Ophthalmic Devices Market

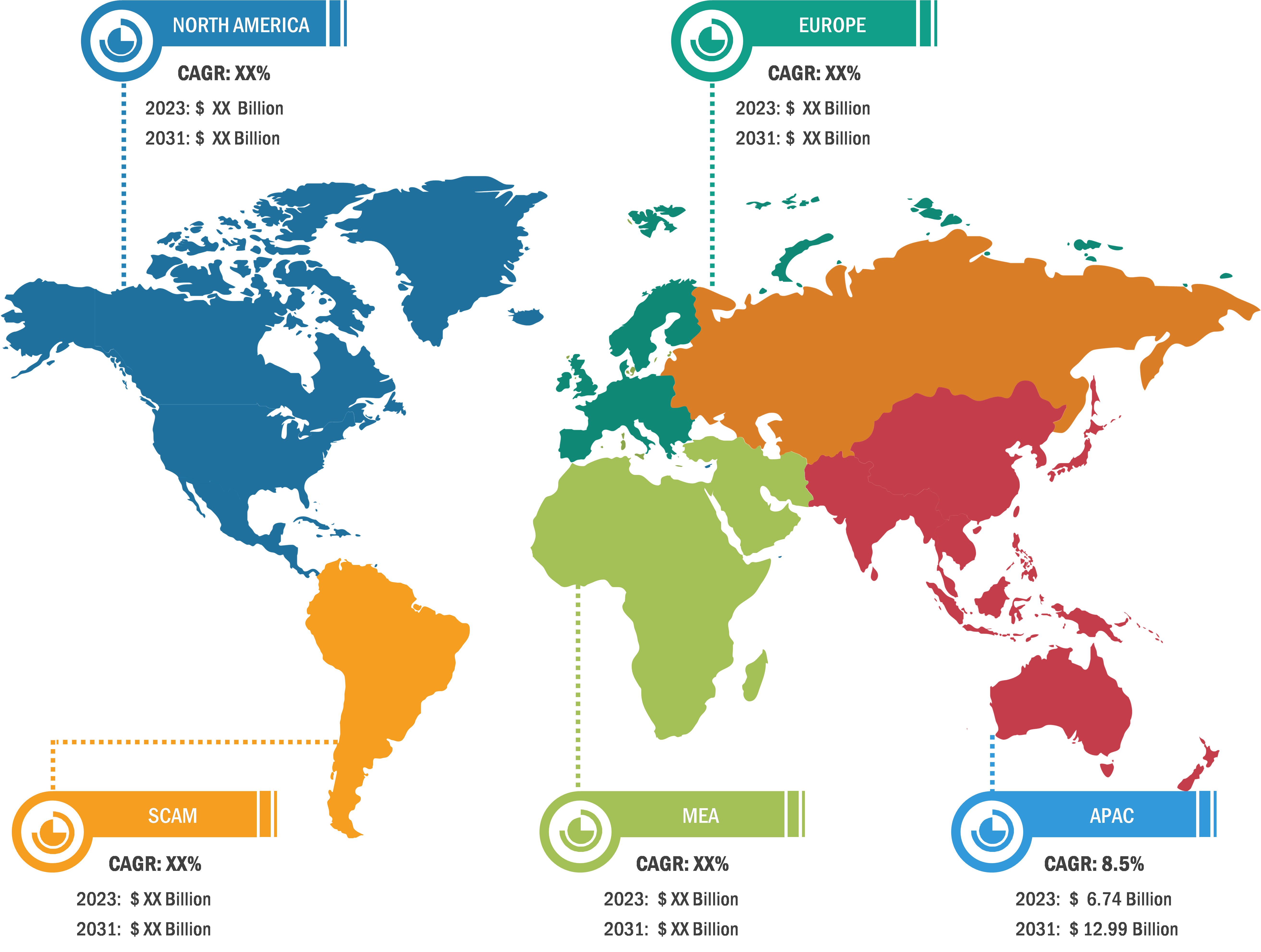

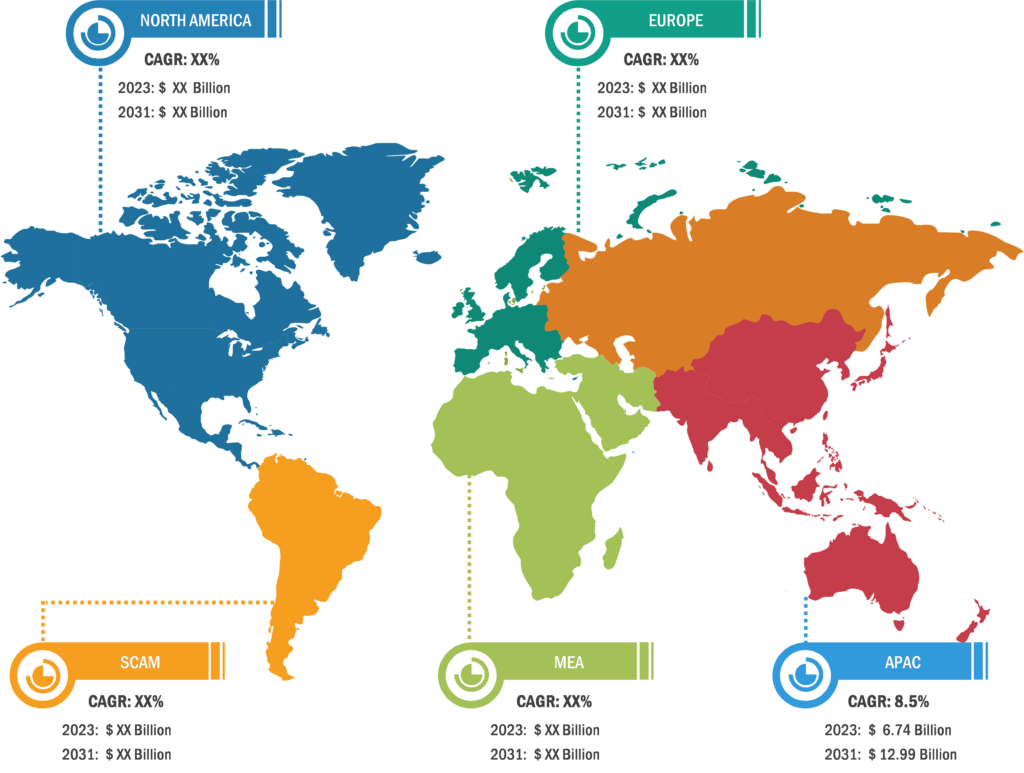

Ophthalmic medical devices used in optometry and ophthalmology applications include invasive devices such as contact lenses, implantable devices such as intraocular lenses and glaucoma stents, and noninvasive diagnostic equipment and instruments. This category of devices also includes surgical equipment and systems such as phacoemulsification machines and lasers. The growing geriatric population and increasing prevalence of optical disorders are noteworthy factors contributing to the growing ophthalmic devices market size in the world. Moreover, the market is anticipated to rise with technological developments, rising demand from emerging countries, and rising awareness of eye health. Government initiatives in regions such as North America and Europe to support and promote vision correction and eye care also contribute to the expansion of the global market for ophthalmic devices. However, the high cost of devices and low treatment rates in emerging nations hinder the growth of ophthalmic devices market.

Increasing Prevalence of Optical Diseases Drives Ophthalmic Devices Market Growth

