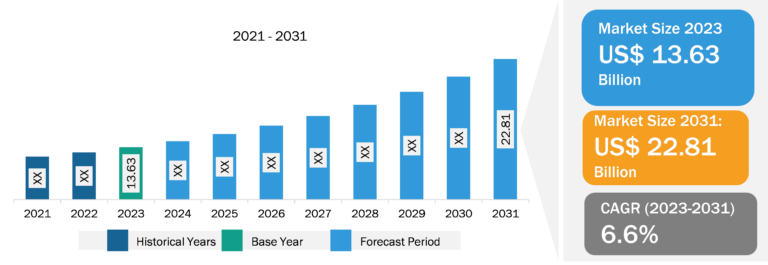

Wax Emulsion Market

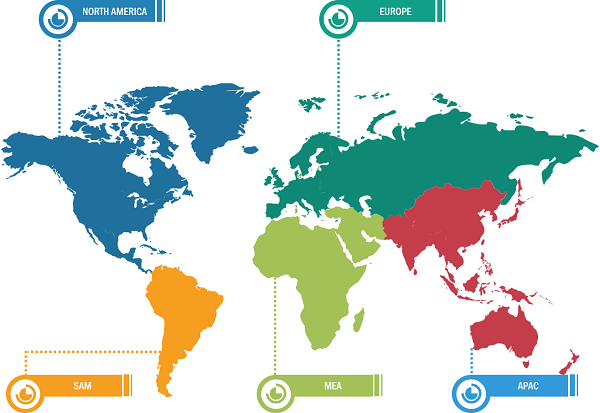

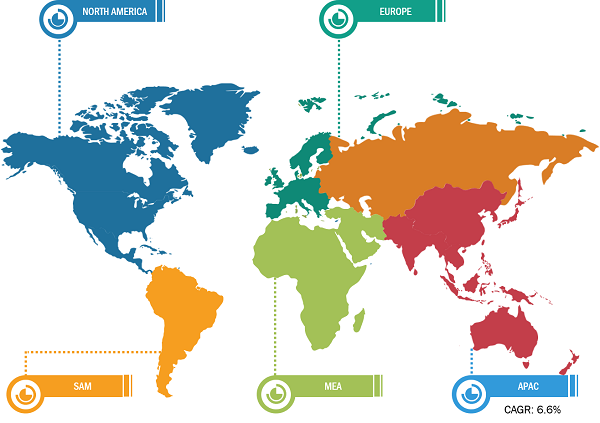

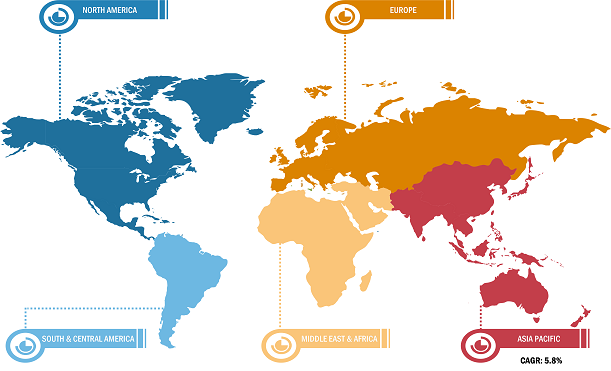

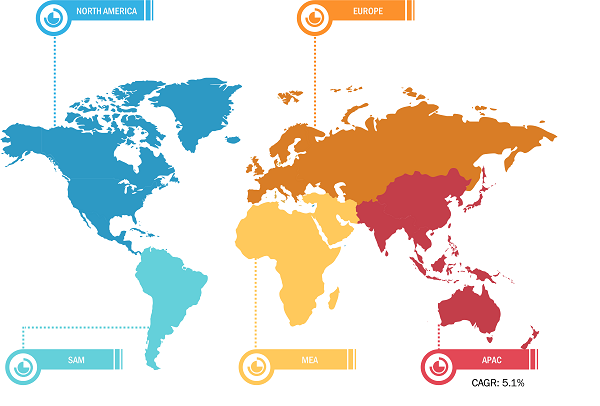

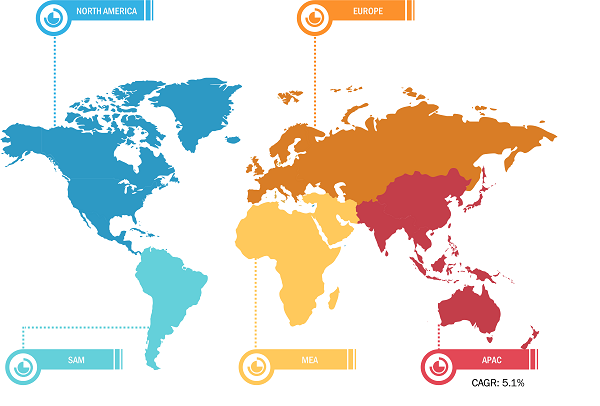

In 2023, Asia Pacific held the largest global wax emulsion market share. The Asia Pacific wax emulsion market is witnessing considerable growth owing to the growth of the paints and coatings, packaging, textiles, and personal care industries. According to the India Brand Equity Foundation, India holds a strong position in the heavy vehicles and textile markets across the world. It is the largest tractor producer, the second-largest bus manufacturer, and the third-largest heavy truck manufacturer globally. Also, the growing foreign investments in the residential & nonresidential construction sector in Japan propel the demand for architectural coatings, thereby positively influencing the wax emulsion market growth in the country. Europe is another major region contributing to a significant global market share. According to the Germany Trade & Invest GmbH, Germany is Europe’s largest automotive market, with strong production and sales, accounting for ~25% of all passenger cars manufactured and almost 20% of all new registrations. The automotive industry growth in the region is mainly driving the demand for wax emulsions.

Innovations in Wax Emulsion Market

The key manufacturers operating in the wax emulsion market are investing significantly in strategic development initiatives such as product innovation and R&D to attract a wide customer base and enhance their market position. Several researchers are focused on enhancing the thermal and physical properties of wax emulsions to improve their characteristics and product life. Moreover, multifunctional additives are incorporated into the wax emulsion to add characteristics such as antimicrobial properties and UV resistance. Researchers across the globe are studying the enhancement of surface properties of emulsions made from nano-sized wax particles. Other innovations in the wax emulsion market include the development of wax emulsions that can be modified according to the requirements of targeted applications and environmental changes such as temperature and pH.

Wax Emulsion Market: Segmental Overview

Based on type, the wax emulsion market is segmented into polyethylene, polypropylene, paraffin, vegetable-based, and others. The polyethylene segment held the largest market share in 2023. Polyethylene wax emulsion is highly used in architectural coatings, food packaging containers, textiles, printing inks, water-borne paints, water-borne polishes, and other applications. Paraffin is another major application segment in the wax emulsion market. In recent years, broader environmental concerns are influencing market trends. The shift toward sustainable and renewable alternatives is playing a significant role in shaping the future of the wax industry. With this, the paraffin wax industry has been witnessing significant innovations driven by the demand for higher quality, environmentally friendly, and application-specific products. Major countries in paraffin wax production are at the forefront of these innovations, leveraging advanced technologies and sustainable practices to meet the evolving needs of the markets. The US is pioneering the development of eco-friendly paraffin wax with the use of non-traditional feedstocks, such as soybean oil and other vegetable-based oils.

