Smart Mining Market

Growth in mining activities increases the adoption of smart technologies among miners for sustainable extraction and processing of minerals and metals. Moreover, growing industrialization and technological advancements are expanding global mining projects. The rise in mining projects is a leading factor contributing to smart mining market growth. Mining companies are increasing their capital expenditure to expand mining products. For instance, in 2022, Vale increased its capital expenditure by 8%, investing US$ 5.4 billion in new mining projects and planning to invest US$ 6.0 billion by the end of 2023. The company’s major mining projects include the Onça Puma, VBME construction, Capanema, Morowali project in Indonesia, and Serra Sul 120 Mtpy projects. Furthermore, the company aims to increase its capital expenditure by US$ 6.0 billion to US$ 6.5 billion from 2024 to 2027 to adopt smart mining techniques. The smart mining techniques involve smart connected devices, equipment, and technologies that provide analytical capabilities, real-time data, and virtual visualization of physical environments. These allow workers to work safely at the mining sites by improving control over mining operations. A few of the new mining projects prevailing across different countries are mentioned below.

- In March 2023, Maritime Resources Corp announced the investment of US$ 1 million from the Climate Change Challenge Fund to Hammerdown gold project to produce a higher-grade product for downstream processing by reducing GHG emissions.

Tietto Minerals developed the Abujar gold project in Côte d’Ivoire, West Africa received an approval in 2022 to start mining activities. The project is an open-pit gold mine with a life of 11 years, which received a pre-production capital investment of approximately US$ 200 million. This project further creates job opportunities in the mining sector by bringing foreign direct investment (FDI) and tax revenues to West Africa.

- In India, 100% of FDI in mining is approved under an automatic route. Also, 100% FDI in the Indian mining sector is permitted for lignite and coal under automatic route. Moreover, the country holds 4th position with respect to iron ore production. Companies such as National Miner and Coal India Limited sanctioned 32 new coal mining projects in 2021, costing ~US$ 6,267.17 million.

Hence, the increase in mining projects fuels the demand for smart mining equipment and solutions to make operations smooth and keep workers safe.

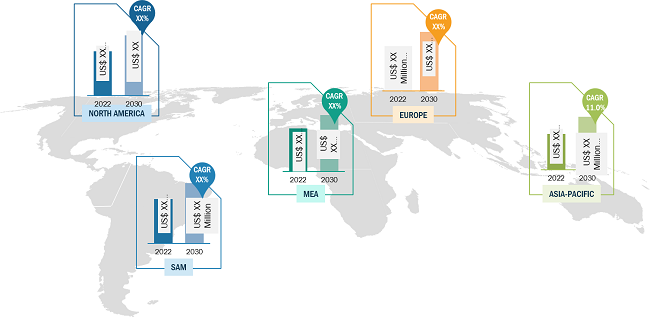

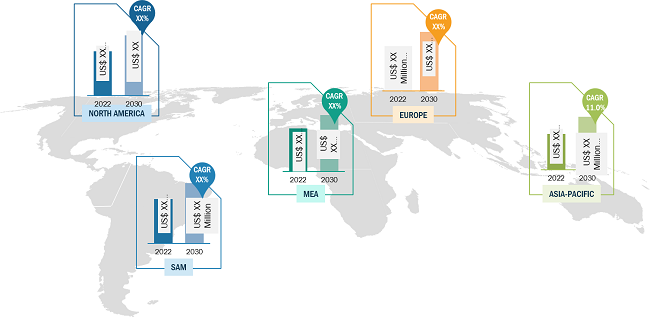

US Dominates Smart Mining Market in North America

The mining sector in the US comprises companies that extract, beneficiate, and process naturally occurring solid minerals from the ground. Coal, metals (such as iron, copper, or zinc), and industrial minerals (such as potash and limestone) are among the mined minerals. Metals and other minerals are vital raw resources for the construction and chemical industries in the US, as well as for manufacturing daily electronics and consumer goods. The US’s diverse mining industry, firms have a tremendous chance to roll out their products to improve the efficiency of the mining operations, resulting in the smart mining market growth in the country.

Growing technological investments, early adoption of smart mining solutions, and rising demand for mine projects are driving the smart mining market in the region. The discovery of shale formations and global dependence on oil and gas resources have paced up mining activities, particularly in the oil & gas sector. Proper infrastructure planning is essential to distribute such supplies, such as oil and gas, effectively with the changing supply system. A strong demand for precious metals has pushed North America’s metals and mining industries to explore, develop, and grow. Recent technological breakthroughs have helped develop new smart mining systems, making overall processes more effective and significantly improving accuracy in various services and solutions. A series of mergers and acquisitions took place in the US to seize this opportunity.

Smart Mining Market: Segmental Overview

Based on component, the smart mining market is categorized into automated equipment, hardware component, software solution, and services. The automated equipment segment held the largest share of the smart mining market in 2022 and is anticipated to register the highest CAGR in the smart mining market from 2022 to 2030.

Based on mining type, the smart mining market is bifurcated into underground mining and surface mining.

The underground mining segment held a larger share of the smart mining market in 2022 and is anticipated to register a higher CAGR in the market from 2022 to 2030.

Smart Mining Market Analysis: Competitive Landscape and Key Developments

ABB Ltd, Alastri, Caterpillar Inc, Intellisense.io, Hexagon AB, Hitachi Ltd, MineSense, Rockwell Automation Inc, SAP SE, and Trimble Inc are among the key smart mining market players that are profiled in the report. Several other essential smart mining market players were analyzed for a holistic view of the market and its ecosystem. The smart mining market report provides detailed market insights, which can help major players strategize their growth.

- In July 2023, Hexagon’s Mining division deployed a fleet management and safety implementation project with Minera San Cristóbal S.A. As part of this project, the company deployed 65 HxGN MineOperate OP Pro systems, nearly 40 HxGN MineProtect Collision Avoidance Systems (CAS), and 30 HxGN MineProtect Operator Alertness Systems (OAS) to the San Cristóbal open pit mine operations in Lipez, Potosí Department, Bolivia.

- In June 2021, Caterpillar Inc launched new technology and equipment at MINExpo 2021. Caterpillar’s MINExpo 2021 experience celebrated the company’s partnership with mines and how it assists customers to mine more efficiently, effectively, safely, and sustainably. The 5,124 sq m (55,000 sq ft) exhibit featured various product displays, new equipment introductions, previews of the future, and remote operating stations.

- In May 2021, ABB signed a Memorandum of Understanding (MoU) with Hitachi Construction Machinery to share their expertise and collaborate in bringing solutions to market that will reduce the greenhouse gas (GHG) emissions associated with heavy machinery in mining.

- In May 2021, Hexagon’s Mining division partnered with Fatigue Science. Combined with fatigue’s real-time operator alertness and collision avoidance solutions, Hexagon can help customers further protect and optimize their people and equipment with FatigueScience’s Ready platform for predictive fatigue management.