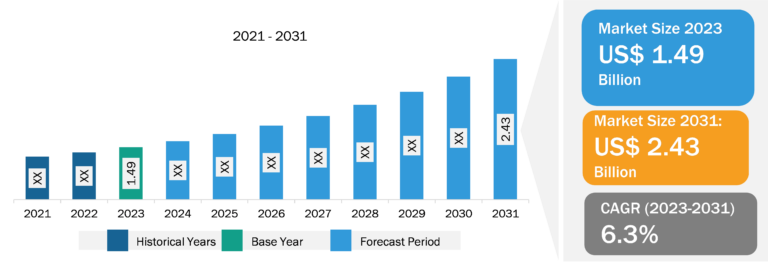

Africa Very Small Aperture Terminal (VSAT) Market

The companies operating in the Africa VSAT market are expanding their business in the region. In August 2020, Cobham Satcom, a renowned provider of radio and satellite communication solutions for the maritime and land sectors, expanded its SAILOR XTR portfolio. This expansion includes introducing two new Ka-band antenna systems designed specifically for Telenor Satellite’s THOR 7 VSAT services. The one-meter SAILOR 1000 XTR Ka and the 65-centimeter SAILOR 600 XTR Ka are newly introduced systems incorporating Cobham Satcom’s cutting-edge VSAT technology platform. These systems ensure high-speed broadband service on the THOR 7 satellite, which supports several network applications, including cloud-based big data management, thereby fueling the Africa VSAT market growth.

Africa VSAT Market

The VSAT market share in South Africa is projected to experience substantial growth in the foreseeable future, owing to the escalating demand for dependable and affordable connectivity solutions, particularly in remote and rural areas. The increasing utilization of VSAT technology to enhance crew welfare within the oil & gas sector, the growing requirement for VSAT systems to facilitate telemedicine in isolated areas, and the expanding use of VSAT systems for effective disaster management and emergency response contribute to the Africa VSAT market growth. VSAT is a satellite communication technology that uses small antennas to transmit and receive data from satellites. VSAT systems are widely used for applications such as broadband, voice, broadcast, maritime, and airborne communications.

VSAT is a two-way ground station that transmits and receives data from satellites. It is used for various types of data management and communication purposes. The Africa VSAT market is driven by factors such as increasing demand for high-speed internet connectivity, advancements in satellite communication technology, and the need for reliable communication networks in remote areas.

Further, in August 2020, Paratus South Africa, a subsidiary of Paratus Africa, a prominent pan-African telecommunications service provider, announced its plans to make significant investments in the South African satellite market. These investments aim to provide high-quality connectivity to South Africa and the Rest of Africa. Paratus is leveraging satellite technology to offer Internet Service Providers (ISPs) and businesses a versatile, dependable, and cost-effective communication solution that caters to a wide range of needs. Thus, such initiatives are expected to benefit the overall Africa VSAT market growth.

Africa VSAT Market Analysis: Competitive Landscape and Key Developments

GlobalTT SaRL, NTvsat, Talia Communications Ltd, Afrikanet Oxford Consultech UK Ltd, Norsat International Inc, Sandstream Telecoms, VSATmena FZCO, Echostar Corp, and Link Communications Systems Ltd are among the prominent players profiled in the Africa VSAT market report. Mergers & acquisitions, partnerships, and R&D activities are key strategies adopted by players to mark their position in the market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the Africa VSAT market. A few recent key market developments are listed below:

- In April 2020, Norsat International announced the launch of a new satellite antenna in its WAYFARER series of portable and easy-to-deploy commercial terminals.

- In January 2024, Es’hailSat, the Qatar Satellite Company, expanded its partnership with Viasat Energy Services for VSAT connectivity throughout the Middle East & North Africa. The agreement makes use of the capabilities of the Es’hail-1 satellite, which is located at 25.5 degrees east and is specifically targeted to diverse sectors such as government, maritime, oil & gas, and energy.