The wax emulsion market, based on application, is segmented into paints and coatings, printing inks, textile, personal care, packaging, and others. The paints and coatings segment accounted for the largest market share in 2023. Paints and coatings are one of the major applications of wax emulsions. This application includes the use of wax emulsion in wood coatings, architectural coatings, car polishes, and floor polishes. Packaging is another major application segment in the wax emulsion market. Wax emulsions are used in different packaging products and packaging coatings. The use of wax emulsions by roller imparts improved properties on different films used for packaging. In paper coatings, wax emulsion is added to the coating mixture to reduce dusting during calendering, increase water repellency, improve flexibility, and raise gloss. Further, the packaging industry is growing significantly due to factors such as upsurging disposable income levels, increasing demand for processed food products, and many other factors. The growth of the packaging industry is driving the demand for wax emulsions.

Wax Emulsion Market: Competitive Landscape and Key Developments

BASF SE, Hexion Inc, Repsol SA, Sasol Ltd, The Lubrizol Corp, Clariant AG, Michelman Inc, Allinova BV, H&R Group, and Productos Concentrol SA are among the prominent players profiled in the wax emulsion market report. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the market.

Key Developments

- In June 2021, Omya signed an agreement with Michelman to distribute Michelman’s surface modifiers and wax emulsion product line to the paints and coating markets in Canada.

- In January 2023, Ter Chemicals announced an agreement with Allinova to be an exclusive distributor of Allinova wax emulsions in Poland. The wide product portfolio ranges from wax emulsions, flame retardants, crosslinking agents, repellents, and solvents to plastic dispersions.

- In October 2021, H&R Group, a global sustainable refiner and marketer of specialty plasticizers, extender oils, softeners, and waxes headquartered in Hamburg, Germany, invested US$ 48.3 million in a specialty manufacturing plant in Lumut, Perak, Malaysia.

- In June 2023, Concentrol updated its catalog of wax emulsions, introducing a wide range of EMULTROL products that cater to various application sectors. These wax or oil emulsions are formulated using diverse materials, offering unique and versatile properties that make them ideal for a wide range of industries and applications.

- In October 2023, Emulco NV launched AquaVeg bio-emulsion into the panel board industry. The emulsion manufacturer is combining its AquaVeg water-based bio-emulsion with formaldehyde-free bio-based binders to produce zero-emission panel boards.