Non-Dairy Yogurt Market

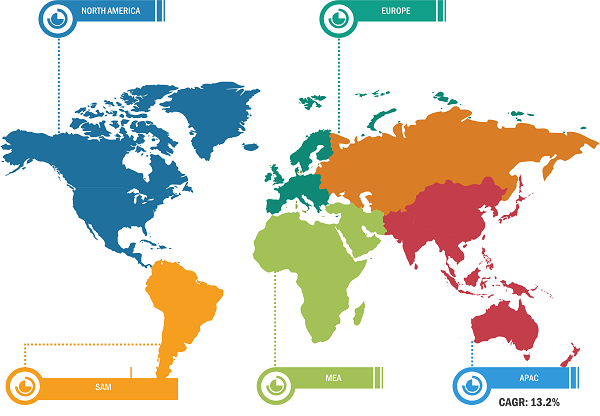

Europe held the largest share of the non-dairy yogurt market in 2022. The considerable demand for plant-based dairy products due to increasing health consciousness and the trend of veganism has made Europe a significant market. Consumers prefer lactose-free foods because of several health benefits, such as the antioxidant properties of dairy alternatives—such as dairy-free yogurt. According to “The Smart Protein Project report,” the sales value of plant-based food in Germany grew by 97% during 2018–2020, while the sales volume increased by 80%. Moreover, consumers are highly inclined toward plant-based dairy products due to rising awareness of animal welfare.

The popularity of plant-based dairy products is increasing in Europe due to the shift in consumer demand from animal protein to plant protein. Thus, due to all the aforementioned factors, the demand for non-dairy yogurt is expected to grow in Europe during the forecast period.

Rising Adoption of Organic Products Boost Non-Dairy Yogurt Market Growth

Organic and natural products are gaining popularity owing to their perceived health benefits. Consumers are highly concerned about their health and wellness, and they pay more attention to ingredients used in processed products. They are willing to pay high prices for products that are free of synthetic ingredients. Further, greater access to infinite information through the internet has made consumers increasingly aware of their health needs, which triggers the demand for organic products. The inclination of people toward organic products has encouraged manufacturers to invest heavily in products produced with organic constituents. In February 2020, plant-based pioneer Forager Project launched a variety of new organic products, including high-protein yogurts, dairy-free butter with Peruvian salt, oat milk, grain-free cereal, and grain-free chips. Thus, increasing demand for organically sourced products is expected to create lucrative opportunities for the non-dairy yogurt market growth during the forecast period.

Non-Dairy Yogurt Market: Segmental Overview

Based on type, the non-dairy yogurt market is bifurcated into flavored and plain. The flavored segment held a larger market share in 2022. Flavored yogurt has gained immense popularity, particularly in the form of a dessert, over the past few years owing to a significant shift in the dietary habits among consumers. The need for naturally enriched fresh fruit-flavored yogurt is significantly high, especially for berry flavors such as blueberry, strawberry, and raspberry. Besides this, other flavors such as mango, chocolate, and coffee are also gaining huge attention. These factors are expected to boost the segment’s share during the forecast period.

Based on distribution channel, the non-dairy yogurt market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. The online retail segment is projected to register the highest CAGR during the forecast period. Online distribution channels reduce the operation cost of manufacturers and allow them to reach targeted customers. Further, various online portals such as Amazon offer home delivery services, secure payment options, and attractive discounts, making the buying process convenient for customers. During the COVID-19 pandemic, online retail channels gained popularity as they offered home delivery services. Hence, the convenience, availability of a vast array of products, and time management properties of online stores promote the non-dairy yogurt market growth for the online segment.

Impact of COVID-19 Pandemic on Non-Dairy Yogurt Market

Various food & beverage industries faced unprecedented challenges during the COVID-19 pandemic in 2020. Moreover, non-dairy yogurt manufacturers faced significant challenges in production and distribution due to supply chain constraints caused by nationwide lockdowns, trade bans, and travel restrictions, eventually leading to price hikes. The operations and processes were temporarily discontinued across the globe due to the shortage of workforce and limited supply of raw materials. These factors negatively impacted the non-dairy yogurt market growth during the pandemic. On the other hand, the dietary preferences of consumers changed significantly, with many consumers switching to plant-based diets. The demand for dairy alternatives increased significantly during the pandemic due to health and wellness concerns. Also, a shift in consumer shopping behavior was witnessed as customers transitioned to e-commerce shopping. These factors boosted the non-dairy yogurt market growth during the pandemic.

Non-Dairy Yogurt Market: Competitive Landscape

The Hain Celestial Group Inc, Danone Sa, Springfield Creamery Inc, Lyrical Foods Inc, Coyo Pty Ltd, Valio Ltd, Oatly Group Ab, Daiya Foods Inc, Forager Project LLC, and Harmless Harvest Inc. are a few of the major players operating in the non-dairy yogurt market. Companies in this market focus on strategies such as investments in research and development activities and new product launches. For instance, in August 2021, Silk, a well-known brand of Danone SA for plant-based products, launched plant-based Greek yogurt. Such products launched by manufacturers strengthen their position in the market.