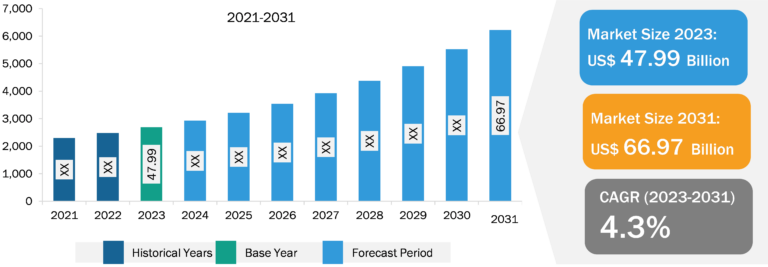

Airborne Pods Market

The increasing military expenditure encourages the incorporation of advanced communication devices, sensor systems, missile detection systems, and surveillance and navigation systems. In addition, a high military budget supports the countries in assigning resources for the advancement of their existing military aircraft, helicopters, and unmanned aerial vehicles. This comprises enhancing or replacing outdated and mature communication, sensor, laser, surveillance, and navigation systems with more advanced and capable ones by incorporating high-end airborne pods. In 2022, CPI Aerostructures, Inc. announced that Collins Aerospace collaborated with CPI Aero and offered a purchase order to manufacture the surveillance and reconnaissance (ISR) and Tactical Synthetic Aperture Radar (TacSAR) intelligence system. In 2020, L3Harris introduced a SIGINT pod named RASISR for airborne platforms. The pod offers full-spectrum SIGINT and advanced sensor technologies for various types of platforms. In 2023, Collins Aerospace tested its MS-110 Multispectral Airborne Reconnaissance System on an F-16 fighter jet, and it is ready for deployment. As airborne pods are majorly used in defense aircraft, helicopters, and unmanned aerial vehicles, the increase in military expenditure boosts the airborne pods market growth.

Increasing Number of Contracts for Supply of Airborne Pods

High-end airborne pods with a wide range of advanced sensors and laser technologies can operate in extreme weather conditions, which is boosting the application of airborne pods in advanced fighter jets, aircraft, unmanned aerial vehicles, and helicopters. Thus, there is a rising need to procure modern surveillance, targeting, intelligence, and countermeasure systems. A few of the contracts signed by the government and manufacturers of airborne pods are mentioned below:

- In 2022, Israel Aerospace Industries secured a new multi-million-dollar deal of delivering Scorpius-SP Airborne Self Protection Jammer pods with Active Electronic Scanned Array technology for an air force in Asia.

- In 2020, Lockheed Martin secured a US$ 485 million contract for Sniper Advanced Targeting Pod (ATP) and airborne sensors for multiple countries and US military services.

- In 2020, INVAP S.E. and the Argentine Air Force collaborated on the development of the airborne POD ISR system aimed at substantially increasing the strength of the defense force.

- In 2020, RAFAEL Advanced Defense Systems secured a contract to supply 5th-generation Litening and RecceLite airborne electro-optical systems for installation on a combat platform of the air force.

Thus, the increasing number of contracts for the supply of airborne pods drives the market globally.

Airborne Pods Market Analysis: Aircraft Type Overview

Based on aircraft type, the airborne pods market is segmented into combat aircraft, helicopters, unmanned aerial vehicles (UAVs), and others. The rise in unstable geopolitical scenarios worldwide is contributing to the rise in the application of airborne pods in military aircraft and helicopters. The increase in government initiatives to strengthen the defense sector to combat modern warfare requirements is also leading to a surge in the application of airborne pods for improved aerial surveillance, detection, targeting, and countermeasure of airborne attacks.

The surge in global security threats, coupled with increased defense spending by several countries, is fueling the procurement of combat aircraft and mission-related equipment across different regions. The combat aircraft segment dominated the airborne pods market in 2022 and is expected to retain its dominance during the forecast period as well. Further, the UAVs segment is likely to register the highest CAGR during 2022 to 2030 and is expected to drive the airborne pods market growth in the coming years.

In addition, a few of the higher military spending countries, such as the US, China, India, and Russia, are also focusing on strengthening their respective airborne forces to increase their firepower. For instance, in 2023, the People’s Liberation Army Air Force announced its plan to increase the number of combat aircraft in its inventory. It also integrates air-to-air missiles and develops a high-end air-to-surface stand-off weapon to strengthen China’s defense force further. China is focusing on advancing its military fleets by replacing the old aircraft with new high-end aircraft equipped with the latest features. In 2022, China introduced its third military aircraft carrier, Fujian. Such factors are likely to generate new opportunities for airborne pods market players during the forecast period.

Airborne Pods Market: Competitive Landscape and Key Developments

BAE Systems Plc, Advanced Technologies Group (ATGI), L3Harris Technologies Inc, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Corporation, SaaB AB, Terma A/S, Thales SA, and Ultra-Electronics Holdings Plc are among the key airborne pods market players profiled during this study. In addition, several other important airborne pods market players have been studied and analyzed during the study to get a holistic view of the airborne pods market and its ecosystem.

| Year | News | Country |

| September 2022 | Northrop Grumman Corporation’s LITENING advanced targeting pod successfully completed its first test flights on the U.S. Navy’s F/A-18 Super Hornet. The Navy selected LITENING to replace the legacy targeting pods on the F/A-18 fleet in early 2022. | North America |

| April 2022 | Saab received an order from the Swedish Defence Materiel Administration (FMV) for the development and integration of a new launch system for Gripen C/D and Gripen E. The order, valued at approximately SEK 400 million (US$ 37 Million), was placed during the first quarter. The order includes the development and integration of a new launch system for air-to-air missiles and countermeasure pods on Gripen C/D and Gripen E. | Europe |