Transfection Reagents and Equipment Market

Strategic Initiatives by Companies to Bring New Trends into the Transfection Reagents and Equipment Market

Companies operating in the transfection reagents and equipment market focus on strategic developments such as collaborations, expansions, agreements, partnerships, and new product launches. These help them improve their sales, expand their geographic scope, and enhance their capacities to cater to a larger than existing customer base. These developments also contribute to introducing new trends to the market to a certain extent. Some noteworthy developments in the transfection reagents and equipment market are mentioned below.

- In April 2023, Thermo Fisher Scientific launched the Invitrogen Neon NxT Electroporation System that facilitates transfection, even with the most challenging cell types, enabling high efficiency, cell recovery, and reproducibility. Neon NxT electrodes are optimally placed to provide minimal surface area, create a more uniform electric field, and maintain apt physiological conditions during transfection, thereby enabling the desired modification to occur in more cells and reducing the number of cells lost during the process. Prominent features of the new system include an improved feedback loop and ergonomic enhancements for ease of use.

- In March 2023, Sartorius Stedim Biotech, a French subsidiary of Sartorius, acquired Polyplus for US$ 2.61 billion from ARCHIMED and WP GG Holdings IV B.V., an affiliate of Warburg Pincus. Polyplus focuses on expanding its portfolio beyond transfection reagents by undertaking acquisitions related to similar technologies, such as plasmid design and plasmid manufacturing, which helps broaden its upstream portfolio for gene therapies and gene-modified cell therapies.

- In August 2021, Mirus Bio launched the TransIT VirusGEN GMP product line of transfection reagents and enhancers to support manufacturing viral vectors to develop gene therapies. The TransIT VirusGEN GMP transfection reagent was developed to enhance the delivery of transfer vaccine DNA to suspension and adherent HEK 293 cells to make the production of recombinant adeno-associated virus (AAV) and lentivirus (LV) vectors more efficient.

- In July 2020, Polyplus-transfection SA launched the first GMP-compliant residual test for its PEIpro product portfolio of transfection reagents designed to support the development of the preclinical, clinical, and commercial process of lentivirus and AAV production for cell and gene therapies. In addition, Polyplus-transfection also launched dual sourcing for its PEIpro-GMP product for late-stage and commercial cell and gene therapies.

Thus, the introduction of products such as transfection reagents and systems, the development of innovative products targeting various health issues to create new or improved products, and the initiation of new businesses to remain competitive in the market, all through collaborations and partnerships can help speed up the development of new transfection reagents and equipment in the coming years.