Eye-related conditions and diseases include diabetic retinopathy (DR), glaucoma, cataracts, and age-related macular degeneration. The incidence of optical diseases leading to vision impairment is rising among the population across the world. High blood sugar levels that damage blood vessels and change the blood vessels of the retina are the major causes of DR. These blood vessels may swell, leak, or close down, thus stopping the passage of blood. In a few people, abnormal new blood vessels grow on the retina’s surface. These changes can hamper a person’s vision. As per an article published by the American Academy of Ophthalmology, nearly 191.0 million people globally are estimated to suffer from DR by 2030. According to the 2021 NCBI article titled “Global Prevalence of Diabetic Retinopathy and Projection of Burden through 2045,” the number of adults with DR across the globe was ~103.12 million in 2020 and is expected to reach ~160.50 million by 2045. DR is also the most common diabetic eye disease and a prominent cause of blindness among US adults. As per a study by the NEI’s Diabetic Retinopathy Clinical Research Retina Network 2022 study, the number of Americans with DR is anticipated to double during 2010–2050, reaching 14.6 million by 2050 from 7.7 million in 2010. Per the International Diabetes Federation data, in 2021, 537 million people were living with diabetes, and the number is projected to reach 783 million by 2045. With the rise in number of people living with diabetes, the cases of DR and vision impairment are also expected to surge in the coming years.

