Drug Discovery Informatics Market

Factors Driving Drug Discovery Informatics Market Growth

Pharmaceutical and biopharmaceutical industries invest heavily in R&D to develop new products and expand product pipelines in areas such as immunology, cancer, and infectious diseases. For instance, many innovative pharmaceutical companies are now investing in genomics to re-energize drug discovery. According to the article published by the Journal of Precision Medicine in March 2021, AstraZeneca launched a project to sequence 2 million genomes—a massive initiative aimed at collecting genome sequences and health records over the next decade. The same source further stated that GlaxoSmithKline invested £40 (UD$ 42.48) million to expand its partnership with the UK Biobank. This investment supports the sequencing of 500,000 individuals, generating a uniquely rich data resource that is both anonymized and secure. Instead of sourcing data, the leading pharmaceutical companies are tapping into population data sets that are rich in genomic, phenotypic, and clinical data. Therefore, the increasing investments in activities focused on drug discovery are fueling the drug discovery informatics market growth.

Market Trends:

The deployment of AI and machine learning (ML) algorithms in drug development and discovery are revolutionizing drug development by enhancing processes’ efficiency, speed, and success rates. These technologies are utilized to analyze vast amounts of data, identify patterns, predict molecular interactions, and accelerate the discovery of novel drug candidates. The advantages offered by the incorporation of AI in informatic sciences are surging the demand for computational tools, algorithms, and databases to discover and develop new drug molecules. Additionally, healthcare technology manufacturers are launching various AI-integrated solutions in the market. For instance, as per the company press release, in December 2023, Merck introduced AIDDISON drug discovery software, an innovative AI solution that combines drug discovery and synthesis. It is the first software-as-a-service platform that bridges virtual molecule design and real-world manufacturability through Synthia retrosynthesis software API integration.

