Digital Pharmacy Market

Upsurge in Online Purchase of Prescription Medicines During COVID-19 Pandemic Propels Digital Pharmacy Market

According to a report published by the ASOP Global Foundation in 2020, nearly 50% of the American population purchased medicines online due to convenience and cost benefits. As per another survey conducted by Abacus Data on 1,500 American consumers, 4 in 10 Americans (42%) purchased medicines online in 2020, recording a 7% rise in the number of online buyers of medicines from 2020 to 2021. Moreover, purchase trends in the US indicate Americans buy an array of prescription drugs online, ranging from products prescribed against chronic and ongoing conditions (23% for all purchases), including high blood pressure, asthma, and diabetes to specialty prescriptions such as cancer and hormone replacement therapy drugs (each accounting 11% of all purchases). Additionally, 64% of the individuals purchased medicines online for the first time in 2021, with intentions to continue buying online medicine even after the pandemic ends. The preference for online medicine platforms is mainly due to the convenience of buying, accessibility to products, and reduced cost of prescription medication (discounts, special offers, etc.). According to a survey conducted by healthinsurance.com, there was a 340% increase in telemedicine usage among Medicare recipients in the US in 2021. 33% of the increased users revealed that they preferred ordering prescription medicines through an online pharmacy during the COVID-19 pandemic. Thus, an increase in the number of online purchases of prescription medicines, coupled with the rapidly spurring e-commerce industry and a massive shift in consumer behavior toward online purchases, favors the global digital pharmacy market growth.

Future Trend

Integrated Web-Based Online Pharmacy Interface Emerges as Key Trend

Integrated e-healthcare systems incorporated with web-based pharmacy interfaces that are accessible to pharmacists and patients are likely to emerge as new trends in the global digital pharmacy market in the coming years. Programs made available by online pharmacies to provide online support to people buying medicines are a notable example of such interfaces. For instance, patients administered with statins as a part of their treatments are likely to discontinue or show irregularities in taking medicines. Reminders and live chat with a pharmacy team member trained in providing adherence support to people consuming statin-based prescribed medicines can help avoid the discontinuation of doses.

Market Opportunity

Technologically Advanced Digital Pharmacy Solutions

The adoption of digital pharmacy services increased gradually during the COVID-19 pandemic, which allowed pharmacists in many states of the US to process prescriptions and medication orders remotely, enabling community pharmacies to operate without interruption. The ability of digital tools to record personalized customer experiences further bolsters the adoption of digital pharmacy solutions and services. For example, customer activity tracking tools assist pharmacies in determining customer preferences and developing data-driven services. Moreover, direct-to-patient channels can reduce the cost of delivery of prescription medicines to consumers, resulting in better customer satisfaction and convenience.

Campaigns authorized by the US Food & Drug Administration (FDA) assist buyers in purchasing prescription medicines online. The BeSafeRx campaign helps consumers learn about how to safely buy prescription medicines online. Such campaigns also feature tools using which consumers can report important information regarding unexpected experiences or adverse effects of medications to the MedWatch portal. Such technologically driven initiatives by health authorities in the US would ultimately drive the growth of the digital pharmacy market in the country during the forecast period.

