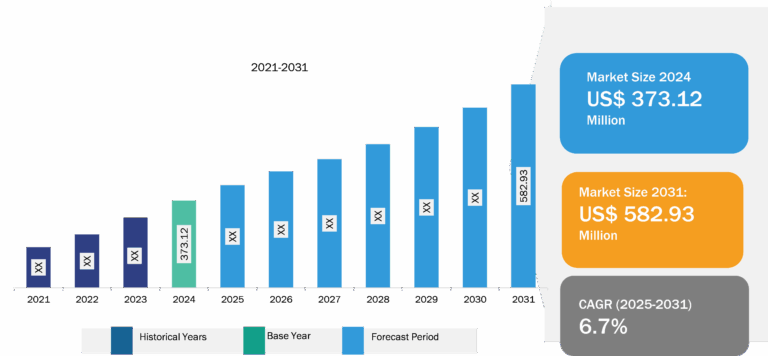

Autonomous Mobile Robots Market

Industry 4.0 transforms how companies manufacture, process, and distribute their products. They are incorporating new technologies such as the Internet of Things (IoT), robotics, analytics, AI, and machine learning into their facilities to boost operational and production efficiencies. Factory automation plays a crucial role in the automation of manufacturing processes to increase production output in minimal time and low labor costs. In addition, it helps improve product quality by minimizing the risk of human error. As a result, industries such as healthcare, automotive, and aerospace are proactively adopting factory automation solutions. In March 2023, ADLINK Technology Inc. launched its latest AMR with the SWARM CORE software platform that integrates the software and hardware for efficient material handling, warehousing, and shipping in smart manufacturing facilities. In the same month, Thira Robotics (South Korea) unveiled a new AMR for healthcare, manufacturing, and supply chain industries seeking to transform their operations with the advent of Industry 4.0. Therefore, the growing demand for automation in various industries propels the growth of the autonomous mobile robots market.

The autonomous mobile robots market analysis is segmented into five major regions—North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and South America (SAM). In 2022, Asia Pacific led the autonomous mobile robots market with a substantial revenue share, followed by Europe and North America. The Asia Pacific autonomous mobile robots (AMR) market is further segmented into Australia, China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, Thailand, and the Rest of Asia Pacific. Asia is the world’s largest market for industrial robots. The installation of industrial robots increased by 33% in 2021 compared to 2022. The adoption of industrial robots in the electronics industry rose by 22% in 2021 compared to 2020, while that in the automotive, and metals & machinery industries increased by 57% and 29%, respectively. According to the International Federation of Robotics (IFR), China, Japan, and South Korea are among the top five most advanced robotics countries in terms of annual installations of industrial robots as of January 2023.

Autonomous Mobile Robots Market Size: Type

Based on type, the global autonomous mobile robots market is segmented into picking robots, self-driving forklifts, and autonomous inventory robots. Picking robots are used to automate picking products from storage shelves and transporting them to packing stations. This can help to improve efficiency and accuracy and reduce labor costs. The picking robot also increases output and profitability of production as well as automates monotonous tasks in the production process. These factors impact the employee’s health and safety.

Autonomous Mobile Robots Market Analysis: Competitive Landscape and Key Developments

KUKA AG, Milvus Robotics, Geekplus Technology Co Ltd, OMRON Corp, Clearpath Robotics Inc, Locus Robotics Corp, Move Robotic Sdn Bhd, Teradyne Inc, Kivnon Logistica SLU, and Boston Dynamics Inc are among the key autonomous mobile robots market players profiled in the report. Several other essential autonomous mobile robots market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed autonomous mobile robots market growth insights, which can help major players strategize their growth.

- In 2023, OMRON Corporation launched its K7DD-PQ Series of advanced motor condition monitoring devices. The series is the latest addition to OMRON’s family of condition monitoring devices that automate the monitoring of abnormalities on the manufacturing site in place of human workers.

- In 2022, ABB Ltd, a leading automation company, built its innovative, fully automated, and adaptable robotics plant in Kangqiao, Shanghai, China. It had a 67,000 m2 production and research facility. The new factory and R&D center strengthened its automation and robotics leadership in China.