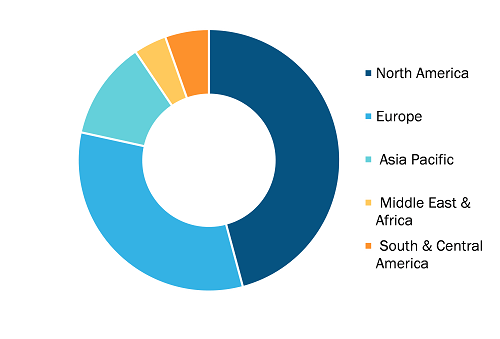

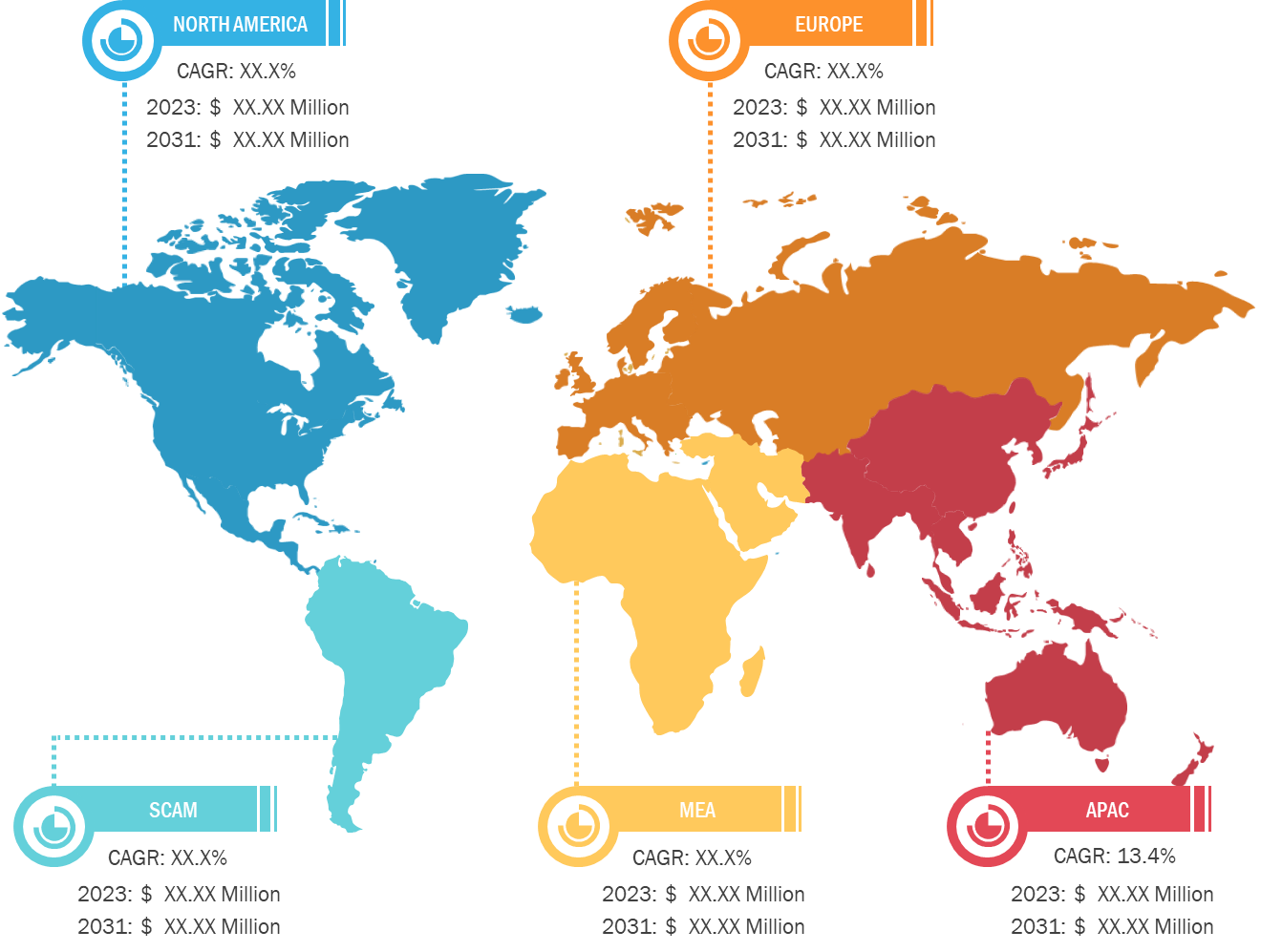

In terms of geography, the drug discovery informatics market is divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). Asia Pacific is expected to register the fastest CAGR in the drug discovery informatics market during the forecast period.

Drug Discovery Informatics Market: Segmental Overview

By workflow, the market is bifurcated into discovery informatics and drug development. The discovery informatics segment held a larger market share in 2023. The drug development segment is projected to register a higher CAGR from 2023 to 2031. The deployment of informatics tools and databases has significantly reduced the time to market for new therapies. This has remarkably impacted society, especially during national and international disasters, such as the Zika and Wuhan virus outbreaks. As a result of exposure to current technology, informatics tools and databases are expected to expand enormously in the coming years. These technologies will be essential in helping the public health sector find novel therapies.

The market, by service, is segmented into sequence analysis platforms, molecular modeling, clinical trial data management, docking, and others. The sequence analysis platform segment is anticipated to hold the largest drug discovery informatics market share in 2023. The molecular modeling segment is projected to register the highest CAGR from 2023 to 2031.

By solution, the drug discovery informatics market is segmented into software and services. The services segment held a larger market share in 2023 and is projected to register a higher CAGR from 2023 to 2031.

Based on end user, the market is segmented into pharmaceutical and biotechnology companies, contract research organizations, and others. The pharmaceutical and biotechnology companies segment held the largest share of the market in 2023. The contract research organizations segment is expected to register the highest CAGR from 2023 to 2031.

Drug Discovery Informatics Market: Competitive Landscape and Key Developments

Certara; Infosys Ltd.; Collaborative Drug Discovery, Inc.; Jubliant Biosys; Curia Global, Inc.; Chemaxon Ltd; Charles River Laboratories; Agilent Technologies, Inc.; Illumina, Inc; Boehringer Ingelheim International GmbH; and Evotec are among the leading companies profiled in the drug discovery informatics market report. In addition, several other players have been studied and analyzed during the study to get a holistic view of the market and its ecosystem. The market players adopt product innovation strategies to meet evolving customer demands and maintain their brand image.

As per company press releases, a few recent developments by players operating in the drug discovery informatics market are mentioned below:

• In January 2024, Evotec partnered with the Crohn’s & Colitis Foundation to develop new treatments for inflammatory bowel disease (IBD). Under this partnership, both companies plan to use Evotec’s comprehensive R&D platform to advance drug discovery for two innovative drug targets that address fibrosis and impaired intestinal barrier function.

• In November 2023, Certara introduced Simcyp Biopharmaceutics software, which aims to increase the efficiency of formulation development for new and generic drugs. The Simcyp Biopharmaceutics software is designed to assist biopharmaceutics, formulation, and scientists in quickly and cost-effectively formulating complex, novel, and generic small molecule medicines.

• In June 2022, Chemical.AI and Chemaxon announced a collaboration to integrate their scientific informatics software. Chemical.AI, a renowned Artificial Intelligence (AI) firm, announced a strategic partnership with Chemaxon, a leading chemical and biological software development company. The collaboration allows end users to access Chemaxon’s Design Hub and Chemical.AI’s ChemAIRS as an option.

• In April 2022, Certara, Inc. and Chemaxon entered a strategic partnership to modernize pharmaceutical research. The partnership integrates their scientific informatics workflows. Certara’s Scientific Informatics software will seamlessly connect with Chemaxon’s Design Hub, providing users with analytics and compound design. This co-development builds on integrations between Certara and Chemaxon products, such as the JChem chemistry cartridge, MarvinSketch, and JChem for Office.