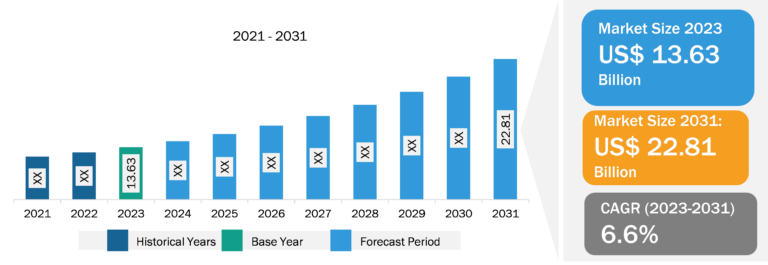

Mining Chemicals Market

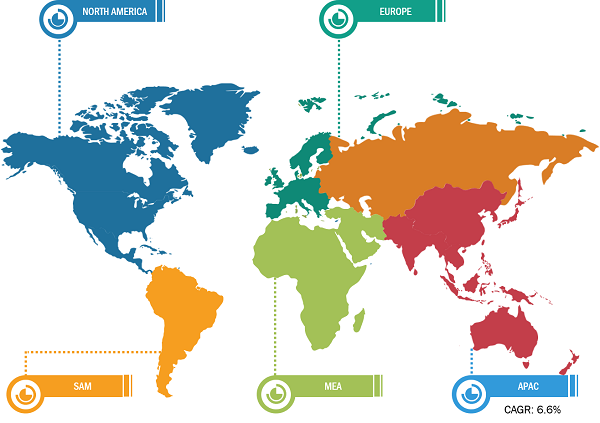

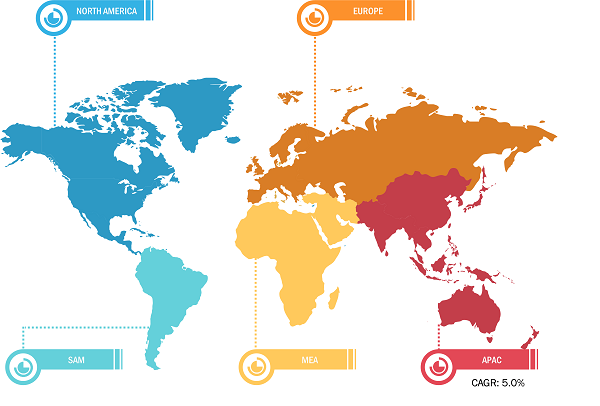

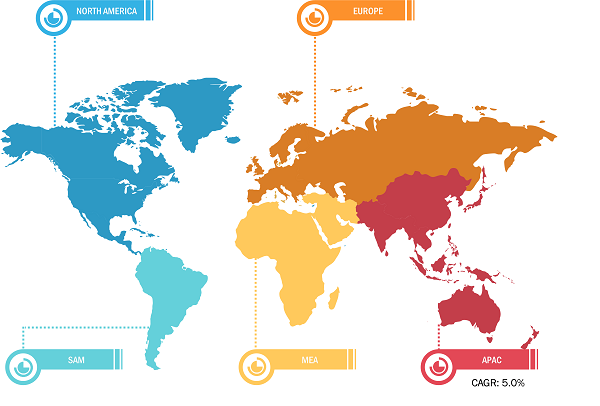

In 2022, Asia Pacific held the largest global mining chemicals market share. Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, and others. As per the World Mining Data 2022 report released by the Federal Ministry Republic of Austria, the mining production rate for minerals in Australia recorded a rise of 142.2% during 2000–2020. As per the International Energy Agency, Chinese companies doubled their investments in critical mineral exploration, especially in lithium projects. According to the National Investment Promotion & Facilitation Agency, the mining industry in India significantly contributes to the country’s economy. India is the second-largest coal producer and ranks fifth among all countries in terms of coal deposits. The mineral production in the country accounted for US$ 1.21 billion from 2022 to 2023. Further, the Government of India announced its plans to increase coal production by 1.3 billion metric tons by 2025 and 1.5 billion metric tons by 2030. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region. Therefore, growth in mining operations bolsters the demand for mining chemicals in Asia Pacific.

