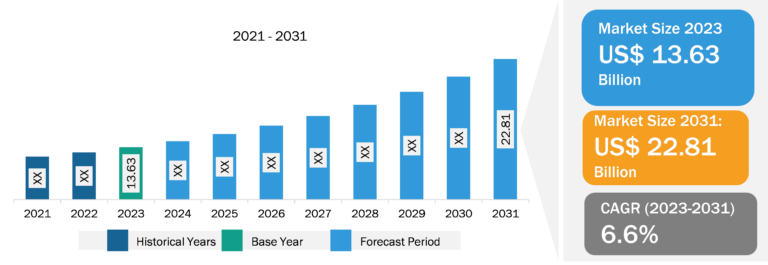

Mammography Detectors Market

Mammography detector-based imaging has become an essential part of the breast cancer detection process. Mammography is a diagnostic and screening technique that involves using low-energy X-rays to examine human breasts for the possibility of breast cancer based on distinct lumps or microcalcifications, thereby diagnosing the condition in its early stage. Mammography detectors use low-dose X-rays to identify cancer before symptoms appear in females. The increasing incidences of breast cancer and rising awareness about the importance of early detection are among the major factors contributing to the growing mammography detectors market size. However, the high cost of mammography procedures hinders the growth of the mammography detectors market.

Rising Awareness About Importance of Early Cancer Detection to Fuel Mammography Detectors Market Growth in Coming Years

The early detection of breast cancer unlocks the possibility of success of multiple treatment options, resulting in a greater survival rate and higher quality of life. Although there is no definitive approach to preventing breast cancer, like any other cancer type, early detection provides the possibility of effective treatments. Mammography is the most widely used method for tumor detection in the breast. The growing implementation of preventive healthcare and disease diagnosis programs creates awareness among the population, offering lucrative growth opportunities for the mammography detectors market players.

The National Breast and Cervical Cancer Early Detection Program by the Centers for Disease Control and Prevention focuses on offering superior-quality breast cancer diagnostics and screening services to underserved, low-income, and uninsured women. It also undertakes strategies to increase the screening rates in health systems, along with assisting in breast cancer detection in the early stages. All Canadian provinces have breast cancer screening programs for women aged 50–74. The women aged 50 and above with average risk are recommended breast cancer screening with mammography every 2–3 years. The Provincial Health Services Authority of British Columbia runs a breast cancer screening program with simple and less expensive tests catering to a large population. The program emphasizes the early diagnosis of breast cancer. Over 80% of breast cancer cases are diagnosed in stages I and II. Similarly in Germany, the German Mammography Screening Programme aims to reduce the breast cancer mortality rate. The diagnosis conducted under this program is based on three imaging techniques: X-ray mammography (X-ray examination of the breast), sonography (ultrasound scan), and magnetic resonance imaging.

There is a burgeoning awareness of the importance of early detection of breast cancer, as it can improve the chances of survival, which presents notable opportunities for the mammography detectors market players. The Xineos CMOS X-ray detector (Teledyne DALSA) is designed to address the rising needs of X-ray mammography applications with just one detector suitable for static full-field digital mammography and dynamic Digital Breast Tomosynthesis modes.

Mammography Detectors Market: Segmental Overview

The mammography detectors market is segmented on the basis of detector type and end user. Based on end user, the market has been segmented into hospitals and clinics, and diagnostic centers. In 2022, the hospitals and clinics segment held a larger share of the mammography detectors market. It is anticipated to register a higher CAGR during 2022–2030. Hospitals are primary contact points for patients for their diagnostic and therapeutic needs. Infrastructure and advanced medical devices available in hospitals can help provide high-quality care for the treatment of any disease condition. The hospitals and clinics segment is estimated to hold a considerable share as most of the patients in emerging and developed countries prefer to visit hospitals for any health-related problem. Hospitals are the primary providers of mammography-related services and have the resources to invest in high-quality mammography detectors.

The hospital and clinics segment is estimated to hold a major market share in the mammography detectors market in the coming years owing to the adoption of advanced diagnostic technologies, an increasing number of diagnoses carried out on a daily basis, and a higher patient footfall for various therapeutic applications. In addition, the rising number of hospitals and clinics, along with the growing accessibility of these facilities in emerging nations, is estimated to offer lucrative opportunities for the growth of the hospitals and clinics segment in the mammography detectors market during the forecast period.

Mammography Detectors Market: Competitive Landscape and Key Developments

Analogic Corporation, Siemens Healthineers, Teledyne DALSA, Varex Imaging, Fujifilm Holdings, Koninklijke Philips NV, Hologic, Inc., PerkinElmer, Carestream Health, and Canon Medical Systems are a few of the key companies operating in the mammography detectors market. These companies focus on product innovation strategies to meet evolving customer demands, along with maintaining their brand name.

A few of the recent developments in the mammography detectors market are mentioned below:

- In February 2023, Teledyne DALSA marked its presence at the European Congress of Radiology 2023 with the latest offering of IGZO X-ray detectors along with its premium line of CMOS-based detectors. Teledyne’s breakthrough Axios X-ray detectors narrow the gap between amorphous silicon and CMOS-based detectors. The new Axios IGZO (i.e., indium gallium zinc oxide) X-ray detector series is built and manufactured solely by Teledyne, and it utilizes the best-performing components, a proprietary new image chain, and cutting-edge IGZO technology.

- In November 2022, Teledyne DALSA introduced a new line of x-ray detectors based on IGZO at the Radiological Society of North America meeting. The new flat panel detector series, called Axios, offers a better diagnosis of medical anomalies by reducing image artifacts and improving the signal-to-noise ratio. The company also showcased its Xineos complementary metal-oxide semiconductor X-ray detector series in the meeting.

- In November 2020, Hologic Inc. and RadNet partnered to advance artificial intelligence technologies to explore their application in breast health. The partnership involves data exchange, research and development, and the modernization of RadNet’s fleet of Hologic mammography systems into a cutting-edge imaging system.

- In October 2020, Hologic, Inc. announced the commercial availability of its Genius AI-powered 3DQuorum Imaging Technology in Europe. The 3DQuorum Imaging Technology uses Genius AI-powered analytics to rebuild high-resolution 3D data, which speeds up image interpretation.