities

Manufacturers in the proteomics industry are focused on providing new methods and devices for disease diagnosis. Companies such as Agilent Technologies, Inc. have recognized the advantages of using technology out-licensing strategies to focus on developing products for protein analysis. The absolute quantification of protein-based diagnostics was made possible through the use of proteomics technology. Key proteomic services and other technologies, including microarray, X-ray crystallography, spectroscopic techniques, chromatography, electrophoresis, and surface plasma resonance systems, form the foundation of the proteomics market.

The increasing investments in research and development in proteomics are fostering the market growth. The US National Institutes of Health (NIH) gave US$ 37 billion for biomedical research. This funding will aid in studying the fundamental mechanisms of disease development, identify biomarkers that indicate the presence of a disease, or identify the gene or protein that causes the disease. The Novo Nordisk Foundation granted the University of Copenhagen a grant of up to US$ 1.5 million to build a mass spectrometry facility, an important step toward protein research. The market quickly gained momentum after the outbreak of COVID-19.

Key players are crucial in improving people’s access to quality healthcare and medicines in developing countries, which also expands their economic prospects and they are also working to increase economic opportunities by creating more jobs, making significant investments, influencing public policy, and providing trainings. The pharmaceutical industry has a significant impact on the growth of economic opportunities in developing countries. In recent years, pharmaceutical companies have achieved excellent financial results. For example, Thermo Fisher Scientific, Inc. posted record profits last year, and future performance is predicted to be even better. The market will continue to flourish as several biopharmaceutical companies are emerging as key players and various R&D activities are being conducted, thereby providing growth opportunities for the global market.

Proteomics Market: Product Overview

Based on product & service, the proteomics market is divided into instrumentation technologies, reagents & consumables, and software & services. The reagents & consumables segment held the largest market share in 2022 and is likely to register the highest CAGR of 14.1% during 2022–2030.

Reagents & kits, consumables, and strips are increasingly used for studying various biological materials in research universities, research institutions, and other areas. Government initiatives in the field of proteomics and genomics are propelling research activities in disease diagnostics. Technical advancements in advanced instruments, such as 3D electrophoresis protein analyzers, which increase biological research’s speed, efficiency, and productivity, are also propelling the demand for reagents and consumables. These factors are contributing to the growing proteomics market size for the segment.

Proteomics Market: Competitive Landscape and Key Developments

Proteome Sciences; Biognosys; Creative Proteomics; SomaLogic Operating Co., Inc.; QUANTUM-SI INCORPORATED; Proteomics International; Promise Proteomics; SCIEX, Illumina, Inc.; and Thermo Fisher Scientific Inc. are among the key companies operating in the proteomics market. Leading players are implementing strategies such as expansions, new product launches, and acquisitions (companies or new clientele) to tap prevailing business opportunities. As per company press releases, below are a few recent developments:

- In January 2022, Seer, Inc. announced the debut of the Centers of Excellence program and the commercial release of the Proteograph Product Suite. The Proteograph Product Suite provides unbiased, unmatched access to the proteome. The approach uses uniquely designed nanoparticles to produce a breakthrough product that enables rapid, thorough, and unbiased large-scale proteomics.

- In February 2021, Agilent Technologies Inc. launched the Agilent Dako SARS-CoV-2 IgG Enzyme-Linked Immunosorbent Assay (ELISA) kit, designed for the qualitative detection of immunoglobulin G (IgG) antibodies to SARS-CoV-2 in human serum or plasma.

- In February 2021, Poochon Scientific, LLC acquired a new Thermo Orbitrap Exploris 240 mass spectrometer that has BioPharma option and FAIMS Pro interface. It is a versatile, new-generation, high-resolution mass spectrometer that offers exceptional performance for proteomics, metabolomics, and biopharmaceutical characterization.