Aircraft Avionics Market

The aviation industry is maturing at a rapid rate over the years, recording a significant number of production and deliveries of aircraft (commercial and military) fleet. The commercial aviation industry is on a tremendous rise over the past few years with the emergence of low-cost carriers (LCCs) and expansion strategies of fleet adopted by the full-service carriers (FSCs). These two factors have showcased massive order volumes on various commercial aircraft manufacturers across the world. Commercial aviation is foreseen to surge in the coming years with an increase in air travel passengers and aircraft volumes. This factor is anticipated to drive the number international flights, thereby boosting the demand for new airport fueling equipment at airports.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) are continuously encountering orders for various aircraft models from different civil airlines. The table below highlights the comparison of orders and deliveries from Airbus and Boeing during 2020–2022:

Aircraft Orders and Deliveries, by Boeing and Airbus, 2020, 2021, and 2022

| Years | 2020 | 2021 | 2022 | |||

| Commercial Aircraft | ||||||

| Aircraft Manufacturers | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus |

| Orders | 184 | 383 | 909 | 771 | 935 | 1078 |

| Deliveries | 157 | 566 | 340 | 609 | 480 | 661 |

The tremendous rise in procurement of aircraft by Boeing and Airbus is one of the most crucial driving factors for the growth of the aircraft avionics market. As with the increasing number of aircraft and airports, the demand for avionics is also expected to rise in the coming years.

