Animal Genetics Market

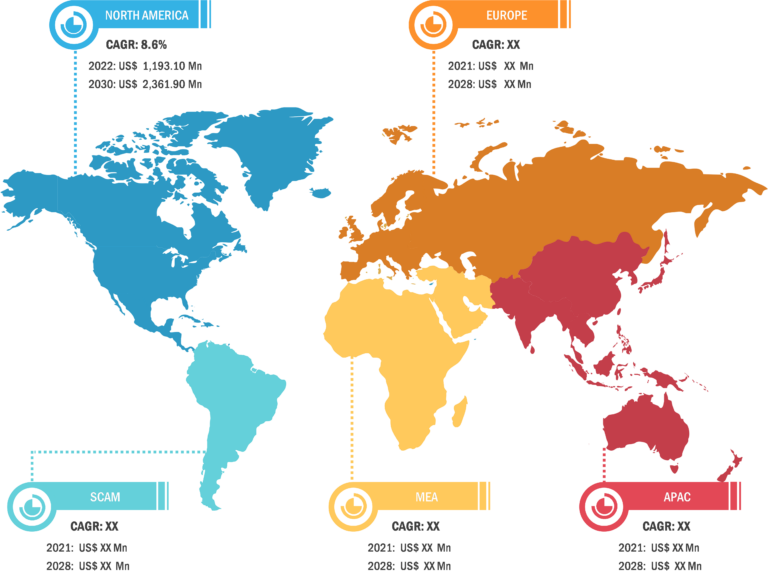

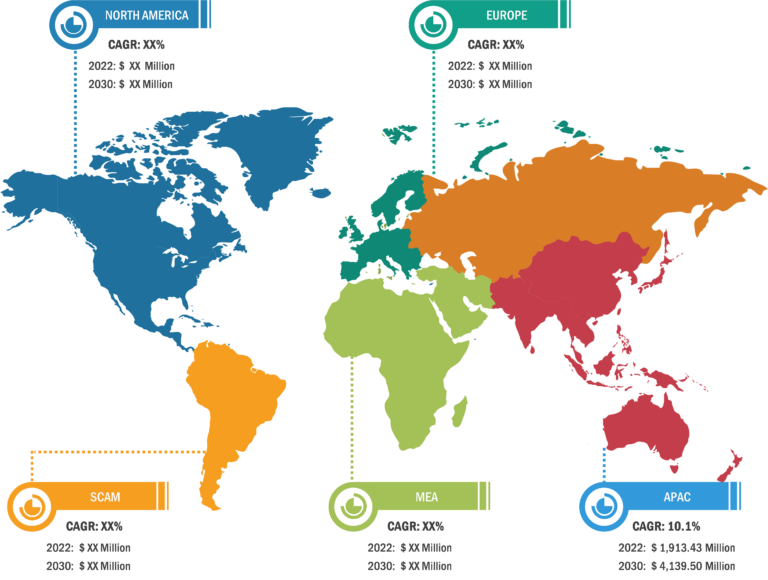

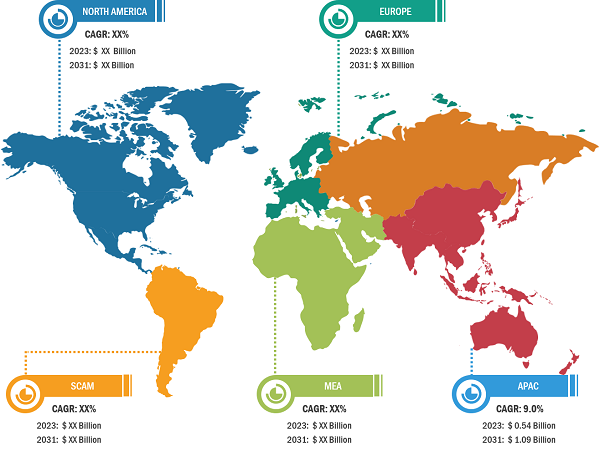

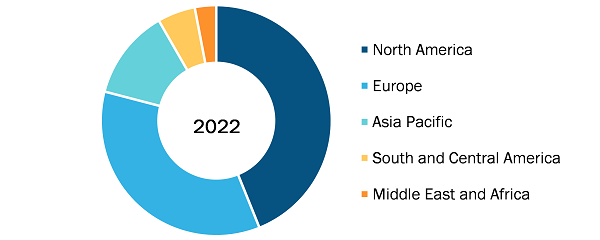

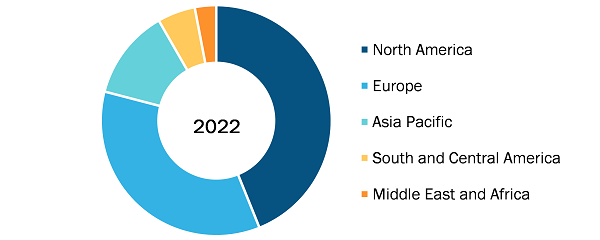

North America is the most significant region in the global animal genetics market, and the US holds the largest share of the market in this region, followed by Canada. The market growth in North America is attributed to growing investments in animal genetics projects, genetically engineered animals in the US, rising livestock production and farming, and increasing initiatives to protect and preserve livestock animals. Meat, milk, eggs, fiber, and draught power are among the major offerings of the livestock industry. Genetic variation within livestock communities favors evolution through natural selection in response to changing conditions and supports human-managed genetic improvement plans. The US generates an ever-increasing demand for dietary protein, which is met through rearing animals for food, pharmaceutical, nutraceutical, and biotechnological applications. NIFA—with the help of scientists from universities and research organizations, and food and animal industries—enables national leadership and funding opportunities to conduct basic, applied, and integrated research to bolster the knowledge about animal genetics and genomics. In January 2022, NIFA invested ~US$ 5.5 million to enhance animal genetics for the production of foods. Also, the Agriculture and Food Research Initiatives are launched in the US to support research to genetically enhance animal production through the Animal Breeding and Functional Annotations of Genomes programs. Such investments and programs propel the animal genetics market in the US.

Based on type, the animal genetics market is bifurcated into products and services. The services segment held a larger market share in 2022, and the same segment is estimated to register a higher CAGR during the forecast period. The market for animal genetics services is subsegmented into DNA typing, genetic trait tests, genetic disease tests, and others. The DNA typing segment held the largest share of the market for services in 2022. The genetic disease tests segment is estimated to register the highest CAGR in the market during the forecast period. In terms of animal, the animal genetics market is segmented into poultry, porcine, bovine, canine, and others. The porcine segment held the largest share of the market in 2022, whereas the bovine segment is anticipated to register the highest CAGR of 7.1% in the market during the forecast period. Based on genetic material, the animal genetics market is bifurcated into semen and embryo. The embryo segment held a larger share of the market in 2022. The semen segment is anticipated to register a higher CAGR of 6.8% in the market during the forecast period.

Growing Preference for Animal-Derived Food Products Boosts Animal Genetics Market

The increasing population and rapid urbanization worldwide have resulted in a growing preference for animal-derived food products such as dairy products and meat. Several studies have proved that genetically modified (GM) cow can produce more milk and is less susceptible to various common cattle diseases, such as bovine respiratory disease complex and clostridial infection. As proteins play an important role in nutrition, the consumption of meat and meat products has increased worldwide. Animal-derived proteins assist in the synthesis of body tissues for renovation and faster growth. The amino acid profile of animal-derived proteins plays a significant role in immunity, environmental adaptability, and other biological functions. Genetically modified poultry such as broilers are easily digestible despite the high protein content.