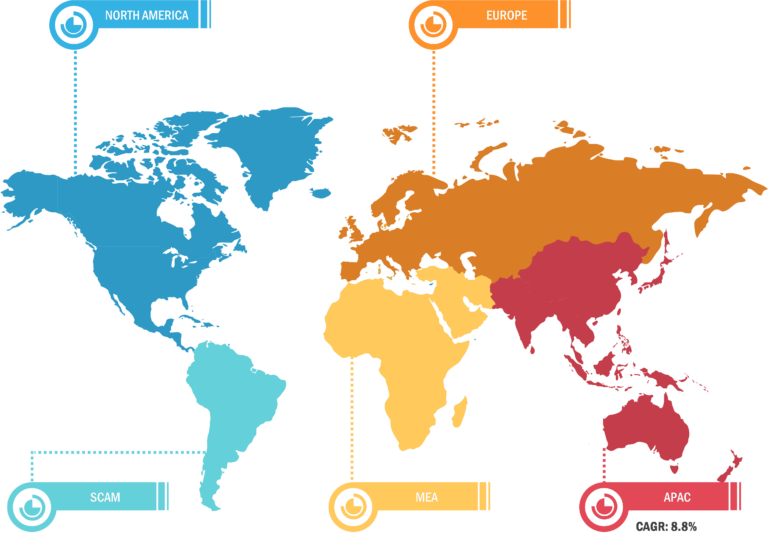

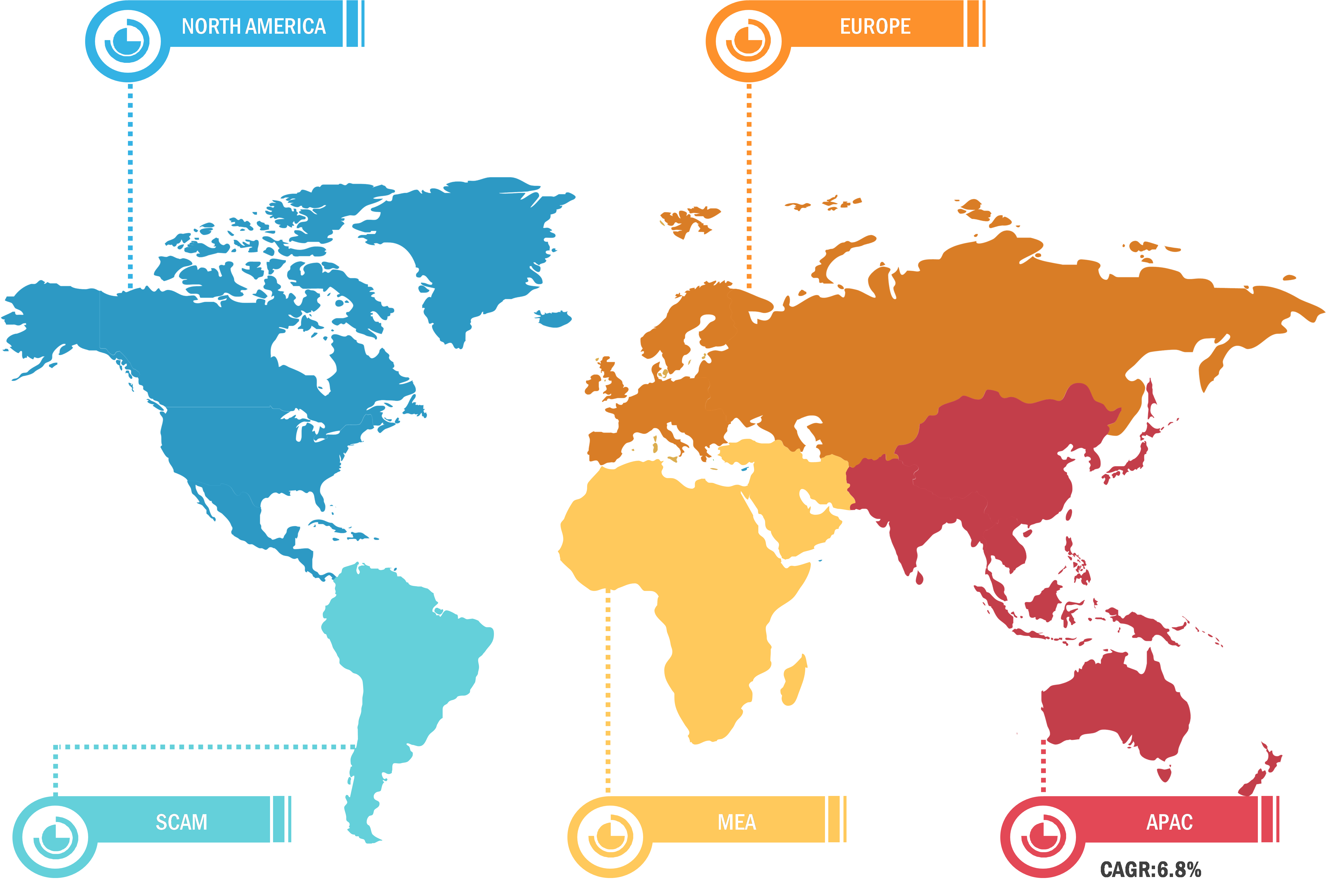

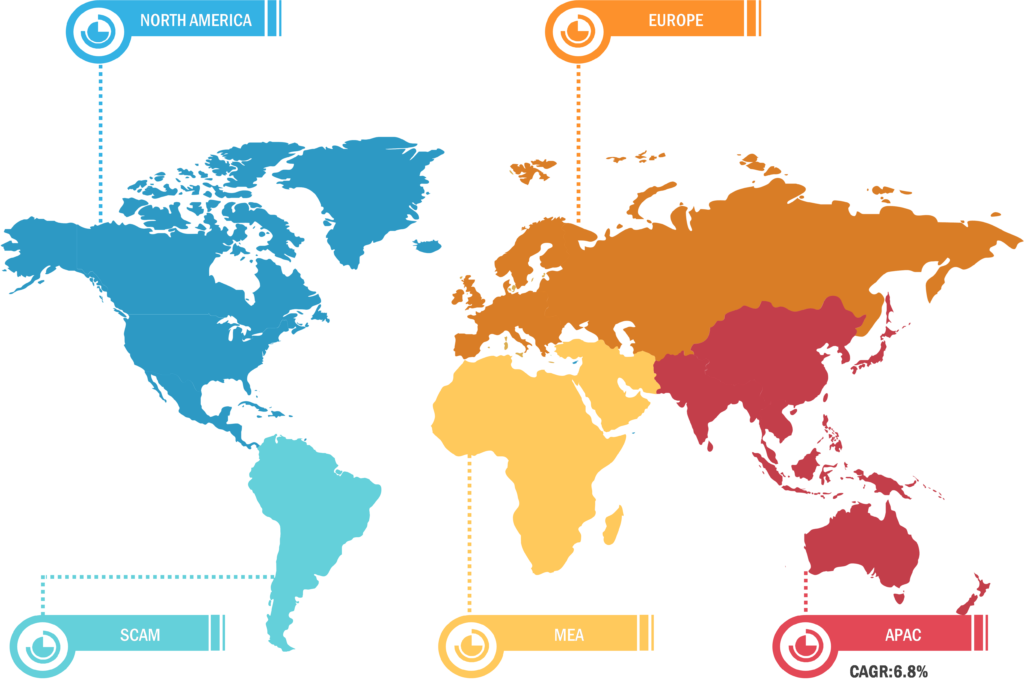

North America held the largest share of the transfection reagents and equipment market in 2022. Market growth in this region is attributed to the rising prevalence of chronic conditions such as cancer and growing cell and gene research activities, which triggers the need for transfection reagents and equipment and attracts funding from strategic and private equity investors. Many market players are expanding their geographic footprint in North American countries. Cell and gene therapies (CGTs) are prescribed to treat patients suffering from serious and rare diseases with unaddressed therapeutic needs. Manufacturing CGTs is a highly complex process, with insufficient infrastructure and expertise being a major limiting factor. Logistics-related challenges associated with intermediates and final products also limit companies’ CGT manufacturing capacity. The CGT manufacturing process involves extracting autologous cells through “apheresis,” dispatching them to specialized laboratories, and sending them back to clinics for patient administration, all of which must be performed with strict quality control. The US Food and Drug Administration (FDA) has approved only 7 CGT drugs so far, while the pipeline of new products has reached ~1,200 experimental therapies; half of these are in Phase 2 clinical trials. With these prospects, annual sales of cell and gene therapies are estimated to grow by 15% and ~30%, respectively, in 2023, as stated in the Chemical & Engineering News Report 2023. Many manufacturers approach contract development manufacturing organizations (CDMOs) such as Labcorp, Lonza, and Catalent to overcome the barriers associated with the production and commercialization of their CGT products. Lonza has invested ~US$ 9.2 million to strengthen its cell and gene therapy manufacturing capabilities. Such initiatives by CDMOs are contributing to the growth of the transfection reagents and equipment market in the US.

