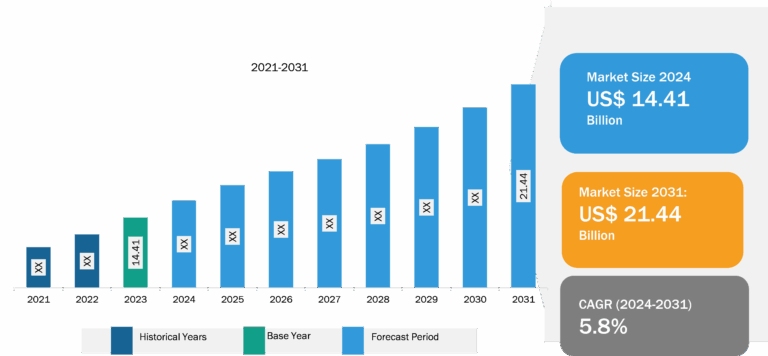

Electronic Health Record Market

A patient’s medical history is maintained by a provider in an electronic health record format for a period of time. It includes important administrative and clinical data, along with demographics, progress notes, health problems, medications, vital signs, past medical history, immunizations, laboratory data, and radiology reports. The electronic health record automates access to information and has the potential to streamline the clinician’s workflow. The electronic health record can also support other care-related activities through various interfaces, including evidence-based decision support, quality management, and outcomes reporting. The market for electronic health records is largely driven by growing incidences of medication errors and rising incentives by the federal government.

Report Segmentation and Scope:

