Outpatient Central Fulfillment Market

The outpatient central fulfillment market report highlights market drivers and restraints. Factors such as automation in pharmacies and risk of medication errors propel the market growth. However, the high capital requirements and problems associated with automation system operations impede the outpatient central fulfillment market growth.

Automating the mechanical procedures of any pharmacy process typically entails tracking and updating customer information in databases (e.g., medical history and drug interaction risk detection), counting small objects (e.g., pills and capsules), and measuring and combining powders and fluids for compilation and other such activities. As a result, automated pharmacies are preferred by many hospitals and pharmacies. The pharmacy automation industry is growing due to increased consumer demand for pharmaceutical products, intensified competition among pharmaceutical companies, technological advancements, and precise robotic equipment availability. The increasing demand for error-free medicines is expected to drive the outpatient central fulfillment market. However, stringent regulatory control, high capital requirements, and problems associated with automation system operations limit the growth of the outpatient central fulfillment market.

Risk of Medication Errors Propels Outpatient Central Fulfillment Market

A medication error can be a result of inappropriate and ineffective medication dispensing. Common medication errors that have the potential to harm patients include dispensing a wrong drug, an incorrect quantity of a drug, and a wrong drug strength. Moreover, omitting items unintentionally may result in medication errors. These errors are alarming and are considered the third leading cause of death worldwide. The World Health Organization (WHO) also stated that a medication error causes 1 death in 1 million population globally. Unsafe practices in medicine have been causing unavoidable risks in the healthcare sector. According to the US Food and Drug Administration (FDA), over 100,000 reports associated with medication errors are received every year. Further, as per the study titled “Medication Errors” published in StatPearls in June 2020, annually ~7,000–9,000 people in the US lose their lives due to medication errors. An article published by the European Alliance for Access to Safe Medicines in September 2022 states that medication errors result in 160,000 deaths every year. The article also revealed that medication errors account for 50% of preventable risks in the healthcare sector, with a yearly cost of ~US$ 42 billion.

Distractions are the leading cause of medication errors. Distractions occur because healthcare professionals are engaged in multiple tasks throughout the day, including examining the patient, interacting with consultants, speaking to patients’ family members, and conversing with insurance professionals. Sometimes a lapse of judgment develops in a hurry to complete their duties, which may lead to a medication error.

Another major cause of medication error is distortion. Poor writing, abbreviations, misunderstood symbols, or improper translation cause distortions. Further, pharmacists and nurses find it difficult to understand the handwritten prescription for medicines, leading to the wrong delivery of medicines to patients. Thus, the undeniable possibility of medication errors triggers the demand for automation in pharmacy operations, thereby bolstering the growth of the outpatient central fulfillment market.

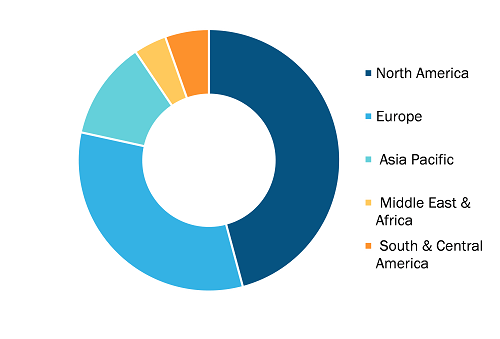

The global outpatient central fulfillment market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America. The market in North America is expected to grow at a CAGR of 11.0% from 2022 to 2030. Market growth in this region is ascribed to the increasing adoption of pharmacy automation in the US, rising public health awareness, increasing strategic initiatives by governments, and the presence of leading pharmacy automation vendors. The US is the largest contributor to the outpatient central fulfillment market in North America. With the growing burden on pharmacies, the frequency of medication errors also increases in the country. The Asia Pacific outpatient central fulfillment market is expected to grow at the fastest CAGR during 2020–2030. The factors contributing to the market progress in this region include the entry of international players in healthcare markets and the increasing geriatric population. In addition, the surging cases of infectious and chronic diseases, and initiatives by government and non-government organizations fuel the growth of the outpatient central fulfillment market in Asia Pacific.

Outpatient Central Fulfillment Market: Segmental Overview

The “outpatient central fulfillment market” is segmented on the basis of product type, end user, and geography.

Based on product type, the outpatient central fulfillment market is divided into automated medication dispensing systems, automated packaging and labeling systems, automated tabletop counters, automated storage and retrieval systems, and other types. The automated medication dispensing systems segment held the largest market share in 2022. It is estimated to register the highest CAGR of 12.0% during 2022–2030. Automated medication dispensing systems, or automated drug cabinets, are electronic devices primarily used for drug storage and dispensing in healthcare settings. Secured with authenticated passwords and biometrics for drug inventory control and security, these systems aid in tracking and controlling drug distribution. These systems are now widely used in many hospitals, clinics, and nursing homes. The Pyxis MedStation system offered by BD is one of the most used automated dispensing systems in the world. It supports decentralized medication management, and its barcode scanning ensures accurate medication dispensing.

Outpatient Central Fulfillment Market: Competitive Landscape and Key Developments

Capsa Healthcare, Cardinal Health, Surescripts, McKesson Corporation, Tension Packaging and Automation, ScriptPro LLC, Omnicell, BD, RxSafe LLC, and Custom Health Inc. are among the leading companies operating in the outpatient central fulfillment market. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and expand their product range with the inclusion of specialty portfolios. Their widespread global presence helps them serve a large set of customers and subsequently enlarge their market share.

Market players are launching new products in the outpatient central fulfillment market.

- In November 2023, Omnicell Inc announced that Baptist Health, Kentucky, opted for Omnicell’s Central Pharmacy Dispensing Service to tackle labor issues, and enhance clinical and economic results. Baptist Health is among the most recent health systems to implement this service offered by Omnicell Inc. To offer this service, the company uses advanced robotics, dispensing optimization tools, and remote and onsite experts for streamlining workflows, improving safety, and enhancing dispensing accuracy. The all-inclusive system enabled under this service can reduce pharmacists’ dispensing time by 75% on average by automating and streamlining pharmacy labor and workflows.

- In March 2022, Tension Corporation acquired the print division assets of Intellus Direct. This acquisition expanded the company’s presence in the high-end direct mail and print marketing space, thereby consolidating its supply chain by vertically integrating the print and envelope converting operations that support Tension’s direct mail and print marketing offerings.