Infectious Disease Diagnostics Market

The growing incidence of infectious diseases across the world and rising application of diagnostics in veterinary infectious diseases bolster the infectious disease diagnostics market size. However, an inadequate reimbursement scenario hinders the infectious disease diagnostics market growth.

Rising Incidence of Infectious Diseases Drive Infectious Disease Diagnostics Market Growth

Fungi, viruses, parasites, bacteria, and toxic products are among the infectious agents that can cause infectious diseases. Public health is adversely affected by infectious diseases, causing morbidity, mortality, and economic burdens. Rising incidence of infectious diseases propels the requirement for accurate and timely diagnosis to form the basis for effective disease management, treatment, and prevention. Diagnosing and monitoring multiple infections and diseases, including hepatitis C, HIV, tuberculosis, human papillomavirus, and sexually transmitted infections (STIs), and infectious disease outbreaks can be performed using molecular diagnostics techniques, laboratory-based assays, and point-of-care tests. According to the Centers for Disease Control and Prevention (CDC), ~10.2 million people visited physician offices for the treatment of infectious and parasitic diseases in African countries every year. According to an article published in the National Library of Medicine (NLM) in 2021, infectious diseases are a major concern in most African countries due to high disease burden and limited healthcare resources. More than 200 pathogens can cause fever in Nigeria, one of the most common reasons for visiting a healthcare facility. According to the World Health Organization (WHO), ~58 million people across the world suffer from chronic hepatitis C infection, and ~1.5 million new infections are diagnosed every year. HIV is a major public health issue across the world. According to The Joint United Nations Programme on HIV/AIDS (UNAIDS), in 2020, ~ 37.7 million people had HIV. Out of these, ~36 million people were adults, and about 1.7 million were children aged 0–14 years. Also, ~1.5 million new HIV cases were reported globally in 2020.

According to WHO, tuberculosis (TB) is the 13th leading cause of death across the world, and it is the second leading infectious disease that leads to death after COVID-19. According to the WHO, 1.5 million deaths were caused by TB in 2020. In 2020, WHO projected that 10 million people had TB across the world, Furthermore, in 2020, 30 countries with high TB burdens accounted for 86% of new TB cases. Eight countries make up two-thirds of the total cases of TB, with India at the forefront, followed by China, the Philippines, Indonesia, Nigeria, Pakistan, Bangladesh, and South Africa. Thus, the upsurging incidence of infectious diseases bolsters the need for infectious disease diagnostic technologies, such as microbial culture, hemagglutination inhibition tests, and enzyme-linked immunosorbent assays (ELISA).

