Vacuum Insulated Tubing Market

Vacuum insulated tubing can be used in oil and gas extraction operations to provide thermal insulation in oil and gas wells. It helps maintain the wellbore’s temperature, preventing heat loss and improving the efficiency of oil recovery processes, such as steam-assisted gravity drainage (SAGD) for heavy oil recovery. This is particularly important when maintaining elevated temperatures is crucial for effective production or well stimulation, such as in steam-based enhanced oil recovery techniques, including steam injection or cyclic steam stimulation.

Further, the economic viability of enhanced oil recovery (EOR) techniques have improved due to factors such as a rise in oil prices, advancements in technology, and cost reductions in implementing EOR projects. As oil prices increase, the additional oil recovered through EOR methods becomes economically attractive, driving investments in EOR projects. In April 2023, Oil and Natural Gas Corporation (ONGC) announced a US$ 7 billion investment for the next 3–4 years to bolster oil and gas production. Currently, up to 24 improved oil recovery (IOR) and enhanced oil recovery (EOR) projects are in progress that will aid in further reversing the trend of depletion of oil and gas output. As a result, the growing adoption of the EOR technique is driving the vacuum insulated tubing market growth.

Major stakeholders in the vacuum insulated tubing market ecosystem include raw material suppliers, vacuum insulated tubing manufacturers, and end users. The raw material suppliers operating in the vacuum insulated tubing market offer stainless steel, copper, ceramic fibers, aluminum, elastomers, and polymers. The timely supply of all these raw materials is crucial for the manufacturing of vacuum insulated tubing. Owens Corning, Saint Gobain, Johns Manville, and Morgan Advanced Materials are a few key insulation material providers in the vacuum insulated tubing market.

The crude oil extraction process includes three phases—primary, secondary, and tertiary (enhanced) recovery. As most of the oil has already been recovered from several oil fields, producers are focusing on several tertiary or EOR techniques that help extract 30 to 60%, or more, of the reservoir’s original oil in place. In recent years, thermal recovery EOR techniques have been gaining traction commercially. In October 2021, LUKOIL and Gazprom Neft announced a collaboration agreement to implement oil recovery enhancement projects. In March 2022, ADNOC Onshore, which operates onshore and in shallow coastal waters of the Emirate of Abu Dhabi, announced a US$ 227 million contract for enhanced oil recovery (EOR) at Bab Field. The company used advanced polymers to boost recoverable reserves up to 70% while unlocking additional barrels of Murban crude. Thus, the oil & gas industry is witnessing a trend of growing adoption of efficient oil extraction techniques, which is expected to support the vacuum insulated tubing market growth in the coming years.

Vacuum Insulated Tubing Market: Industry Overview

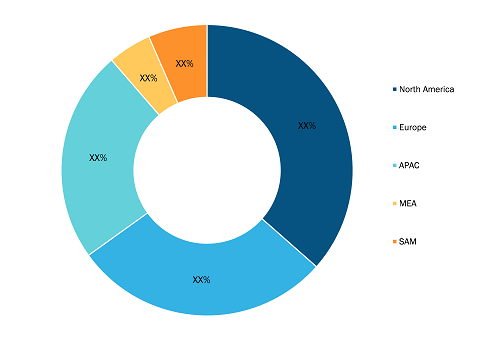

Trade wars, conflicts, wars, and other threats to the energy supply tend to increase oil and gas prices, which was the case following the Russian Federation’s aggression in Ukraine. As a result, the European countries strive for energy security by reducing dependency on oil imports. Developing domestic oil resources is seen as a means to enhance energy independence, reduce vulnerability to price fluctuation, and ensure a reliable energy supply for domestic consumption. Thus, the oil & gas industry in Europe is witnessing a rise in the adoption of enhanced oil recovery techniques for rejuvenating mature oil wells, thereby increasing domestic oil production. This can result in the vacuum insulated tubing market growth.

Low-cost assets, reduced production costs, and a rise in oil-well efficiencies are contributing to the growth of the oil & gas industry in North America. As a result, the key players in the oil & gas industry are investing considerable amounts to increase their market share. In January 2018, Exxon Mobil announced its plan to invest US$ 50 billion in the US over the next five years to increase production in the Permian basin, a shale oil region in western Texas and eastern New Mexico.

Vacuum Insulated Tubing Market: Competitive Landscape and Key Developments

Andmir Group, Exceed Oilfield Equipment Inc, Imex Canada Inc, ITP Interpipe, Lake Petro, Dongying Lake Petroleum Technology CO Ltd, Nakasawa, Shengji Group, Tenergy Equipment & Service Ltd, TMK Group, and Vallourec. are among the key vacuum insulated tubing market players profiled during this study. In addition, several other important market players were studied and analyzed during this market study to get the vacuum insulated tubing market size and its ecosystem.

- In April 2022, Oil and Natural Gas Corporation (ONGC), an Indian central public sector company in petroleum and natural gas production, announced the first EOR project in Indian offshore with an investment of US$ 724.2 million to boost oil and gas output.