Distributed Control System Market

The report includes growth prospects owing to the current distributed control system market trends and their foreseeable impact during the forecast period. By adopting modular and open architectures, DCS can be easily adapted to various applications and scaled up or down depending on specific needs. This flexibility caters to a wider range of customer demands and fosters market growth. Modern architectures promoting seamless integration with different devices and systems (e.g., PLCs, SCADA) create a more collaborative and data-driven control environment. This improved interoperability attracts customers seeking integrated solutions for complex processes, expanding the market potential. Further, integrating edge computing capabilities into DCS architecture allows for localized data processing and decision-making. This reduces network traffic, improves response times, and opens doors for applications such as real-time control and optimization, attracting customers seeking improved efficiency and performance.

The DCS is often a mission-critical system for industrial users. Moreover, it is a heavy investment; hence, replacing them every time a new technology comes along, which could have a beneficial impact on the business, is not practical or affordable. The future DCS will solve this obstacle by being more digital and more flexible. The aim is to enable a more innovative architecture that gives users the capability to improve the DCS without interrupting its working, effectively separating the core functions of the DCS from those that are less time- or process-critical. Thus, architectural development in DCS is expected to provide significant opportunities for the distributed control system market growth.

Canada has seen tremendous growth in many industries. The country has several automation companies that are specialized in operating ICT industries throughout the country. For instance, in October 2023, Vention, the Quebec-based company behind the only fully integrated manufacturing automation platform (MAP), announced an investment of US$ 15 million from the Fonds de solidarité FTQ. With the support of its partners, Vention continues its strong growth and pursues its mission to democratize industrial automation, boosting the productivity and competitiveness of manufacturing companies. In addition, the innovations and developments by the companies in Canada have led to an increase in the adoption of advanced systems. For instance, in August 2023, ANYbotics strengthened its presence in Canada, appointing MicroWatt Controls as a reseller partner. Calgary-based MicroWatt Controls increased inspection robot deployment in the country’s oil & gas, chemical, energy, and mining sectors. Canada has become the hub for many technical innovations and improvements in the recent past. A continued development scenario in process industries is anticipated to drive the distributed control system market in the country.

Mexico’s factory automation offers customers better quality, standardized, and reliable products within time and at an affordable cost. Due to low labor costs, several US-based and other companies are shifting their manufacturing base to Mexico, which, in turn, widens the scope for manufacturers to set up their plants. Also, several companies are planning to increase their investments in Mexico. For instance, in December 2022, AtomTech announced that it would increase its presence in Mexico. In addition, in September 2022, Bosch Rexroth strengthened its presence in North America with a new manufacturing plant in Mexico. Thus, the rising industrial automation and the increasing number of manufacturing plants in Mexico fuel the growth of the distributed control system market.

The UK is one of the most technologically advanced countries in Europe. The availability of various technology companies is pushing the UK government to focus on advanced technologies such as the Internet of Things (IoT) and artificial intelligence. The automotive industry in the UK is exploiting these technologies to optimize productivity. Further, the demand for DCS is rising among British manufacturers since several automotive manufacturers are investing time and money in developing and delivering connected cars. The DCS facilitates easy data transfer among connected vehicles. Hence, the manufacturing sector in the UK is focusing heavily on the adoption of DCS, which is boosting the distributed control system market growth.

US Dominates Distributed Control System Market in North America

In North America, the US held the largest distributed control system market share in 2022. The US is a global leader in industrial automation and associated equipment and controls. Industrial automation is broadly categorized into hardware and components, which are used to automate systems in industrial or manufacturing settings. Companies in the US are taking various initiatives to increase the implementation of industrial automation. For instance, in September 2023, Rockwell Automation partnered with BIC to drive digital transformation and efficiency through the Plex manufacturing execution system (MES). Such initiatives by the companies are likely to have a significant impact on the distributed control system market forecast in the next few years. In addition, oil & gas, petrochemicals, and pharmaceuticals industries are growing at a rapid pace. Technological advancements in these industry verticals are also high due to the presence of technological companies in the country, coupled with increased investments from the government for research and development activities. Moreover, the high per capita income of people in the region is fueling the growth of various industry verticals, coupled with investments from the private sector, which is further propelling the distributed control system market growth in the country.

Segmental Overview

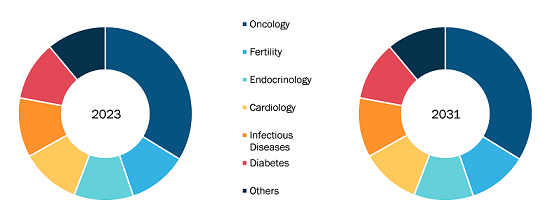

Based on component, the distributed control system market is segmented into hardware, software, and services. The software segment recorded the largest distributed control system market share in 2022. The services segment is anticipated to register the highest CAGR during the forecast period. Based on industry, the market is segmented into power generation, oil & gas, pharmaceutical, food & beverages, chemicals, and others. The oil & gas segment recorded the largest share in the distributed control system market in 2022. The pharmaceutical segment is anticipated to register the highest CAGR during the forecast period.

Market Analysis: Competitive Landscape and Key Developments

ABB Ltd, Emerson Electric Co, General Electric Co, Honeywell International Inc, NovaTech LLC, Rockwell Automation Inc, Schneider Electric SE, Siemens AG, Toshiba Corp, and Yokogawa Electric Corp are among the key players that are profiled in the distributed control system market report. Several other essential players were also analyzed for a holistic view of the market and its ecosystem. The distributed control system market report provides detailed market insights to help major players strategize their growth.

A few key strategic initiatives taken by the market players, as per the company press releases, are mentioned below.

• In February 2023, ABB unveiled the latest version of the ABB Ability Symphony Plus distributed control system (DCS) to assist digital transformation in the power generation and water industries. The most recent version of Symphony Plus will enhance clients’ digital journeys by providing streamlined and secure OPC UA1 connectivity to the Edge and Cloud without interfering with key control and automation capabilities.

• In May 2023, Emerson introduced the NextGen Smart Firewall, enhancing perimeter security for DeltaV distributed control systems, offering improved performance, increased bandwidth, and role-based access control.