Embedded Systems Market

Increase in technological advancements fuels the demand for embedded systems among businesses to increase safety and security by monitoring and controlling physical assets, which is expected to boost the embedded system market during the forecast period. Technological giants worldwide are highly focused on research and development of new technologies. IoT is positioned at the core of the next-gen software technologies in the embedded systems market. Embedded systems have a wide range of applications in the IoT sector. They are used to collect data, control and monitor devices, and communicate with users. An embedded system is capable of monitoring a room’s temperature and adjusting the thermostat. It can also check a car’s performance and alert the driver prior to any damage occurring. Embedded systems are a vital component of the IoT ecosystem and provide dependable, energy-efficient, and cost-effective benefits to businesses and individuals. Furthermore, IoT-based embedded systems are simple to upgrade and update, they offer a high level of security, and they are tamper-proof, which allows users to access the most recent features and functionality regularly.

IoT-based embedded systems can collect data from physical devices to help the user make intelligent decisions and communicate the results to the physical devices. The significant benefits offered by embedded systems are making them the future of connected devices and services. The extensive adoption of IoT is fueling the embedded systems market growth. For instance, according to the Cisco Visual Networking Index, in 2022, there were more than 28 billion network devices enabled with embedded systems and powered by IoT. The network devices help users to improve connectivity and security and reduce additional operational costs of the business. The integration of embedded systems with IoT devices and platforms is enabling new applications and services in areas such as smart homes, smart cities, and industrial IoT. Also, the expansion of smart cities and smart home projects increases the demand for IoT-based embedded systems among consumers.

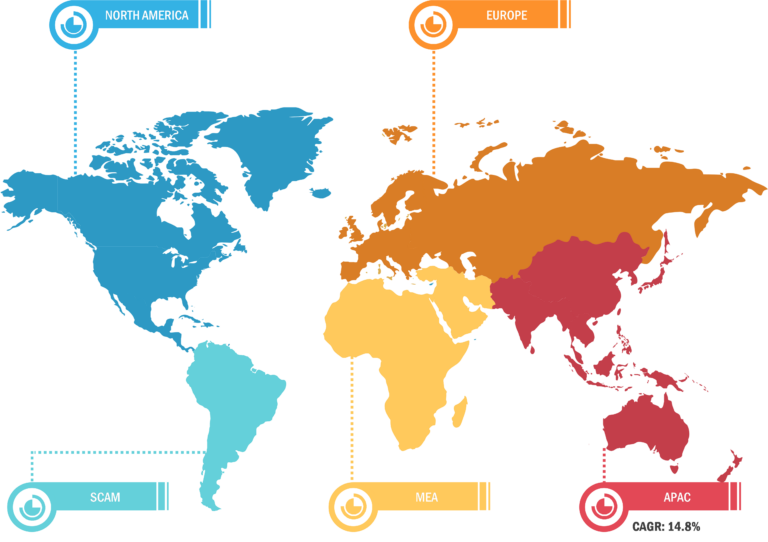

US Dominates Embedded Systems Market in North America

The demand for embedded systems in the US is due to the growing number of tech-savvy enterprises that are willing to invest in artificial intelligence (AI) technology. For instance, according to Goldman Sachs data, in 2022, the US invested US$ 47.4 billion in AI technology. This investment encourages manufacturers to develop AI-based embedded systems. The AI supports the embedded system to make real-time decisions, which provide faster and more accurate responses to changing conditions. For example, an AI-powered traffic management system can adjust real-time traffic based on traffic patterns, which reduces congestion by improving traffic flow.

Similarly, many key players in the country are launching AI-based embedded systems to explore healthcare and life sciences applications. For instance, in May 2023, Cognex Corporation launched an Embedded AI-Based Vision System with applications for OEMs in life sciences. Embedded AI-Based Vision System is an all-in-one vision system that includes advanced machine vision, edge learning technology, and barcode reading to automate the measuring of the phases of centrifuged blood, test tube detection and classification, and identifying pathology samples. Due to its scalability, accuracy, and ease of use, the AI-based embedded system is expected to be a game-changer in the life sciences industry. Moreover, recent technological breakthroughs have helped develop new systems, making overall processes more effective and significantly improving accuracy in supply chain management. A series of mergers and acquisitions took place in the US to seize this opportunity.

Embedded Systems Market: Segmental Overview

Based on component, the embedded systems market is categorized into hardware and software. The hardware segment is sub segmented into sensor, microcontroller, processors and ASICs, memory, and others. The processors and ASICs segment held the largest share of the embedded systems market in 2022 and is anticipated to register the highest CAGR in the embedded systems market from 2022 to 2030.

Based on functionality, the embedded system market is categorized into real-time embedded systems, standalone embedded systems, networked embedded systems, and mobile embedded systems. The mobile embedded system segment held the largest share of the embedded systems market in 2022 and is anticipated to register the highest CAGR in the market from 2022 to 2030.

Based on application, the embedded system market is segmented into automotive, telecommunication, healthcare, industrial, consumer electronics, and others. The consumer electronics segment held the largest share of the embedded systems market in 2022 and is anticipated to register the highest CAGR in the market from 2022 to 2030.

Embedded Systems Market Analysis: Competitive Landscape and Key Developments

Infineon Technologies AG, Intel Corp, NXP Semiconductors NV, Qualcomm Inc, Renesas Electronics Corp, STMicroelectronics NV, Texas Instruments Inc, Microchip Technology Inc, Advantech Co Ltd, and Marvell Technology Inc are among the key embedded systems market players that are profiled in the report. Several other essential embedded systems market players were analyzed for a holistic view of the market and its ecosystem. The embedded systems market report provides detailed market insights, which can help major players strategize their growth.

- In January 2023, AMD and Qualcomm Technologies, Inc.—a subsidiary of Qualcomm Incorporated—collaborated to optimize the Qualcomm FastConnect connectivity system for AMD Ryzen processor-based computing platforms, beginning with AMD Ryzen PRO 6000 Series processors and the Qualcomm FastConnect 6900 system.

- In May 2022, Intel Corporation unveiled the 4th-generation Intel Xeon Scalable processors, Intel Xeon CPU Max Series, and Intel Data Center GPU Max Series to bring the company to the forefront of the processor market amid intense competitive pressure. With a purpose-built workload-first approach, the products mark a landmark achievement by this chip manufacturer and are likely to strengthen its leading market position.