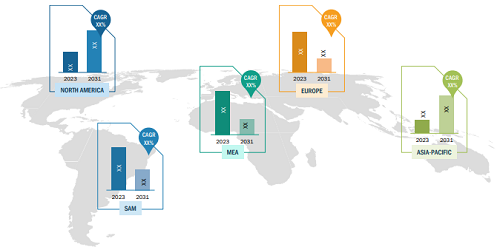

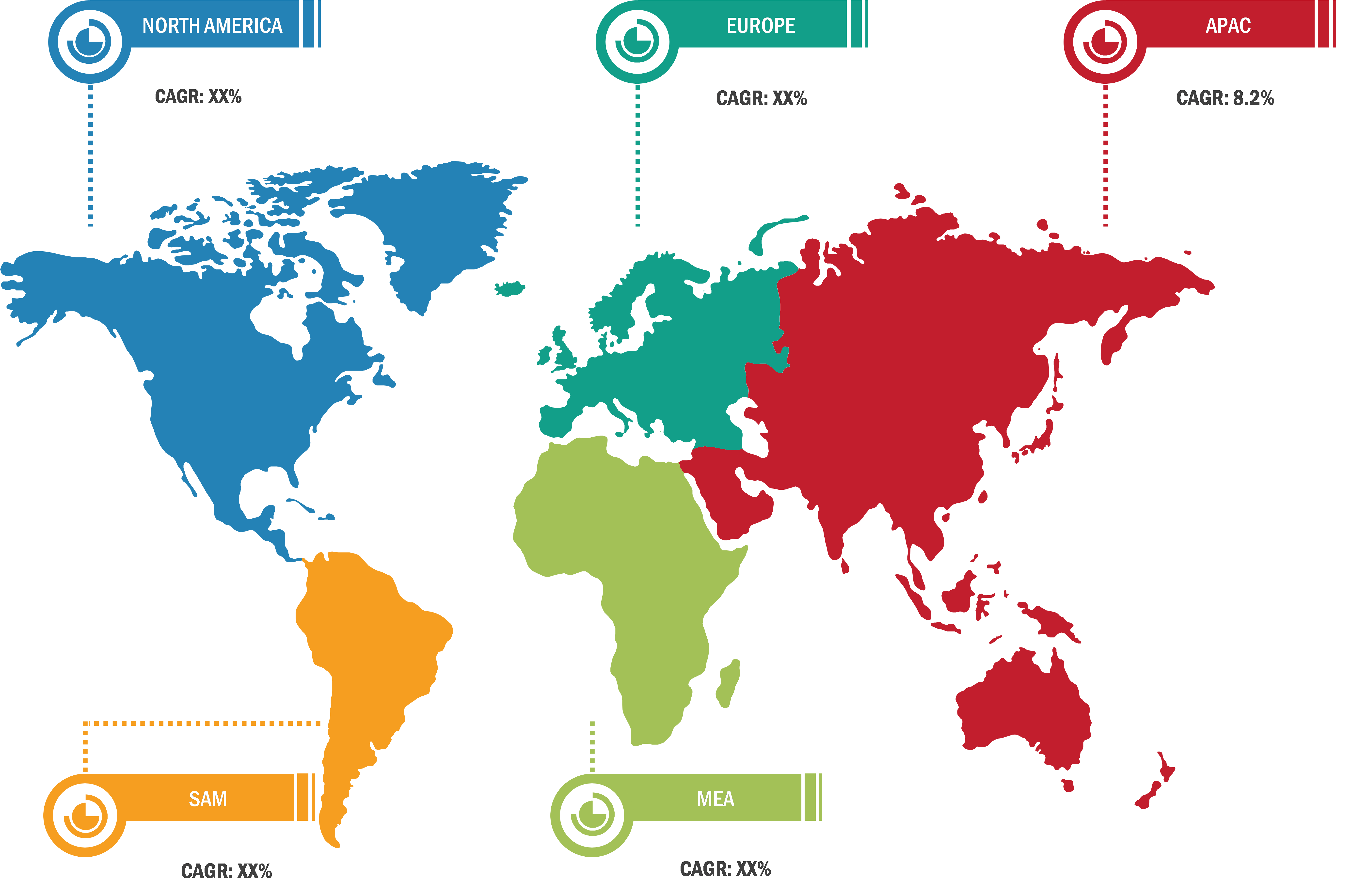

North America was estimated to be the largest region in terms of market share in the global aircraft avionics market share in 2022 and it is also expected to retain its dominance during the forecast period as well. This is mainly due to the presence of large number of aircraft and avionics manufacturers and the presence of countries such as the US and Canada which have already been some ideal pioneers in the field of aircraft technologies since past few decades. Moreover, the growth in number of aircraft orders across the US is another major factor boosting the growth for aircraft avionics market in the region. Also, the Asia Pacific region is expected to witness a fastest growth rate during the forecast period in the global aircraft avionics market. This is mainly due to the rising orders for different types of aircraft and growing awareness for the electrification of older aircraft fleet for applications such as inflight media & entertainment, flight controls, fuel controls, flight management, and other applications. Such factors have been pushing the global aircraft avionics market growth across the Asia Pacific region.

In addition, the supportive government policies for construction of new airports across the countries such as India and China acting as another major factor catalyzing the demand for new aircraft operations across such countries which is also expected to generate the demand for aircraft avionics market across the Asia Pacific region. For instance, the Indian government has already announced their plans for the construction of 160 new airports by the end of 2026 to cater to the rising passenger traffic and growing country aircraft fleet. Such factors are likely to drive the growth for global aircraft avionics market across different regions from where the aircraft procurement is expected to be made in the coming years.

Rising Procurement of Military Aircraft to Provide Lucrative Opportunities for Aircraft Avionics Market

One of the major factors driving the growth for aircraft avionics market includes the rising production and deliveries of military aircraft across different countries. Moreover, another major factor supporting the deployment of aircraft avionics includes refurbishment of older military aircraft fleet. Below are some of the aircraft procurement contracts that are driving the growth for aircraft avionics market across different regions:

- In October 2023, Airbus Defense and Space won contract worth US$ 1296.02 million to provide capability enhancement and the in-service support of the French A330 MRTTs (Multi Role Tanker Transport) fleet of French military.

- In November 2023, Lockheed Martin secured a contract worth US$ 177 million to upgrade Chilean F-16 fighter jets.

- In April 2023, Lockheed Martin Corporation won a contract worth US$ 7.8 billion from the US Pentagon to upgrade 126 units of F-35 multi-role military aircraft.

- In July 2023, Boeing announced that it has secured a contract worth US$ 795 million to provide military aircraft to the US Army.

- In September 2021, Tata and Airbus collaborated and signed a contract worth US% 2,736.32 million to manufacture military aircraft in Indian region.

Such procurement and refurbishment (upgrades) of military aircraft is providing new opportunities for aircraft avionics market players across different regions.

Aircraft Avionics Market: Segmental Overview

Based on aircraft type, the market is segmented into commercial aircraft and military aircraft. The commercial aircraft segment held the largest share of the market in 2022, and it is also anticipated to register the highest CAGR in the market during 2022 to 2030. Based on avionics type, the aircraft avionics market is segmented into navigation systems, communication systems, power & flight management systems, weather monitoring system, electronic flight display, and others. The power & flight management systems segment held the largest share of the aircraft avionics market in 2022, and it is also anticipated to register the highest CAGR in the market during 2022 to 2030.

Aircraft Avionics Market Analysis: Competitive Landscape and Key Developments

L3Harris Technologies Inc, Raytheon Technologies Corporation, Curtiss-Wright Corporation, Honeywell International Inc, General Electric Company, Safran SA, BAE Systems Plc, Moog Inc, Meggitt Plc, and Garmin Ltd are a few of the key companies operating as some of the major aircraft avionics market players across different regions. The market leaders focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

- In December 2021, HAL (Hindustan Aeronautics Limited) signed a contract worth US$ 288 million with BEL (Bharat Electricals Limited) to supply avionics components for the LCA Tejas Mk1A fighter aircraft programme.

- In April 2023, GE Aerospace and AJW Group signed an agreement to provide the support for avionics and electrical power systems for B777, B737 and A320/30/40 family of aircraft models.