RTLS for Healthcare Market

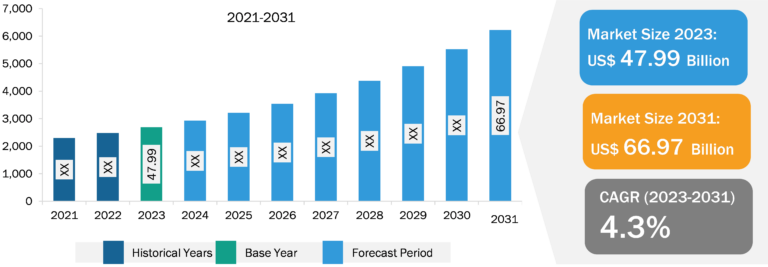

Increasing awareness about the advantages of RTLS for staff management and high return on investment with reduced capital expenditure propel the RTLS for healthcare market growth. However, data security and privacy issues hinder the growth of the market.

Use of RTLS in Home Healthcare: A New Trend in Market

RTLS has revolutionized the way healthcare supply chains, hospitals, and healthcare providers operate by providing cost-efficient solutions. RTLS technology saves time, money, and lives. With the increasing number of patients and elderly population each year, the demand for constant care and full-time caretakers is growing. With this high demand for full-time caretakers, constant care processes can become overwhelming for healthcare workers. Having to remain on-site monitoring an at-home patient can not only increase nurse burnout but can also be really time-consuming. Thus, implementing an RTLS system offers healthcare professionals the capability to monitor patients from different rooms while being able to complete their other tasks.

Home healthcare is a cost-effective solution for patients who require continuous monitoring instead of monitoring in hospitals. As a result, home health patients have begun to save a substantial amount of money while receiving care at home. As nurses who travel from house to house, it is easy for medical equipment to be misplaced at another location or even lost altogether. With the RTLS system, the nurse is reminded to carry the assets, thus preventing the loss of the medical equipment. Using an RTLS system, healthcare facilities can track where their nurses or doctors are traveling with real-time accuracy. Ultimately, having this information can avoid mix-ups of nurses or doctors traveling to the same or wrong location. This knowledge can also prevent the cross-contamination of equipment or diseases among nurses and staff. The benefits of RTLS for monitoring patients in home healthcare settings are expected to bring new RTLS for healthcare market trends in the coming years.

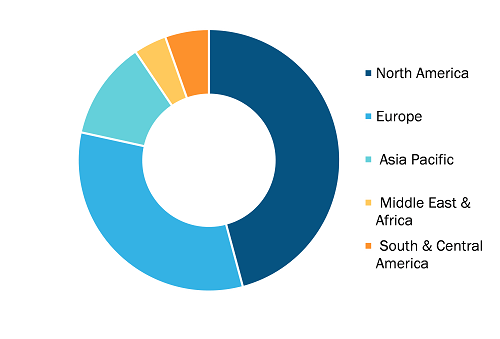

The scope of the RTLS for healthcare market report covers North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). North America held the largest global RTLS for healthcare market share in 2022 owing to increasing number of technologically advanced hospitals, growing use of RTLS in senior living facilities and homecare, and presence of key market players involved in new and existing product developments.

In North America, the US held the largest RTLS for healthcare market share in 2022. The growth of this market is largely driven by increasing adoption of RTLS, transformation of digital healthcare, and support from the federal government to implement RTLS to improve the quality of care. The US RTLS market for healthcare is also driven by other factors such as a higher rate of software technologies in healthcare, higher number of hospitals, and implementation of strategic government policies. Additionally, the need for automated systems due to the increasing patient population and crunch of healthcare resources are projected to fuel the adoption of RTLS systems in the US.

As per the study published in the Journal of Patient Safety, an estimated 400,000 patient casualties are caused due to administrative errors in the US each year. To avoid these patient casualties, hospital facilities are installing RTLS in the US to accurately track healthcare professionals and the equipment that is required as soon as possible. Thus, emphasis on error reductions in hospital administrative work, which is causing considerable mortalities, is also prominently anticipated to drive the growth of the market during the forecast period. In addition, contributions and market initiatives of the key players such as CenTrak and GE Healthcare, in the US are influencing the RTLS for healthcare market growth.

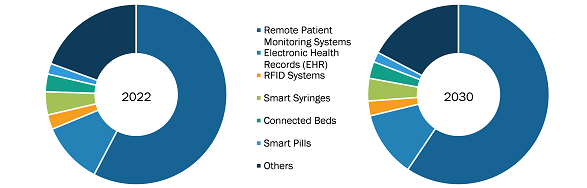

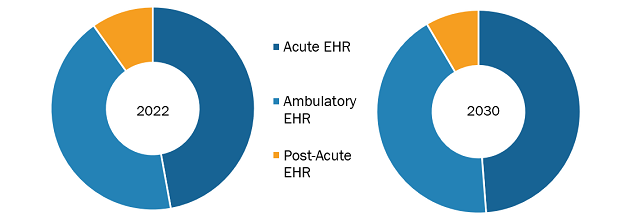

The RTLS for healthcare market analysis has been carried out by considering the following segments: offering, technology, application, facility type, and geography. By offering, the market is segmented into hardware, software, and services. Hardware is further segmented into readers/trackers/access points, tags/badges, and other hardware. The services segment is further divided into consulting, deployment and integration, and support and maintenance. Based on application, the market is divided into inventory/asset tracking & management, personnel locating & monitoring, supply chain management & automation, and others. In terms of technology, the market is segmented into Wi-Fi, RFID, and others. Based on facility type, the market is segmented into hospital and healthcare facilities, and senior living facilities.

RTLS for Healthcare Market: Competitive Landscape and Key Developments

CenTrak Inc, Advantech, Securitas Healthcare LLC, Zebra Technologies, Aruba Networks, GE Healthcare, Ubisense, TeleTracking Technologies, Siemens Healthcare Pvt Ltd, and HID Global Corporation are among the prominent players profiled in the RTLS for healthcare market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and new product launches to meet the growing demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.

A few strategic plans by key players operating in the RTLS for healthcare market are listed below:

- In March 2023, Midmark RTLS launched a Staff Duress solution based on its cloud software platform and enabled by the Bluetooth Low Energy (BLE) sensory network. The CareFlow Cloud platform seamlessly integrates with Midmark’s BLE sensory network for smart deployment. Installations for existing or new facilities can be completed in a few weeks, with minimal internal resources needed, and without disrupting patient care.

- In June 2021, Inpixon launched the Inpixon Asset Tag, a compact, active radio frequency (RF) tag for long-range RTLS asset tracking. The new tag, complete with IP65-rated housing, is pre-configured and ready to use with Inpixon’s 2.4 GHz chip technology.