Glaucoma ranked as the second-leading cause of blindness worldwide, damages the eye’s optic nerve. The situation occurs when a layer of fluid fills up on the outer side of the eye, creating pressure and thus causing damage to optic nerves. Per the National Glaucoma Research data, the number of people suffering from glaucoma is anticipated to rise from ~80 million in 2020 to ~111 million by 2040. Additionally, 50% of people having glaucoma are unaware of their condition, and 90% of glaucoma cases in developing nations go undiagnosed. It is also the prominent cause of irreversible blindness among the US population, and more than 3 million Americans have glaucoma, as per the Glaucoma Research Foundation. In 2019, as stated in a report on the Detection of Glaucoma and Other Eye Disorders in Japan, ~238,019 cases of glaucoma were recorded.

Per the World Health Organization estimates, as of October 2021, 2.2 billion people worldwide suffered from near- or far-sighted visual impairment. Cataracts (~94 million cases) and uncorrected refractive errors (~88.4 million cases) were the primary causes of visual impairment and blindness. According to the Centers for Disease Control and Prevention data, ~12 million people in the US aged 40 and over suffered from vision impairment in 2022, of which 3 million had vision impairment after correction and 8 million suffered from vision impairment due to uncorrected refractive index.

Thus, the rapid rise in the prevalence of optical diseases, such as glaucoma, cataracts, and DR, significantly contributes to the demand for surgical and vision care devices, thereby driving the ophthalmic devices market growth.

Ophthalmic Devices Market: Segmental Overview

The ophthalmic devices market is segmented on the basis of product, indication, and end user. Based on end user, the market is categorized into hospitals and eye clinics, academic and research laboratories, and other end users. The hospital and eye clinics segment held a significant ophthalmic devices market share in 2023 and is estimated to register the highest CAGR during 2023–2031.

Ophthalmic Devices Market: Competitive Landscape and Key Developments

Alcon, Topcon, Bausch + Lomb, Carl Zeiss Meditec, Haag Streit Holding, Essilor, Johnson & Johnson Vision, Nidek Co. Ltd, Hoya Corporation, and CooperVision are a few of the key companies operating in the market. These companies focus on product innovation strategies to meet evolving customer demands, along with maintaining their brand name in the ophthalmic devices market.

A few recent developments initiated in the global ophthalmic devices market report are mentioned below:

- In April 2023, Bausch + Lomb launched the StableVisc cohesive ophthalmic viscosurgical devices (OVD) and the TotalVisc viscoelastic system in the US. The two OVDs offer new options for eye surgeons to provide dual-action protection during cataract surgeries. StableVisc and TotalVisc provide surgeons with new OVD options that provide unique benefits designed to ensure the best possible surgical outcomes for patients.

- In February 2023, Nidek partnered with Hoya Vision Care. The partnership allows Hoya’s customers to access Nidek’s optical products, services, and instruments through their local distributors. Under this partnership, HOYA’s eye care professionals can access Nidek’s complete portfolio of ophthalmic instruments and products to offer a full-service approach to patient care, from eye examination to consultation and the final delivery of spectacle lenses.

- In January 2023, Topcon Healthcare launched the NW500, its new user-friendly, fully automatic, robotic fundus camera that produces reliable, sharp-quality imaging even in ambient light. It contributes to a streamlined workflow and improved patient experience by providing the ability to acquire retinal images in a lighted setting without the need to dilate patients.

- In February 2021, the US Food and Drug Administration approved the TECNIS Eyhance and TECNIS Eyhance Toric II intraocular lens developed by Johnson & Johnson Vision to treat cataract patients in the US. With this approval and following commercial launch, ophthalmologists in the US have gained the ability to choose this next-generation monofocal lens as the lens of choice for their patients with or without astigmatism.