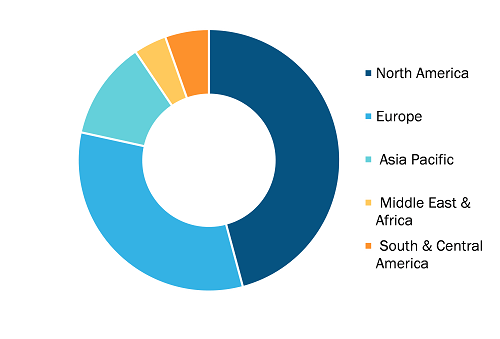

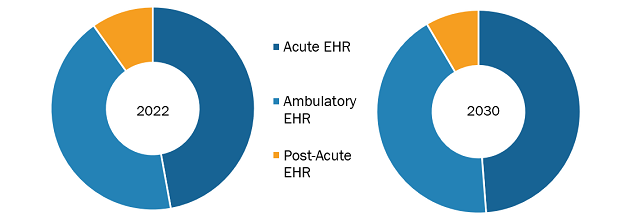

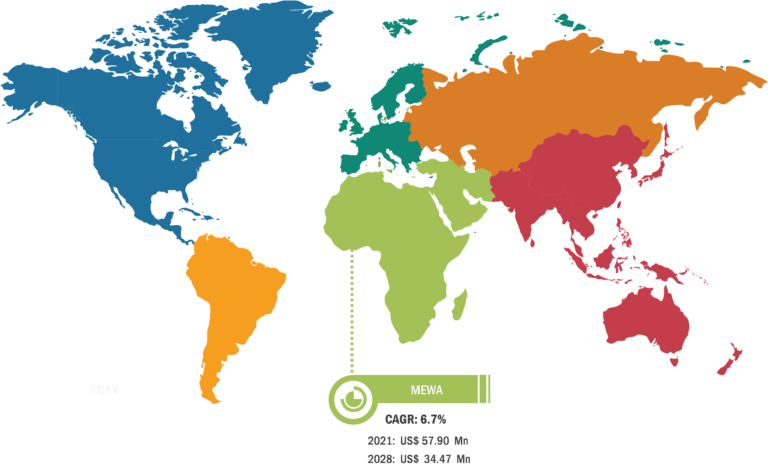

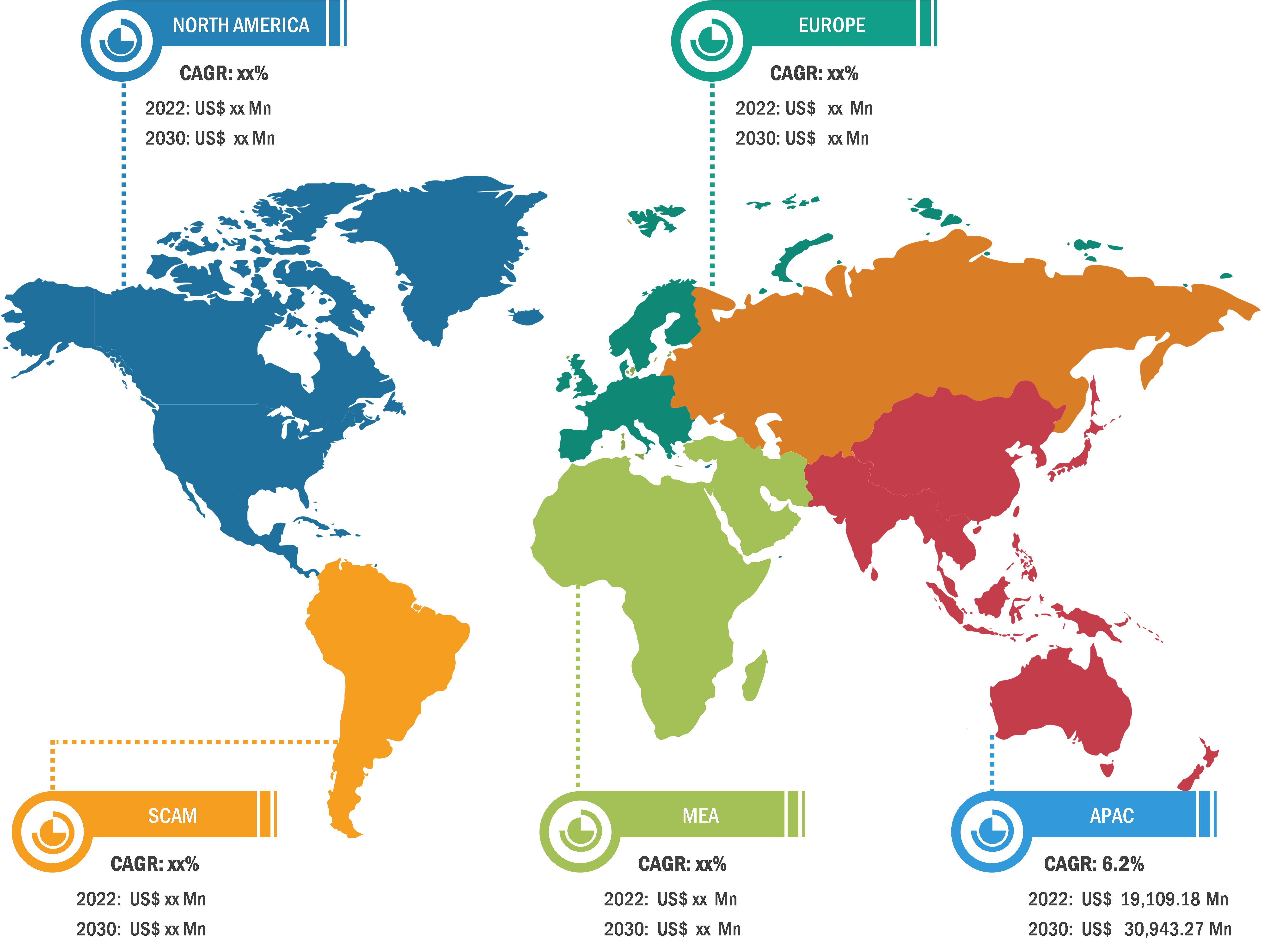

Digital Pharmacy Market: Segmental Overview

The “Global Digital Pharmacy Market” is segmented on the basis of drug type, product, platform, and geography. Based on drug type, the market is bifurcated into prescription medicines and OTC medicines. In 2022, the prescription medicine segment held a larger share of the market. Based on product, the global digital pharmacy market is segregated into personal care, vitamins and supplements, medicines and treatments, and others. The medicines and treatments segment held the largest market share in 2022. In terms of platform, the digital pharmacy market is categorized as app-based and website-based. The app-based segment held a larger share of the market in 2022 and is anticipated to register a higher CAGR in the market during 2022–2030.