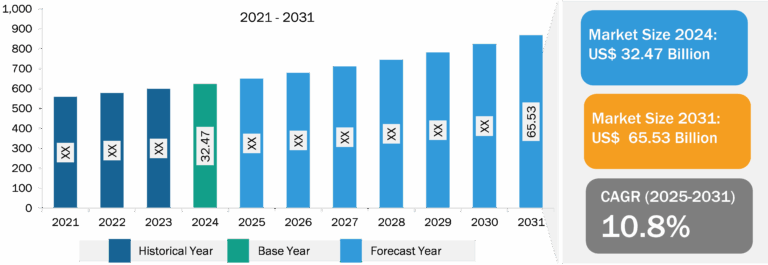

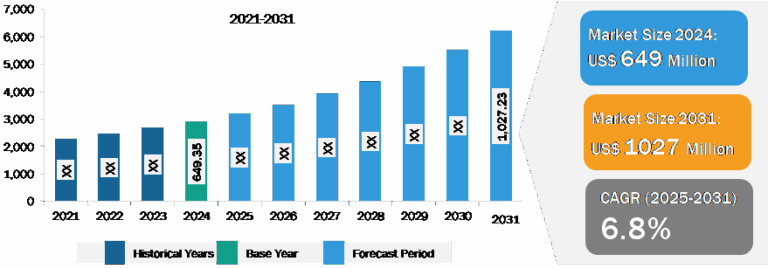

Airline Ancillary Services Market

Increasing Deployment of In-Flight Wi-Fi to Fuel Airline Ancillary Services Market Growth During Forecast Period

Airlines have started offering Wi-Fi services to attract customers and provide better services to compete with large global airlines. In the coming years, in-flight Wi-Fi is expected to deliver higher speed. For instance, in June 2023, the Thales Group, a defense conglomerate, collaborated with the civil aviation ministry of India to introduce in-flight internet services. In November 2022, AirAsia India and Sugarbox (a cloud technology firm) partnered to provide in-flight Wi-Fi service on all AirAsia aircraft. The collaboration aims to enable passengers to access over 1,000 international and Indian movies. Carrier service providers such as Lufthansa, Austrian Airlines, and Eurowings are anticipated to soon provide their customers with “home-style” broadband, whereas other carrier service providers, including Air France-KLM, SAS, Finnair, British Airways, Aer Lingus, and Iberia, are planning to deploy the latest generation of connectivity equipment. Thus, the increasing deployment of in-flight Wi-Fi owing to rising demand for high connection speed is anticipated to boost the growth of the airline ancillary services market during the forecast period.

Airline Ancillary Services Market: Industry Overview

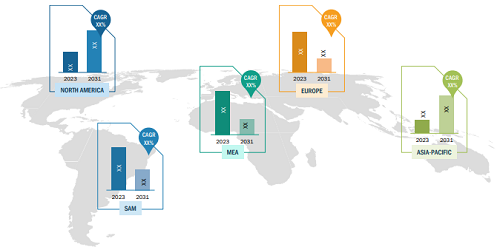

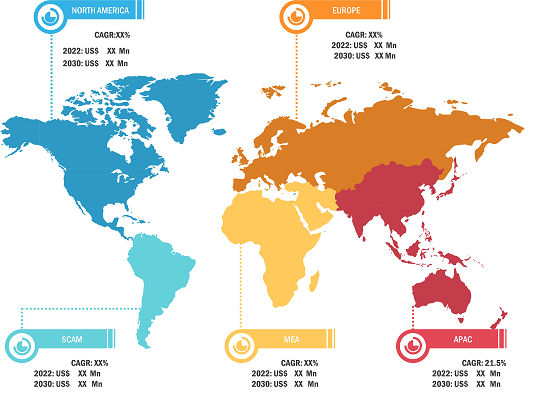

The airline ancillary services market is segmented on the basis of type and carrier type. Based on type, the airline ancillary services market is segmented into baggage fees, on-board retail and a la carte services, airline retail, FFP mile sales, and others. Based on carrier type, the airline ancillary services market is bifurcated into full-service carriers and low-cost carriers. By region, the airline ancillary services market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The global airline ancillary services market is segmented into five major regions: North America, Europe, APAC, the Middle East & Africa, and South America. In 2022, Asia Pacific led the global airline ancillary services market with a substantial revenue share, followed by North America and Europe. Asia Pacific is a diverse region with more than 4 billion people and comprises dynamic economies that cumulatively generate 35% of the global GDP. The aviation industry in the region is a pivotal contributor to its social and economic development. Also, in APAC, government initiatives on airline ancillary services propel the APAC airline ancillary services market growth. In December 2022, the Singapore government provided an additional US$ 84 million to the aviation sector amid the COVID-19 pandemic to support the airline ancillary services market. The funding will enable aviation companies to develop and deploy innovative technologies and measures to protect airport workers and aircrew from contracting SARS-CoV-2. This led to increased demand for ancillary services such as aircraft and baggage sanitization systems, creating opportunities for service providers in the market. The growth of Asian economies is primarily driven by a wide range of income levels and a rapidly growing middle-class population, especially in countries such as India and China. The airlines recording prominent digital and mobile revenue are anticipated to stay ahead in the airline ancillary services market growth.

Airline Ancillary Services Market: Competitive Landscape and Key Developments

United Airlines Holdings Inc, American Airlines Group Inc, Delta Air Lines Inc, EasyJet Plc, Deutsche Lufthansa AG, Qantas Airways Ltd, Ryanair Holdings Plc, Southwest Airlines Co, The Emirates, and Air France KLM SA are among the leading players profiled in the airline ancillary services market report. Several other essential market players were analyzed for a holistic view of the market and its ecosystem. The report provides detailed market insights, which help key players strategize their market growth. A few of the developments in the airline ancillary services market are mentioned below.

- In February 2023, United Airlines recently announced its decision to allow families with small children to select adjacent seats at no additional cost. This customer-friendly move acknowledges the importance of providing families a seamless and comfortable travel experience, highlighting United’s commitment to enhancing its ancillary offerings.

- In January 2023, Delta Air Lines’ announced free Wi-Fi for passengers in the US, made possible through a partnership with T-Mobile. Starting February 1, the frequent flier program members of SkyMiles would enjoy complimentary Wi-Fi. This move, made as a significant step toward enhancing ancillary service offerings, demonstrates Delta’s commitment to improving the inflight experience and adding value to its loyal customers.

- In July 2022, EasyJet took steps to improve the customer experience with a series of initiatives for the summer travel season. These include a dedicated customer hotline for families, extended customer service hours, “Helping Hands” at key airports, and the reintroduction of the Twilight Bag Drop service. The airline aims to provide additional support and convenience to passengers, showcasing its commitment to enhancing ancillary services.