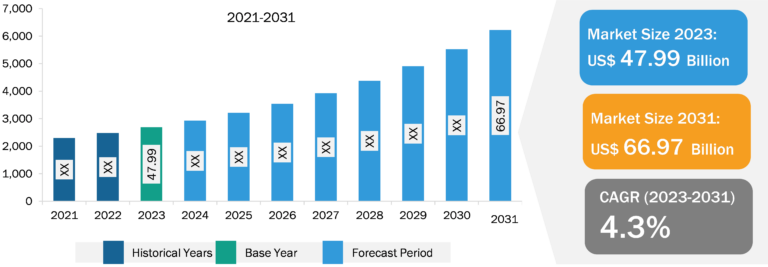

Hair Transplant Market

Opportunities in Developing Countries are fueling the Hair Transplant Market Growth

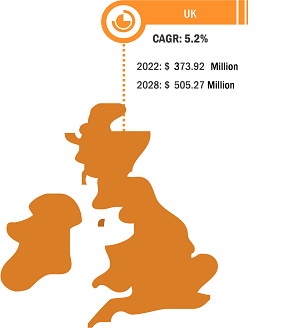

Governments in developing countries are taking several initiatives to improve healthcare infrastructure and attract patients from around the world. As a result, developing countries, such as India, are gaining popularity as medical tourism destinations. The cost of a hair transplant procedure varies across the globe. Compared to the US and Australia, the cost of hair transplants in India is less. Thus, people from countries such as the US, the UK, Australia, Canada, Turkey, and Dubai prefer India as a unique destination for getting hair transplant surgery. For instance, compared to the US, where a similar number of grafts cost between US$ 3,615 and US$ 14,463, the average cost of a hair transplant surgery in India with pre-and post-operative care is between US$ 1,084 and US$ 1,807. Furthermore, the availability of highly skilled professionals and increased medical tourism for cosmetic surgery has surged the number of procedures performed in developing countries.

The rising number of people looking for a less expensive treatment is boosting medical tourism in several developing countries. For instance, the medical tourism corporation states that ~92,000 Americans and other Westerners have had hair transplants in India and other Asian nations. Additionally, an increase in the number of clinics to address customer demand is anticipated to offer a lucrative opportunity for the market. For instance, in July 2023, DHI International, one of the world’s top hair restoration and transplant chains, opened a new clinic in Noida. This clinic offers advanced hair restoration and hair transplant treatments with the highest standard of care for patients.

Increasing Incidences of Hair Loss is Driving the Growth of the Hair Transplant Market

Several reasons, such as Telogen Effluvium (TE), drug side effects, tinea capitis, and alopecia areata, are responsible for hair loss. TE is a common type of hair loss caused due to severe infection and prolonged illness. For instance, as per the article published in the Journal of Medicine and Life, telogen effluvium is one of the effects of the COVID-19 pandemic. Medications and stressful circumstances brought on by COVID-19 have resulted in causing TE.

Increasing use of medications such as lithium, beta-blockers, warfarin, heparin, amphetamines, and levodopa (Atamet, Larodopa, Sinemet) can also result in hair loss. In addition, many cancer chemotherapy drugs, including doxorubicin, frequently result in hair loss. Furthermore, fungal infection of the scalp is one of the major reasons for hair loss in children. According to an article published in PLOS ONE in 2023, yearly tinea capitis accounts for 25 to 30% of all infections. Alopecia areata (AA) is an autoimmune disease that causes hair loss. As per the article published in the Journal of the German Society of Dermatology, 40% of patients experience their first AA symptom by age 20, and 83–88% experience it for the first time by age 40. Moreover, compared to Asian and Caucasian populations, African and African American people are more likely to develop type AA. Thus, increasing incidences of hair loss due to various factors are boosting the market growth.

