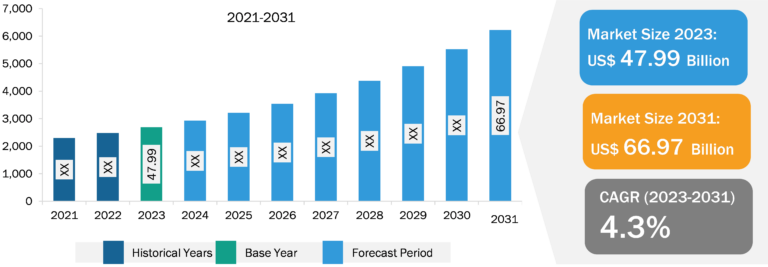

Track and Trace Solutions Market

Continuous Technological Advancements to Fuel Track and Trace Solutions Market Growth in Coming Years

The rising need for security and safety of products has raised the demand for technically advanced devices. The advancements in sensors, wireless data, and cloud computing are providing food & beverage companies unprecedented levels of visibility as the demand for the same is on the rise. The available technologies for tracking and tracing include RFID, barcode, magnetic stripe, voice and vision systems, optical character recognition, and biometrics. Several market players are focused on developments in this emerging field and have gained prominence with track and trace solutions. In January 2022, Mettler-Toledo PCE launched the Integrated Mark & Verify System and Software, which helps pharmaceutical companies fulfill their compliance requirements. This system and software integrates code marking and verification capabilities into the manufacturers’ product line and also enables the printing and verification of 1D and 2D alphanumeric texts as well as codes. In May 2022, OPTEL Group launched Optchain, a modular intelligent supply chain solution suite for the food & beverages industry. Optchain’s track and trace technology enables all stakeholders to easily capture and digitize critical tracking events and key data elements during the entire supply chain, whether at the item, case, or pallet packaging levels. Additionally, the track and trace solution has led to the maximum use of tracking devices for various industries. In June 2022, SEA Vision and Marchesini Group launched a new solution for primary pack serialization and aggregation, including a complete range of technologies to print, inspect, and pack serialized blisters and aggregate them with respective cartons. Thus, continuous technological advancements are expected to fuel the Track and Trace solutions market growth in the coming years.

