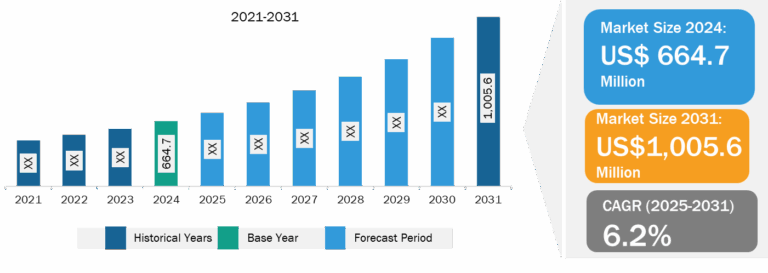

Pharmacy Automation Systems Market

Artificial Intelligence in Pharmacies Would Lead to Future Trends in Market

Artificial intelligence (AI) has brought a significant evolution in the healthcare sector. AI complements the deployment of robotics in drug and medicine businesses. In addition, it has the potential to assist pharmacists and clinical personnel in identifying problems such as potentially harmful drug interactions, cross-verifying patient data, drug-disease contraindications, drug–drug interactions, improper dosages, and repetition of drug therapies more effectively than ever. In addition to solving these problems, AI can provide real-time guidance when prescribing medicine, dispensing, and administering medicine. It would help provide personalized medicines to patients, aiding in pharmacy management. AI in medicine dispensing will enhance the efficiency of automated dispensing cabinets, pill dispensers, and their features, such as alarm modules, speakers, and other features. Thus, AI can reduce pharmacists’ efforts in medicine dispensing, allowing them to focus more on patient care.

According to the article “Innovative Robotic Technologies and Artificial Intelligence in Pharmacy and Medicine: Paving the Way for the Future of Health Care—A Review,” published by MDPI in August 2023, ~37% of the operating players have prioritized their investment plans to integrate AI technologies in their pharmacy systems by 2026. Moreover, considering the widespread trend of remote care, which gained popularity during the COVID-19 pandemic, nearly 42% of healthcare players have continued to sustain their growth with remote care. Thus, the use of AI in the pharmacy sector is anticipated to lead to new growth trends in the pharmacy automation systems market in the coming years.

