Middle East and Africa Botulinum Toxin Market

Increasing Popularity Of Minimally Invasive Cosmetic Procedures to Boost Middle East and Africa Botulinum Toxin Market Growth During Forecast Period

The increasing popularity of minimally invasive cosmetic procedures in countries like Saudi Arabia, the UAE, South Africa, and the rest of the Middle East regions can be attributed to several factors, such as cultural shifts, technological advancements, medical tourism, increased disposable income, influence of social media and accessibility to clinics.

According to the American Society of Plastic Surgeons, in 2020, ~4% of Africans underwent Cosmetic minimally-invasive procedures for Botulinum toxin type A. In South Africa, it is registered for treating severe eyelid spasms and spastic foot deformities.

Changing societal attitudes towards cosmetic enhancements and a greater acceptance of aesthetic procedures contribute to the rise in demand for minimally invasive treatments. Also, the availability of advanced technologies for minimally invasive procedures, such as Botox injections, dermal fillers, and laser treatments, enhances safety and effectiveness, attracting more individuals to these options. Some of the Middle Eastern countries, particularly Saudi Arabia and the UAE, have become hubs for medical tourism. Individuals from various regions seek high-quality and advanced cosmetic procedures, contributing to the growth of the industry. Cosmetic tourism has brought a remarkable boom in the local economy. As per the Dubai Chamber of Industry and Commerce, the cosmetic sector in the UAE contributes around 50% of the medical tourism industry. Dubai witnessed remarkable growth in medical tourism in 2022 with around 674,000 medical tourists spending AED 992 million (US$ 270 million) in the year, an increase of AED 262 million (US$ 71.32 million) from 2021. As per the report by the Dubai Health Authority (DHA), ~39% of the medical tourists were from Asian countries, ~22% from Europe and the Commonwealth of Independent States and about 21 % from Arab and Gulf Cooperation Council (GCC) countries.

Furthermore, economic prosperity and higher disposable incomes in these countries allow individuals to invest in aesthetic treatments for self-enhancement. Additionally, the influence of social media platforms showcasing beauty standards and cosmetic transformations has played a role in increasing awareness and interest in minimally invasive cosmetic procedures. Increasing establishment and accessibility of specialized clinics and aesthetic centers offering a range of minimally invasive treatments contribute to the growing popularity. It’s important for individuals considering such procedures to seek qualified and reputable practitioners and for clinics to adhere to ethical and safety standards to ensure positive outcomes.

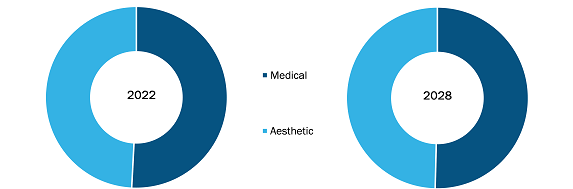

Based on product, the Middle East and Africa botulinum toxin market is segmented into Botox, Dysport Xeomin, and others. The Botox segment held the largest market share in 2022 and is expected to retain its dominance during the forecast period. By application, the market is bifurcated into medical and aesthetic. The medical segment held the largest market share in 2022. However, the aesthetic segment is anticipated to register the highest CAGR during the forecast period. The botulinum toxin market, by end-user, the market is fragmented into hospitals and clinics, specialty and dermatology clinics, and others. The specialty and dermatology clinics segment held the largest share of the market in 2022 and is anticipated to register the highest CAGR in the market during the forecast period.

Based on country, the Middle East and Africa botulinum toxin market is divided into Saudi Arabia, UAE, South Africa, Lebanon, Oman, Jordan, Qatar, Kuwait, Bahrain, and the Rest of the Middle East and Africa. The rest of the Middle East and Africa region consists of countries like Israel, Egypt, Iran, Iraq, and other small economies. The most common brands of Botulinum toxin used in Israel are Dysport and Botox. According to the Jerusalem Post, a total of 290,000 Israelis received botox injections for cosmetic purposes in the year 2021. The most popular aesthetic procedure by far is Botox, which is injected into the face to reduce the appearance of wrinkles.

Furthermore, few manufacturers in this region are highly involved in the research and development activities for Botulinum toxin. For instance, Mapi Pharma is a clinical-stage pharmaceutical company developing proprietary pharmaceuticals. Mapi Pharma Ltd is located in Ness Ziona, Israel, and has GMP-approved API and FDF facilities. The company currently has a few products in the pipeline, one of which is Botulinum toxin Yearly Injection (Botox) for Urinary incontinence. Such ongoing research and development by companies in this region is expected to provide growth opportunities in the future.Top of Form

Middle East and Africa Botulinum Toxin Market: Competitive Landscape and Key Developments

Abbvie Inc., Merz Aesthetics, Galderma, Evolus, Revance Therapeutics Inc., Ipsen SA, Medytox Inc., Evolus Inc., Hugel Inc., Lanzhou Institute of Biological Products Co Ltd, Gufic, and Metabiologics, Inc. are among the leading companies operating in the Middle East and Africa Botulinum Toxin market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, thereby tapping prevailing business opportunities in the Middle East and Africa Botulinum Toxin Market market.

In January 2023, Korea-based Medytox, a biopharmaceutical company, signed a memorandum of understanding (MOU) with Dubai Science Park to build a botulinum toxin production facility in the United Arab Emirates (UAE), seeking to capitalize on the country’s fast-growing market for cosmetic products.

However, side effects associated with the botulinum toxin market are likely to hamper its growth.

In October 2022, Daewoong Pharmaceutical obtained product approval from the Saudi Arabian and Ukrainian governments for Nabota, a botulinum toxin (BTX) product.