Needle-Free Drug Delivery Devices Market

Increasing R&D Expenditures in Pharmaceutical Companies Acts as Opportunity of Needle-Free Drug Delivery Devices Market

Research & development (R&D) is an essential part of any company’s business. R&D spending by biopharmaceutical companies has also increased over the years. According to a study “Total Global Pharmaceutical R&D Spending 2014–2028” by Matej Mikulic, spending on R&D in the global pharmaceutical industry amounted to ~US$ 238 billion in 2021. Compared to other industries, pharmaceutical companies are more driven by the need to create innovative products and spend a significant amount on R&D. This is mainly due to the time-limited patent protection of drugs and the resulting threat of a collapse in sales due to competition from generics and biosimilars. Pharmaceutical and medical device companies focus on R&D to introduce new molecules for various therapeutic applications with the most significant medical and commercial potential. Strong R&D capabilities also help them bring high-quality and innovative products to the market. For instance, Evonik has underpinned a leading position in offering delivery systems for mRNA-based therapeutics with the construction of its US$ 220 million global-scale pharmaceutical lipids production facility in Lafayette, Indiana, US.

According to a study “Global Trends in R&D 2022” by IQVIA, 84 Novel Active Substances (NAS) were launched worldwide in 2021, twice as many as five years ago, which brings the total number of launches to 883 over the past 20 years. The US continues to be the country with the earliest and highest number of launches in the world. Furthermore, 44 (over 60%) of the 72 NAS launched worldwide in 2021 were approved as a first-in-class medication by the FDA, and 40 (more than 50%) of them carried the orphan drug designation, indicating their use for treating rare diseases. Venture capital deals and investment flows in the US have upsurged in the past two years owing to the increased interest in life sciences.

Therefore, the growing R&D expenditure by pharmaceutical industries is expected to fuel the needle-free drug delivery devices market during the forecast period.

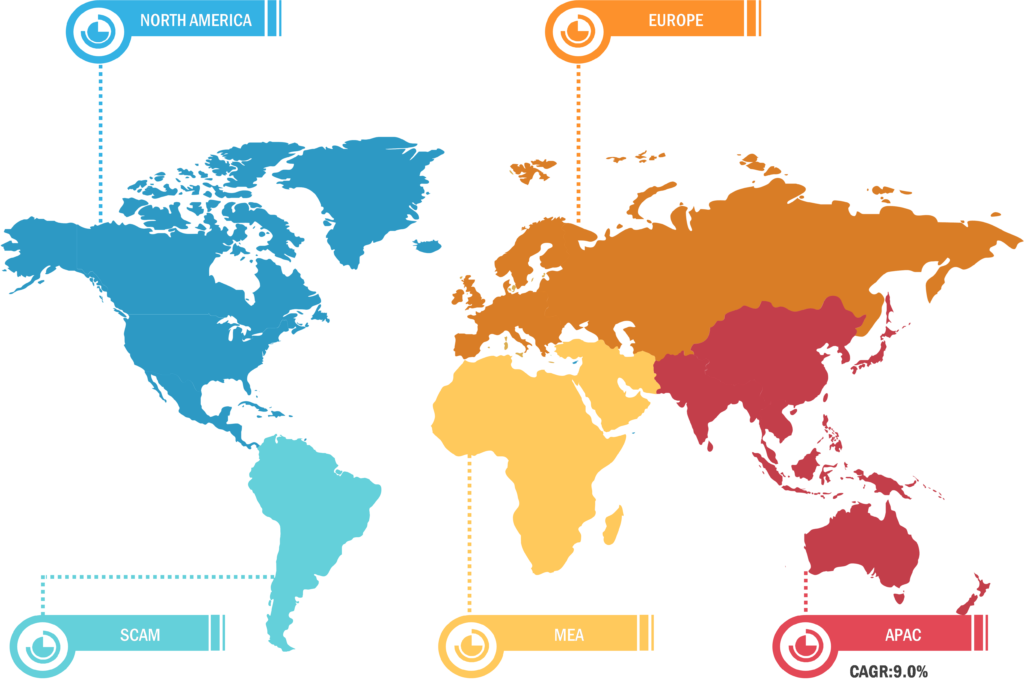

Geographically, the scope of the needle-free drug delivery devices market report is primarily segmented into North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). North America held the largest global needle-free drug delivery devices market share in 2023 owing to an increasing number of technologically advanced hospitals, increasing use of RTLS in senior living facilities and home care, and the presence of key market players involved in new and existing product developments.

In North America, the US held the largest needle-free drug delivery devices market share in 2023. The National Diabetes Statistics Report of the Centers for Disease Control and Prevention (CDC) stated that in 2022, nearly 37.3 million people in the US had diabetes, of which type 1 diabetes accounted for nearly 3.75%, i.e., ~1.45 million people. Thus, the rise in the population suffering from diabetes in the country is expected to propel the demand for various drug delivery systems for disease treatment. The American Hospital Association estimates that approximately 133 million Americans have at least one chronic disease. By 2030, that number is expected to reach 170 million, with many patients needing drugs that require infusion or injection, including biologics. Patients suffering from diabetes and cancer are highly contributing to the usage of needle-free drug delivery devices, which, in turn, boost the needle-free drug delivery devices market. Therefore, the continuous rise in the prevalence of diabetes and cancer is likely to contribute to the market growth in the US during the forecast period.

Based on type, the needle-free drug delivery devices market is categorized into inhalers, jet injectors, novel needles, transdermal patches, and others. In 2023, the jet injectors segment held the largest share of the market and is expected to record the highest CAGR during 2023–2031.

In terms of application, the market is segmented into insulin delivery, vaccination, pain management, and others. In 2023, the insulin delivery segment held the largest needle-free drug delivery devices market share. However, the personnel location & monitoring segment is expected to record the highest CAGR during 2023–2031.

Needle-Free Drug Delivery Devices Market: Competitive Landscape and Key Developments

NuGen Medical Devices Inc; NovaXS Biotech; GlaxoSmithKline; AstraZeneca; Roche; Boehringer Ingelheim; Merck; Cipla; Novartis; Teva Pharmaceuticals; Omron Healthcare; and Sumitomo Pharma Co., Ltd are among the prominent players profiled in the needle-free drug delivery devices market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and latest product launches to meet the rising demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

Various initiatives taken by key players operating in the needle-free drug delivery devices market are listed below:

- In November 2023, Becton, Dickinson, and Company (BD) introduced the new PIVO Pro Needle-free Blood Collection Device following 510(k) clearance from the US Food and Drug Administration (FDA). Designed to be compatible with integrated catheters, the new needle-free blood draw technology further enables BD’s “One-Stick Hospital Stay” vision.

- In March 2023, Stevanato Group collaborated with Recipharm to develop and manufacture pre-fillable syringes that will be integrated into a new soft mist inhaler for inhaling sensitive biological products. The new strategic collaboration aims to provide innovative primary packaging to pharmaceutical and biopharmaceutical companies using Recipharm’s proprietary soft mist inhalers.