Pharmacy Automation Systems Market: Segmental Overview

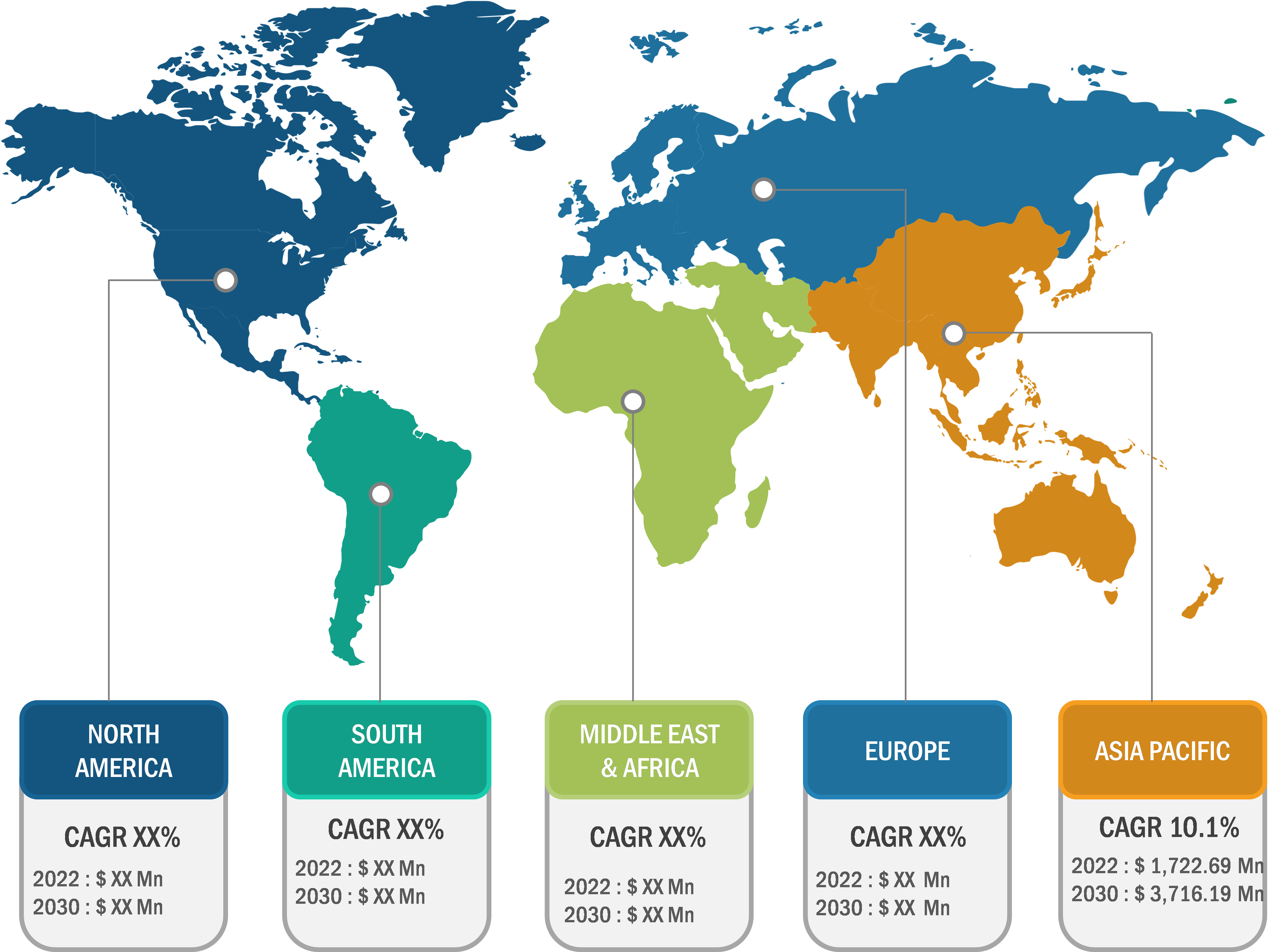

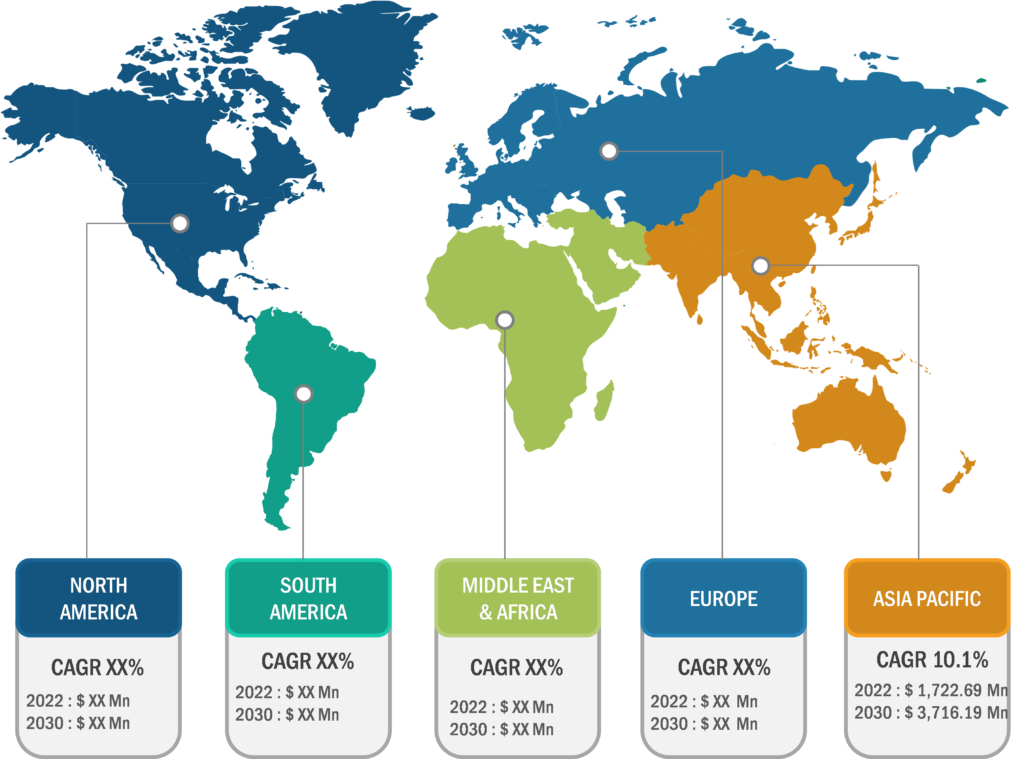

The pharmacy automation systems market is segmented on the basis of type, end user, and geography. Based on type, the pharmacy automation systems market is classified into automated medication dispensing systems, automated packaging and labeling systems, automated tabletop counters, automated storage and retrieval systems, and other types. The automated medication dispensing systems segment held the largest market share in 2022, and it is projected to record the highest CAGR during 2022–2030. Further, the automated medication dispensing systems are further divided on the basis of product type and operation. The market for automated dispensing systems, by product type, is subsegmented into robotic automated systems, carousels, and automated dispensing cabinets. Based on operation, the pharmacy automation equipment market for automated dispensing systems is subsegmented into centralized prescription fulfillment and centralized prescription fulfillment.

The pharmacy automation systems market, based on end user, is segmented into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment held the largest market share in 2022, and the same segment is anticipated to register the highest CAGR during 2022–2030.

Pharmacy Automation Systems Market: Competitive Landscape and Key Developments

McKesson Corp, Becton Dickinson and Company, Capsa Solutions LLC, Omnicell Inc, Oracle Corp, Deenova Srl, ScriptPro LLC, Veradigm LLC, Innovation Associates, YUYAMA Manufacturing Co Ltd, and Swisslog Healthcare AG. are among the leading companies operating in the pharmacy automation systems market. These players focus on expanding and diversifying their market presence and acquiring a novel customer base, thereby tapping business opportunities prevailing in the pharmacy automation systems market.

