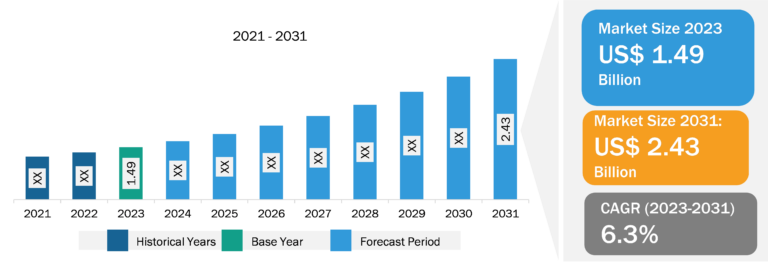

Micro Battery Market

The rising adoption of wearable devices, such as smartwatches, fitness trackers, and medical wearables, is fueling the demand for micro batteries. These devices require compact and lightweight power sources to ensure long-lasting and reliable performance. Furthermore, the rapid advancements in the Internet of Things (IoT) and wireless sensor technologies are driving the demand for micro batteries. Wireless sensors, which are widely used in various applications, rely on micro batteries as a viable power supply option. The growth of IoT applications and the need for reliable power sources contribute to the expansion of the micro battery market.

The demand for compact batteries in medical devices, such as hearing aids, pacemakers, and surgical tools, is driven by several factors that prioritize the need for small and lightweight power sources which can offer long-lasting performance and ensure patient’s safety. One of the key drivers is the miniaturization of medical devices. As technology evolves, there is a growing trend of developing smaller and more portable medical devices. This is particularly important for devices that are implanted inside the human body, such as pacemakers and defibrillators. Compact batteries are essential in these cases as they need to fit within the limited space available while still delivering reliable power. Thus, all the factors mentioned above drive the micro battery market growth.

US Dominates Micro Battery Market in North America

The micro battery market in the US is experiencing notable growth due to the ever-increasing demand for high-speed data transmission driven by the proliferation of smart devices and the rise of the Internet of Things (IoT). Micro batteries offer the necessary energy density and longevity for these devices, driving their adoption across the region. Furthermore, there has been a significant investment from key players and government bodies, which, in turn, is driving the micro battery market in the region. For instance, in June 2021, the Department of Energy unveiled the National Blueprint for Lithium Batteries 2021 to 2030, which included a specific goal to stimulate the manufacturing sectors related to electrodes, cells, and battery packs in the US. Additionally, the administration has committed to strengthen requirements for procuring batteries from American-made sources. Furthermore, the infrastructure bill passed in November 2021 includes provisions that allocate a total of US$ 30.7 billion for the deployment of electric vehicles (EVs) and funding for charging infrastructure.

Segmental Overview

Based on type, the micro battery market is segmented into thin film battery, solid-state chip battery, and button battery. The button battery segment dominates the micro battery market. Both button cell and lithium coin cell batteries are spherical, metallic. They power many household items. Button batteries have the appearance of little buttons. Because of their disc shape, which resembles a button or a coin, they are known as button batteries. They are frequently utilized in hearing aids, watches, toys, calculators, cameras, musical greeting cards, and small electronic devices. Button batteries are small, round batteries with a diameter of fewer than 25 mm and a height of fewer than 5 mm. Thus, owing to the above parameters, button batteries are gaining traction in the micro battery market.

Market Analysis: Competitive Landscape and Key Developments

Molex LLC, Murata Manufacturing Co Ltd, Varta AG, Duracell Inc, Renata Sa, Maxell Holdings, Ltd, Seiko Instruments Inc, Riot Energy Inc, Panasonic Energy Co Ltd, and Enfucell Flexible Electronics Ltd are a few of the key firms operating in the market. The micro battery market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities. Several other essential micro battery market players were also analyzed for a holistic view of the market and its ecosystem. The market report provides detailed market insights to help major players strategize their growth.

- In May 2022, Murata launched child-resistant packaging for its lithium coin cell batteries, available in a 5-piece tear-strip package. Murata is transitioning to child-resistant packaging for all lithium coin cell batteries available in a 5-piece tear strip package, which includes the popular CR2016, CR2025, and CR2032 sizes. Each coin cell battery in the 5-piece tear strip pack can still be easily detached. Each coin cell battery is fully encapsulated in plastic, replacing the conventional, easy-to-open perforated packaging. Each capsule now requires a pair of scissors to open. Coin cells and packaging are also marked with the “keep away from small children” symbol.

- In January 2021, Murata, a renowned manufacturer, built a strong reputation in the watch battery industry by focusing on eco-friendly practices and producing mercury-free watch batteries. The company’s commitment to environmental sustainability has positioned it as a leading partner and supplier of mercury-free watch button cell batteries to international watch and jewelry makers who prioritize ecological consciousness.