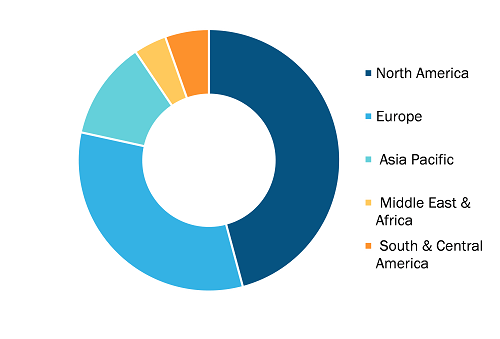

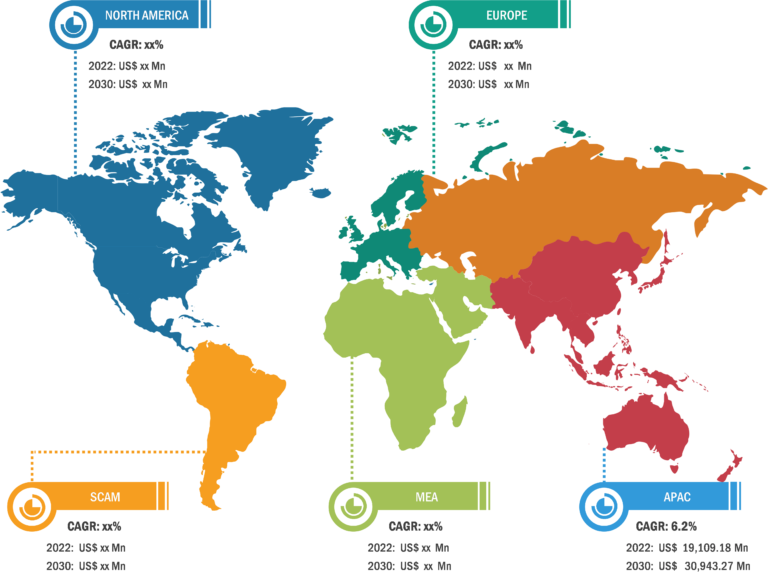

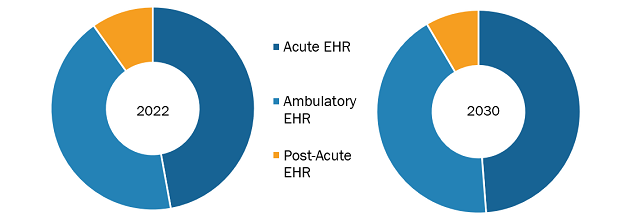

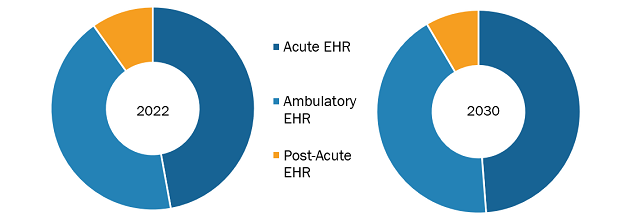

The “global electronic health record market” is segmented on the basis of installation type, type, application, and end user. Based on installation type, the market is bifurcated into cloud-based and on-premise. In terms of type, the global electronic health record market is divided into acute electronic health record, ambulatory electronic health record, and post-acute electronic health record. By application, the market is segmented into clinical records, administrative task and billing, physician support, and patient portal. Based on end user, the market is segmented into hospitals and clinics, physician’s office/specialty care centers, and ambulatory surgical centers.

Rising Incentives by Government Drives Electronic Health Record Market Growth

The government has invested billions in training health information technology workers and founding regional extension centers to provide technical advice. In 2009, as part of the Health Information Technology for Economic and Clinical Health (HITECH) Act, the federal government reserved US$ 27 billion for an incentive program that motivates hospitals and providers to implement electronic health record systems that would enable the health data that was historically confiscated in paper files to be shared among providers and use to improve the healthcare quality.

The Medicare Electronic Health Record Incentive Program is governed by the Centers for Medicare & Medicaid Services (CMS). In the US, the Medicare and Medicaid Electronic Health Records Incentive Programs offer incentives to hospitals, physicians, and other healthcare facilities for meaningful use of certified Electronic Health Records technology. A qualified professional or hospital can get a maximum incentive amount of up to US$ 63,750 through the Medicaid Electronic Health Records Incentive Program and up to US$ 44,000 through the Medicare Electronic Health Records Incentive Program. This incentive program succeeded in inspiring many healthcare facilities to adopt electronic health record systems.

Furthermore, the high healthcare spending and implementation of numerous programs to adopt and strengthen electronic health records will influence market progress. Governments across various nations inject huge funds and investments into the healthcare sector. For instance, in 2021, the Government of India launched a digital health initiative scheme called Ayushman Bharat Digital Mission (ABDM) to provide easy access to treatment records, enabling faster and more effective treatments for patients.

Growing Strategic Initiatives Provides Opportunities for Market Players in the Electronic Health Record Market

Health systems across the world are experiencing growing consumer engagement. Several established brands and start-ups are expanding their businesses beyond their national boundaries. For instance, the US-based Cleveland Clinic is expanding its markets in the UAE. An increasing number of mergers and acquisitions are being led by top companies, resulting in a significant growth of the electronic health record market. In January 2021, Allscripts Healthcare Solutions partnered with the US Orthopedic Alliance (USOA) to bring about market-efficient infrastructure to assist orthopedic practices with agility, providing evidence-based guidelines to support evolving clinical protocols, improve electronic health record implementation timelines, and create community-wide connectivity with value-based care analytics. In March 2022, CareCloud, Inc.’s management modified staff assignments for home care management and gave clinicians and administrators visibility and control over operational metrics.

Electronic Health Record Market: Competitive Landscape and Key Developments

Oracle Corp, AltexSoft Inc, Veradigm Inc, Greenway Health LLC, eClinicalWorks LLC, Infor-Med Inc, Microwize Technology Inc, Athenahealth Inc, ChipSoft BV, CureMD.com Inc, AdvancedMD Inc, and PracticeSuite Inc are among the leading companies functioning in the electronic health record market. These companies opt for product innovation strategies to meet growing customer demands, which allows them to maintain their brand name in the electronic health record market.

A few of the recent developments in the global electronic health record market are mentioned below.

- In November 2023, eClinicalWorks LLC launched AI assistant tools that easily translate medical documents into its patients’ native language within the electronic health record.

- In September 2023, Oracle announced significant additions to its healthcare solutions, including new cloud-based electronic health record capabilities, generative AI services, public Application Programming Interfaces (APIs), and back-office enhancements designed for the healthcare industry.

- In May 2022, Greenway Health released Greenway Secure Cloud, a fully bundled, cost-effective cloud-based electronic health record and practice management solution. Greenway Secure Cloud increases the safety of patient health information and practice records, eradicates the necessity to manage software upgrades, and provides scalable, all-inclusive pricing to clients. This solution protects against cybersecurity threats by managing provider data in a maximum-security center and regularly and consistently repairing security concerns in the ever-changing landscape of ransomware and malware attacks.