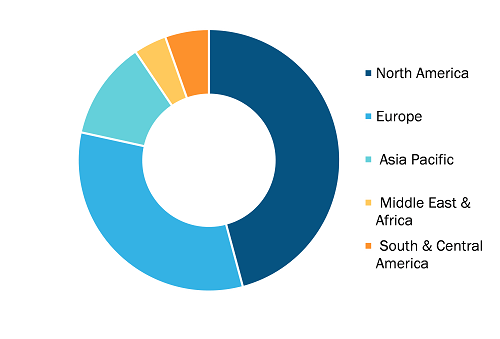

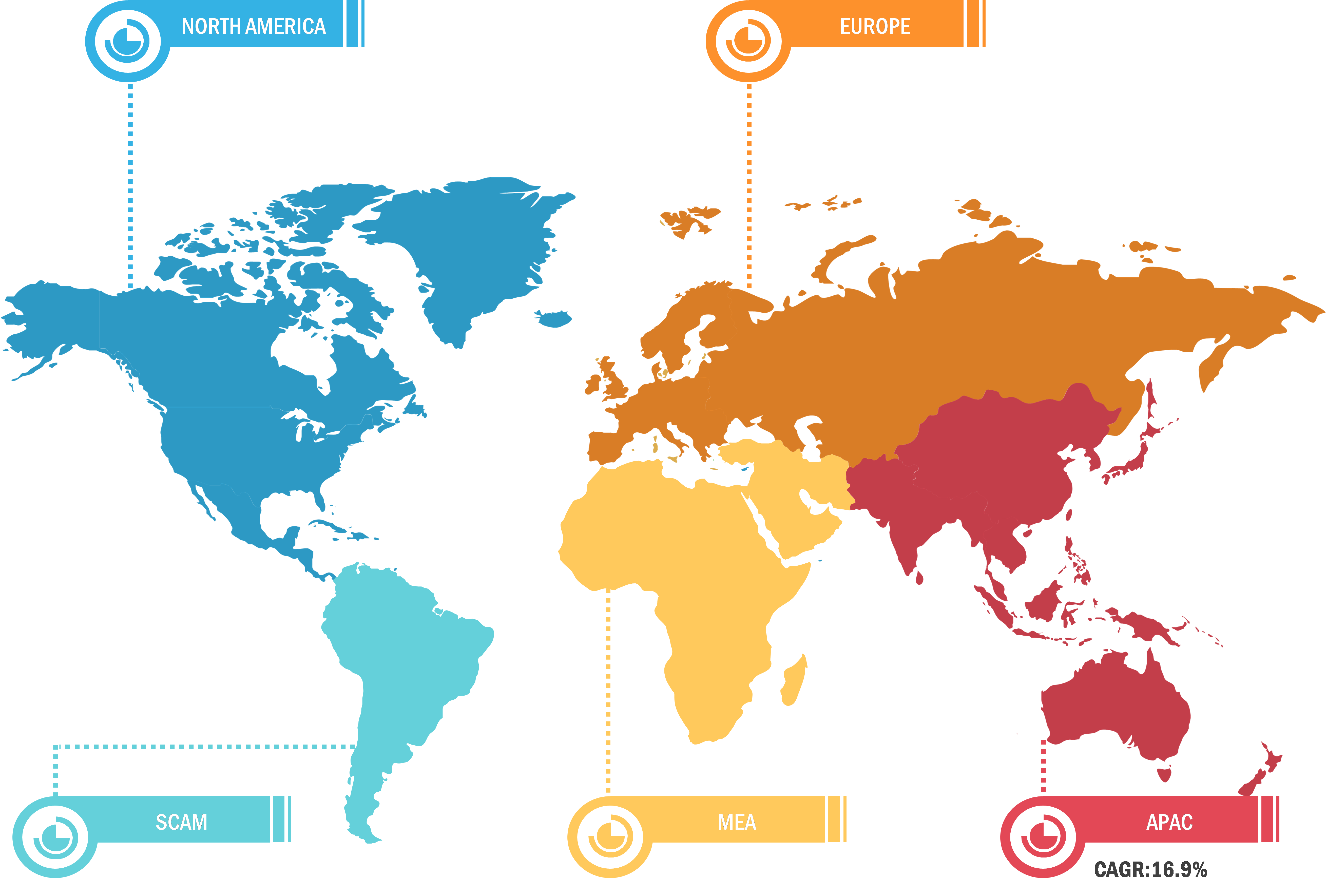

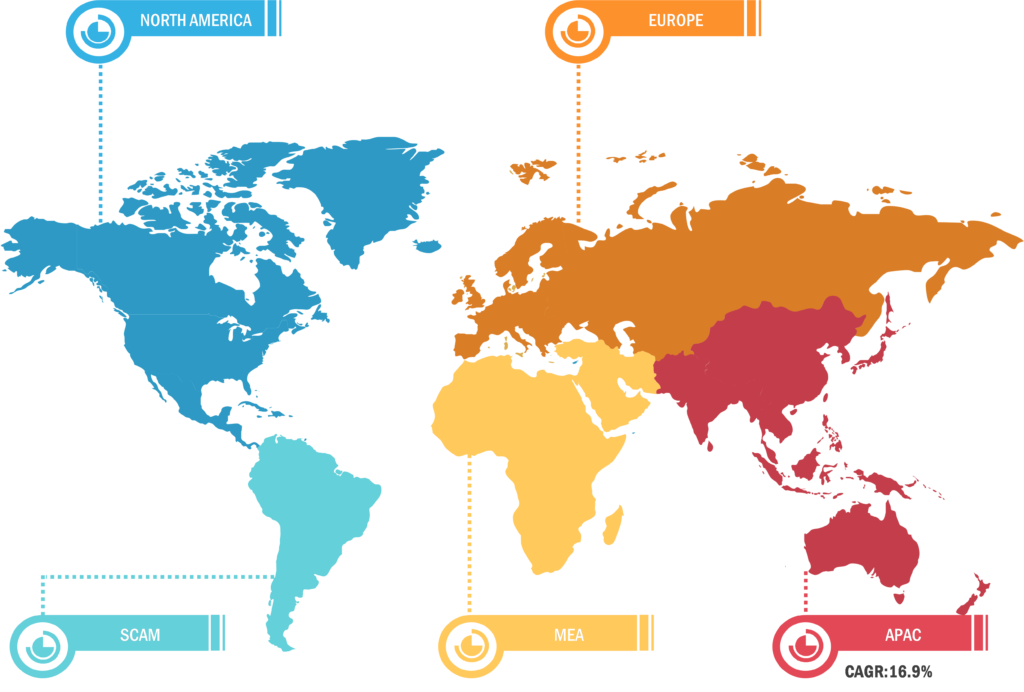

The scope of the track and trace solutions market report covers North America (US, Canada, and Mexico), Europe (Spain, UK, Germany, France, Italy, and Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America). North America held the largest share of the market in 2022 owing to the presence of large players launching innovative product launches, particularly track and trace, growing product introduction in the region, and technological advancements in Track and Trace solutions. In the US, batch-level tracking has been mandatory since 2015, with package-level serialization obligatory since 2017. According to the Drug Supply Chain Security Act (DSCSA) report, the unit-level traceability of the supply chain is expected to be completed in the US by 2023. Similarly, the Food and Drug Administration (FDA) mandates that all medical devices sold in the US have to be labeled with a unique device identifier (UDI) and production identifier (involving lot or serial number and expiration date), and information has to be stored in the Global UDI Database (GUDID). Also, medical devices intended to be reprocessed must have a permanent marking on devices, ensuring UDI compliance. Through such mandates, the detection and monitoring notification of fake products in the supply chain in the US can be improved. Further, the US Government Accountability Office report states that there has been a nationwide shortage of prescription drugs. Therefore, the FDA established a Drug Shortage Program aiming to prevent, alleviate, and resolve such shortages.