Hair Transplant Market: Segmental Overview

Based on procedures, the hair transplant market is divided into surgical and nonsurgical transplant procedures. A surgical hair transplant procedures segment is further segmented into Follicular Unit Strip Surgery (FUS), Follicular Unit Extraction (FUE), and other surgical procedures. The non-surgical treatment options for hair loss include platelet-rich plasma (PRP) for hair, laser cap therapy, and others. PRP is an injectable therapy used to treat hair loss. PRP treatments hold a success rate of approximately 70–90%. Laser therapy, such as Low-level laser therapy (LLLT), promotes hair growth in both women and men. Non-surgical procedures are less expensive than surgical procedures, owing to which their adoption is increasing, thereby driving the market for the segment. For example, depending on the clinic and location, PPR hair treatment costs range between US$ 50 and US$ 200, which is comparatively lower than surgical treatment.

Hair loss is widespread, affecting ~50 million men and 30 million women in the US. Thus, people are seeking various options for hair loss treatment. PRP is useful in treating male pattern baldness, reducing hair loss, and encouraging new hair growth with approximately 70–90% success rate. PRP stimulates the growth of human Dermal Papilla Cells (DPCs) that control hair follicle development. DPCs bind growth factors and interact with primitive stem cells to activate the proliferative stage of the hair follicle cycle, resulting in hair follicle development and maintenance. Faster scalp recovery, less swelling, and reducing the severity of any bruising by increasing blood clotting factors in the tissue are the advantages of PRP therapy. Hence, the evolving role of PRP in hair regrowth to improve the quality of life of millions of people is likely to create significant opportunities, thereby favoring the market growth for the segment.

The LaserCap is a non-surgical method of reducing hair loss and regrowing hair. LaserCap contains laser diodes that emit low-intensity red light to illuminate hair follicles. Low-level-light therapy (LLLT) is a treatment that has been clinically demonstrated to regrow hair in those who have thinning or receding hair. The LaserCap method is FDA-approved for hair restoration in men and women suffering from androgenic alopecia. The unveiling of technologically advanced products by key players is projected to drive market growth for the segment. For instance, in November 2022, Curallux, LLC, a leading player in laser therapy products, announced the launch of Capillus MD medical-grade cap offering 320 laser diodes. It is the next-level advanced therapy for hair restoration. Through Rotational PhotoTherapy (RPT), an FDA-approved LLLT procedure called the Revage 670 Laser enables non-surgical hair restoration. Both men and women who have hair thinning may benefit from this. The system has 30 laser diodes that revolve 180 degrees around the scalp while emitting painless, cool laser energy to stimulate blood flow to the hair follicles just below the thinning or balding scalp. It is a noninvasive, painless therapy with a 40% success rate in improving hair density and an 85% success rate in halting the progression of hair loss. This is expected to increase the demand for Revage 670 Laser therapy, thereby driving the market growth for the segment.

Others segment include robotic hair transplant, stem cell hair loss therapy, and tissue expansion. Robotic hair transplant is an FDA-cleared minimally invasive procedure. It is physician-assisted technology that offers long-lasting, realistic results. An increase in focus on improving transplantation with the help of technologically advanced products is anticipated to drive the market for the segment. For instance, in March 2023, Venus Concept Inc., a leader in medical aesthetic technology, announced the launch of the latest generation of ARTAS iX.

Cutting-edge robotics, machine learning, artificial intelligence, and machine vision technologies have become the new standard for hair transplants. Stem cell hair loss treatment is the most recent advancement that promises to stimulate new hair growth. Thus, increasing focus on research and development to introduce newer therapies for hair transplant is likely to create an opportunity for market growth.

Hair Transplant Market: Competitive Landscape

Cole Instruments Inc., Vision Medical Inc., Bernstein Medical PC, Curallux LLC, HairMax Inc., NovaGenix LLC, Apira Science Inc., Theradome Inc., Robotics Restoration Inc., and LaserCap Co are among the leading companies operating in the hair transplant market. These players focus on enlarging and diversifying their market presence and acquiring a novel customer base, tapping prevailing business opportunities in the hair transplant market.