According to the Food and Agriculture Organization of the United Nations (FAO) estimates, the global demand for meat products has increased by 58% from 1995 to 2020. The estimates also show that meat consumption has risen from 233 million metric ton in 2000 to 300 million metric ton in 2020. Similarly, milk consumption has increased from 568 in 2000 to 700 million metric ton in 2020. The FAO also estimated that egg production has increased by 30% in 2020. China and Brazil are among the major developing countries propelling the demand for poultry, pig meat, and milk. In contrast, countries such as the US, Brazil, and Thailand are the largest producers of poultry, pig meat, and milk. Thus, animal genetics is serving to be a great tool to meet the growing demand for animal-derived food products.

Animal Genetics Market: Competitive Landscape and Key Developments

Neogen Corp, Genus Plc, Topigs Norsvin Nederland B.V, Zoetis Inc, Hendrix Genetics B.V, Inotiv Inc, Animal Genetics Inc, Alta Genetics Inc, GROUPE GRIMAUD LA CORBIERE, and Charles River Laboratoires International Inc are among the key companies operating in the animal genetics products market. Leading players are adopting strategies such as the launch of new products, expansion and diversification of their market presence, and acquisition of a new customer base for tapping prevailing business opportunities.

- In September 2022, Topigs Norsvin opened its new nucleus farm named Innova Canada, which helps position itself as a global supplier of genetics. The new nucleus farm would be part of a bigger plan to upgrade and expand the nucleus capacity in Canada. With this investment, Topigs Norsvin expects to meet the growing demand for Topigs Norsvin genetics, especially in the US.

- In December 2021, Neogen acquired Delf Ltd, a UK-based manufacturer and supplier of animal hygiene and industrial cleaning products.

- In October 2022, Genus Plc and Tropic extended their trait development collaboration for the application of Tropic’s Gene Editing induced Gene Silencing (GEiGS) technology in porcine and bovine genetics. The extended collaboration will enable the two to explore additional traits based on the GEiGS platform to expand animal welfare traits in bovine and porcine species.

- In October 2020, Topigs Norsvin signed a partnership agreement with Grupo de Intercambio Tecnológico Argentino Holandés (GITAH Porcino, Argentina). This partnership is a part of the former’s aim to contribute to better pork production in Argentina with the help of local swine breeders. GITAH Porcino helps the Dutch business through knowledge exchange, network building, and positioning in Argentina.

- In April 2020, Zoetis Animal Genetics and Angus Australia entered into a strategic partnership that will aid Angus Australia breed stock and commercial breeders an additional benefit from genomic, or DNA-based technology. Zoetis has made a considerable investment in the expansion of the Angus genomic reference population through the provision of genotyping services and sponsorship.