Recommendations for Executive Actions by FDA

| Agency Affected | Recommendation | Status |

| FDA | To strengthen the FDA’s ability to protect public health by overcoming drug shortages, the Commissioner of the FDA developed an information system that will enable the Drug Shortage Program to manage its daily workload and track data related to drug shortages. | In March 2016, the FDA developed a system to track drug shortages—the Shortage Tracker. Additionally, in June 2017, the FDA reported that the Shortage Tracker was fully operational for a year. The system allows the agency’s drug shortage staff to manage their daily workload systematically and track data related to drug shortages and associated causes. |

Source: US Government Accountability Office

According to the US FDA report, food traceability comprises the movement of food products and their ingredients at every step in the supply chain. Therefore, the US market highly adopts Track and Trace through the FDA Food Safety Modernization Act (FSMA), addressing rapid and effective tracking and tracking of the food. Also, FSMA section 204, “Enhancing Tracking and Tracing of Food and Recordkeeping,” instructs the FDA to develop additional recordkeeping requirements for certain food products. Therefore, the Food Traceability Final Rule establishes a standardized approach for traceability recordkeeping, adopting, harmonizing, and leveraging digital traceability systems in the US for the food & beverages sector.

The consumption of prescription-based drugs has significantly increased in Canada. The Statistics Canada report reveals that 55% of adults aged 18–79 consume at least one prescription medication, while 36% consume two or more, and 24% consume three or more. The rising consumption of prescription drugs resulted in a drug shortage supply chain. For example, Tier 3 drug shortages severely impacted the drug supply and healthcare system in Canada. Therefore, to overcome challenges associated with prescription drug shortages, Canada proposed regulations to integrate track and trace solutions into all categories of pharmaceuticals. These involve prescription drugs, behind-the-counter drugs, over-the-counter (OTC) drugs, and natural health products approved by the country’s Natural Health Products Regulations. For instance, in February 2022, the publication entitled “Roadmap to the Implementation of GS1 ‘DataMatrix’ Barcodes on Pharmaceuticals in Canada” reveals that the country is actively working on 2D DataMatrix codes for pharmaceutical products. The DataMatrix codes comprise a Global Trade Item Number (GTIN), a lot number, and an expiry date with serial numbers optional. Food safety concerns are at the forefront owing to issues related to Salmonella bacteria found in eggs and tomatoes and melamine in milk, resulting in product recalls. Therefore, regulatory agencies are increasing their focus on preventative strategies and food safety quality programs for tracing solutions. For example, the Canadian Safe Food for Canadians Act and the US FDA are increasing regulatory compliance on food manufacturers. Moreover, the traceability requirements in the Safe Food for Canadians Regulations are based on the International Standard established by the Codex Alimentarius for tracking food starting from the customer to the supplier. Such aforementioned factors are responsible for the growth of the track and trace solutions market.

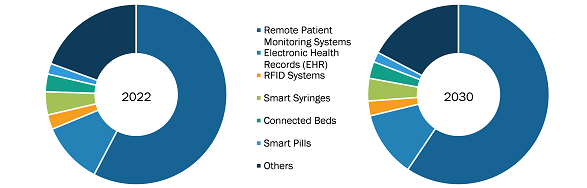

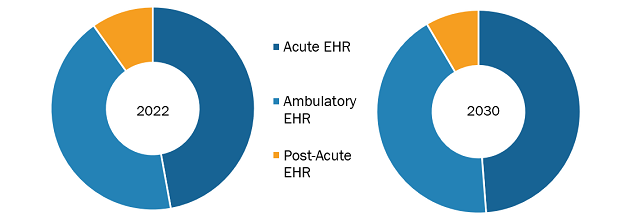

The track and trace solutions market analysis has been carried out by considering the following segments: component, enterprise size, application, industry, and geography. By component, the market is bifurcated into hardware and software. The hardware component is further segmented into barcode scanner, radiofrequency identification reader, and others. The software component is further categorized into plant manager, line controller, and others. Based on enterprise size, the market is divided into SMEs and large enterprises. In terms of application, the market is divided into serialization and aggregation. Based on industry, the market is segmented into pharmaceutical, medical devices, consumer goods, food & beverages, and others.

Track and Trace Solutions Market: Competitive Landscape and Key Developments

ACG, Axway Software SA, Antares Vision SPA, Markem-Imaje AG, Mettler-Toledo International Inc, Optel Group, SEA Vision Grp, Siemens AG, TraceLink Inc, and Zebra Technologies Corp are among the prominent players profiled in the Track and Trace solutions market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. These companies focus on geographic expansions and new product launches to meet the increasing demand from consumers worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large customer base, subsequently facilitating market expansion.