Hydrocolloids Market

Hydrocolloids are high molecular weight polysaccharides exhibiting thickening, gelling, emulsifying, and stabilizing properties. They are extracted from plants, algae, and seaweed, and can be synthesized using microbial processing. Thus, these polymers can be classified as natural and synthetic based on their sources. Various types of hydrocolloids include gelatin, pectin, agar, xanthan gum, carrageenan, gellan gum, alginates, guar gum, locust bean gum (LBG), modified starches, cellulose, chitin, and chitosan. Hydrocolloids are used for various food and non-food applications. In the food & beverages industry, hydrocolloids are used as gelling, thickening, and stabilizing agent in bakery and confectionery, dairy and frozen desserts, beverages, meat snacks, seafood, among others. The other applications of hydrocolloids include animal feed, pet food, personal care and cosmetics, pharmaceuticals and nutraceuticals, oil & gas, paper, textile, among others. The rising demand for hydrocolloids across various end-use industries is driving the hydrocolloids market growth.

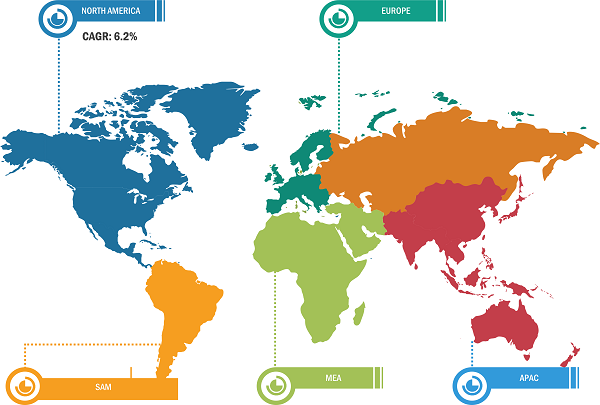

Asia Pacific held the largest share of the global hydrocolloids market in 2022. North America is expected to grow at the fastest CAGR in the hydrocolloids market from 2022 to 2030. The rapidly expanding food & beverages sector in countries such as China, Japan, and India create a notable demand for hydrocolloids. These materials are used in applications such as bakery products, meat products, confections and chocolates, dairy alternatives, and meat substitutes for their outstanding gelling, thickening, and stabilizing properties. Moreover, the thriving cosmetic industry in Asia Pacific due to the improving lifestyle of people, influence of Western culture, growth of the corporate sector, and focus on self-grooming provides potential opportunities for the hydrocolloids market growth in Asia Pacific.

Rising Demand for Natural Beauty Products to Provide Lucrative Opportunities to Hydrocolloids Market

The natural beauty trend fuels the demand for hydrocolloids as these polymers serve as key ingredients in natural and clean-label beauty formulations. Hydrocolloids contribute to the texture, stability, and viscosity of cosmetic and skin care products, meeting the consumer preference for natural, plant-based alternatives. Their multifunctional properties make them a valuable ingredient of any sustainable and effective formulation. An upsurge in consumer awareness regarding the potentially harmful effects of synthetic materials and chemicals in beauty products has led to consumers’ inclination toward natural alternatives, aligning with the growing trend of eco-friendly, herbal, and beauty products with transparent labels. Hydrocolloids derived from plants or seaweed offer renewable and environmentally friendly options, supporting the sustainability aspect of natural beauty trend. Thus, the versatility and natural origin of hydrocolloids position them as a sought-after choice in the evolving landscape of the beauty industry.

Hydrocolloids Market: Segmental Overview

Based on application, the hydrocolloids market is segmented into food & beverages, pharmaceuticals and nutraceuticals, personal care, and others. Market for the food & beverages segment is further segmented into bakery and confectionery; dairy and frozen desserts; meat, poultry, and seafood; beverages, and others. The food & beverages segment held the largest share of the hydrocolloids market in 2022. Hydrocolloids are used as a thickening agent, emulsifier, and gelling agent in different food products and beverages. They also help improve the taste and mouthfeel by providing the desired texture. This versatility makes them indispensable in soups, sauces, dressings, frozen desserts, bakery products, etc. Considering the burgeoning demand for healthier food options, hydrocolloids are used to develop low-calorie and low-sugar products. Thus, their ability to improve product consistency and sensory properties allows manufacturers to meet the preferences of health-conscious consumers without compromising on taste and product quality.

Impact of COVID-19 Pandemic on Hydrocolloids Market

The COVID-19 pandemic affected almost all industries in various countries. Lockdowns, travel restrictions, and business shutdowns in North America, Europe, Asia Pacific (APAC), South & Central America, and the Middle East & Africa (MEA) resulted in restricted operations in several industries. However, the demand for plant-based meat and dairy products increased with the surge in sustainability concerns along with heightened awareness of the health benefits of plant-based products during the COVID-19 pandemic. This transformation propelled the demand for plant-based gums and hydrocolloids such as xanthan gum, pectin, guar gum, and locust bean. Thus, supply chain disruption and raw material shortage along with increased demand resulted in a significant demand–supply gap, which affected the profitability of manufacturers. The challenges in raw material sourcing also led to elevated prices, which hampered the pricing strategies of small-scale and medium-sized manufacturers. All these factors hindered the growth of the hydrocolloids market during 2020–2021.

In 2021, the governments of various countries announced relaxation in lockdown restrictions and permitted the manufacturers to operate at full capacity. Thus, the manufacturers could procure raw materials smoothly and overcome the demand–supply gap. They further plan to expand their production capabilities due to the availability of resources and laborers in abundance after the relaxation of restrictions. All these factors had a positive impact on the hydrocolloids market growth.

Hydrocolloids Market: Competitive Landscape

Cargill Incorporated, ADM, Ingredion, DSM, J M Huber, Tate & Lyle Plc, Kerry Group Plc, Gelita AG, International Flavors & Fragrances Inc, and American International Foods Inc. are among the major players in the global hydrocolloids market. They are focused on product innovation, expansion, merger and acquisition, and innovative marketing strategies, which are expected to open new growth opportunities in the coming years. In January 2019, DSM unveiled new brand identities for its xanthan gum and gellan gum portfolio under the names Gellaneer, ClariXan, and XanTreme. Gellaneer is the brand name for DSM’s gellan gum portfolio. The ClariXan brand name is for its food-grade and personal care-grade xanthan gum offerings. The XanTreme brand name is for its xanthan gum offerings tailored to industrial and oil & gas applications. The new brand identities are given to enhance its brand image among the customers as a part of its efforts to expand its share in the hydrocolloids marketplace. Darling Ingredients Inc acquired Gelnex, a Brazil-based gelatin and collagen manufacturer, in April 2023. With this acquisition, Darling Ingredients is expected to significantly expand the gelatin and collagen portfolio to serve a large set of consumers.