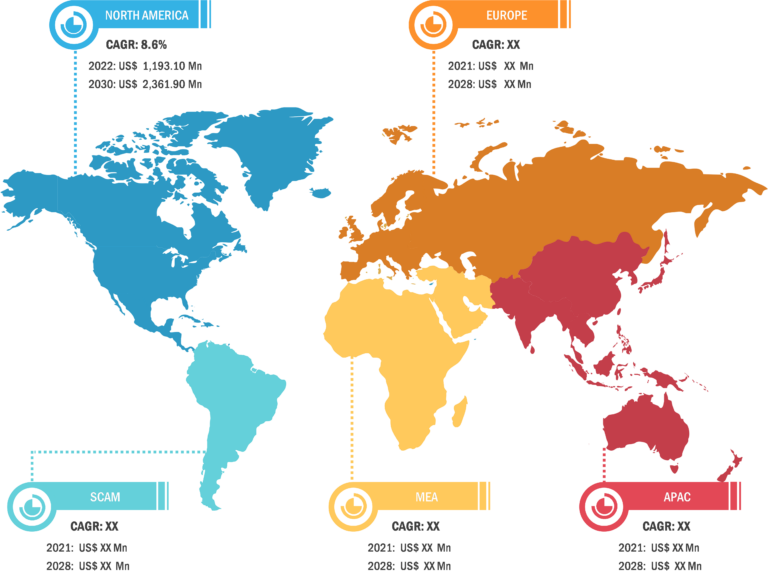

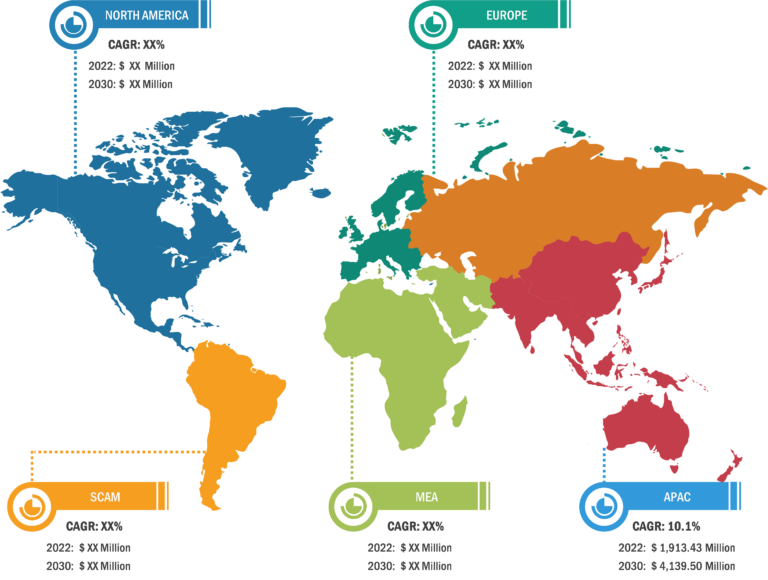

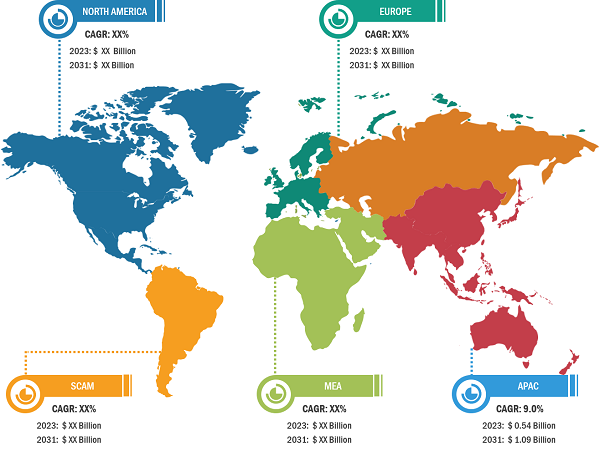

North America held the largest share of the global infectious disease diagnostics market in 2022 owing to the increasing acceptance of technologically advanced products, rising research and development activities, presence of large healthcare businesses, and growing use of molecular diagnostics kits for infectious disease diagnosis. The implementation of POC testing is increasing in hospitals owing to the rising importance of real-time electronic reporting. The healthcare sector in Canada has been significantly adopting advanced molecular diagnostics technologies for the detection of infectious diseases. In August 2021, the Government of Canada made rapid antigen test kits for infectious diseases available for numerous small and medium-sized organizations through associated pharmacies. Further, in October 2021, Cepheid announced the launch of direct commercial operations in Canada. Cepheid Canada’s operations include direct service, order management, and technical support. Cepheid offers GeneXpert systems and Xpert tests that deliver fast, accurate, and reliable real-time PCR test results. These systems are already in use across many community hospitals and clinics in Canada, as well as the National Microbiology Lab of the Public Health Agency of Canada. With the start of direct commercial operations in Canada, Cepheid plans to strengthen its partnership with Canadian healthcare leaders. This strategy would help small medical clinics and high-volume reference laboratories and hospitals in the country to benefit from the speed and accuracy of molecular diagnostics for infectious diseases.

Infectious Disease Diagnostics Market: Competitive Landscape and Key Developments

Abbott Laboratories, Bruker Corp, Cardinal Health, F. Hoffmann-La Roche Ltd, Trinity Biotech Plc, Danaher Corp, Bio-Rad Laboratories Inc, AccuBioTech Co Ltd, ACON Laboratories, and DiaSorin SpA are a few key companies operating in the infectious disease diagnostics market. Market players adopt product innovation strategies to meet evolving customer demands, thereby maintaining their brand names in the infectious disease diagnostics market.

A few of the recent developments in the global infectious disease diagnostics market are mentioned below:

• In August 2023, Danaher Corp entered into a definitive agreement to acquire Abcam plc. Danaher acquired all outstanding shares of Abcam for US$ 24.00 per share in cash, or a total enterprise valued of ∼US$ 5.7 billion, including assumed indebtedness and net of acquired cash.

• In January 2022, Cepheid announced that Health Canada had approved the medical device license of Xpert Xpress CoV-2/Flu/RSV plus, a rapid molecular diagnostic test for the qualitative detection of viruses causing Flu A, Flu B, COVID-19, and respiratory syncytial virus (RSV) infections from a single patient sample.

• In December 2021, Roche launched the first infectious illness tests on the Cobas 5800 System, a new molecular laboratory instrument. Cobas HIV-1/HIV-2 Qualitative, Cobas HBV, cobas HCV, cobas HIV-1, and Cobas Omni Utility Channel kit are a few of these options.