Canada is the second-largest market for transfection reagents and equipment in North America. The pharmaceutical industry in Canada is rapidly developing, thus enabling the best research opportunities for professionals. The Canadian government supports drug discovery projects that use transfection technologies, especially in discovering personalized medicines. In February 2022, the Minister of Innovation, Science and Industry announced the funding of US$ 45 million to the Government of Canada through the Canada Foundation for Innovation (CFI) to ensure that research teams have appropriate labs and infrastructure and access to technology departments for conducting world-class research. The Canadian Institutes of Health Research (CIHR) announced a partnership with the Quebec Consortium for Drug Discovery (CQDM) for a new collaborative funding program on personalized medicine to accelerate drug discovery and drug development.

Transfection Reagents and Equipment Market: Competitive Landscape and Key Developments

Thermo Fisher Scientific Inc., Promega Corporation, Qiagen N.V., Merck KGaA, Lonza Group, F.Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc., Mirus Bio LLC, MaxCyte Inc, and Polyplus-Transfection SA are a few key companies operating in the transfection reagents and equipment market. Market players adopt product innovation strategies to meet evolving customer demands, maintaining their brand names in the transfection reagents and equipment market.

A few of the recent developments in the transfection reagents and equipment market are mentioned below:

- In August 2023, Mirus Bio launched the RevIT AAV Enhancer. When added to the adeno-associated virus (AAV) production process, the novel enhancer increases AAV titers 2–4 times in suspension 293 cells. It can be combined with Mirus Bio’s VirusGEN transfection platform and with polymer-only transfection reagents with minimal process optimization. As evidence of its broad applicability, the RevIT Enhancer has been used to increase titers in all AAV serotypes tested to date, with various cell lines and cell culture media commonly used to produce recombinant AAV.