Market players are launching new products to the market. Below are a few instances:

- In April 2023, iA, launched NEXiA Enterprise Analytics, its first cloud-based application for NEXiA software for pharmacy fulfillment. NEXiA Enterprise Analytics adds a new intelligence application to iA’s NEXiA software suite, enabling customers to visualize pharmacy operations across multiple fulfillment locations in real time. Enterprise Analytics can help customers identify trends more quickly and aid in delivering prescription drugs to patients with optimal speed and efficiency. NEXiA Enterprise Analytics is the first cloud-based application released within the NEXiA software suite for pharmacy fulfillment.

- In October 2022, McKesson Corporation opened a new state-of-the-art pharmaceutical distribution center in Jeffersonville, Ohio, between Cincinnati and Columbus. The new facility would distribute pharmaceutical, over-the-counter (OTC), home healthcare (HHC) products, and consumer packaged goods (CPG) to customers across Ohio, Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia.

- In February 2023, the province of Nova Scotia collaborated with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) under their collaboration agreement they signed for 10 years with Oracle Cerner to implement and serve over 1 million Nova Scotians with an integrated electronic care record across the province. The collaboration would help health professionals use and share patient information. The new “One Person One Record” (OPOR) venture is intended to provide clinicians with easier access to real-time health information. In addition, it will allow healthcare workers to spend less time in front of computers and more time with their patients.