Development of Environment-Friendly Mining Chemical Solutions to Become Trend in Mining Chemicals Market During Forecast Period

The development of environment-friendly mining chemicals is a significant step toward sustainable mining practices. Conventional mining chemicals such as cyanide and sulfuric acid have detrimental effects on the environment, including water contamination, soil degradation, and air pollution. Scientists are developing novel bio-based reagents that can be used to extract metals from ores. Researchers are also developing new technologies to recycle and reuse mining chemicals. Some companies are developing methods to extract tailings, which are the waste materials left over from the mining process. The development of ionic liquids and supercritical fluids for extraction of metals from ores is further being researched. Some companies and research organizations are exploring the potential of microbial applications for water treatment in mining operations. In 2022, Rio Tinto, a mining company, supported a research and development project to find biotechnological solutions to recover metals from mine-influenced water. Thus, the development of environment-friendly mining chemical solutions is expected to emerge as a trend in the mining chemicals market in the future.

Mining Chemicals Market: Segmental Overview

Based on mineral type, the mining chemicals market is segmented into base metals, non-metallic minerals, precious metals, and others. The non-metallic minerals segment held the largest share of the market in 2022. Non-metallic mineralsinclude lime, mica, dolomite, coal, gypsum, and others. In coal flotation, collectors and frothers are generally used as chemical reagents. The collector helps enhance the hydrophobic properties of coal. In addition, various water treatment chemicals are used during coal production. The rising demand for various non-metallic minerals drives the growth of the market.

The market, based on application, is segmented into mineral processing, wastewater treatment, and others. The mineral processing segment held the largest share of the mining chemicals market in 2022. Mineral processing uses a vast number of reagents ranging from bulk commodity inorganics to specialty synthetic polymers and extractants. In the mining industry, collectors for mineral flotation, frothers, depressants, dispersants, etc., are used during mineral processing. Many companies operating in the market offer customized solutions for mineral processing. Also, they work in close partnership with their customers to develop unique formulations and tailored solutions for flotation operations.

Impact of COVID-19 Pandemic on Mining Chemicals Market

Before the COVID-19 pandemic, the mining chemicals market was mainly driven by their increasing use in mineral processing, wastewater treatment, and other applications. However, due to the pandemic, governments of various countries across the world imposed country-wide lockdowns that directly impacted the growth of the industrial sector. The shutdown of production facilities hindered the mining chemicals market growth in 2020. The negative impact of the pandemic on the mining industries has reduced the demand for mining chemicals.

Various industries regained momentum with the ease of lockdown measures, which increased the demand for mining chemicals. Further, various economies began reviving with the resumption of operations in different sectors in 2021. The market is growing with increasing demand for different metals and minerals.

Mining Chemicals Market: Competitive Landscape and Key Developments

Orica Ltd, Kemira Oyj, BASF SE, Clariant AG, Dow Inc, AECI Ltd, Nouryon Chemicals Holding BV, Betachem Pty Ltd, Solvay SA, and Arkema SA are among the players operating in the global mining chemicals market. Players operating in the global market focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansion, partnerships, and collaborations to stay competitive in the market.

Key Developments

- In October 2023, BASF SE mining solutions launched two new product brands—Luprofroth and Luproset—to complement its growing flotation portfolio. Luprofroth is for growing frothers, whereas Luproset is for flotation modifiers. These brands aim to communicate the company’s flotation portfolio clearly and consistently, demonstrating its commitment to innovation and becoming a full solution provider for the mining industry.

- In October 2023, BASF SE and the Catholic University of the North partnered to enhance research, development, and innovation in mining, fostering collaboration between academia, students, and industry experts and establishing a technical service laboratory at UCN.

- In November 2022, BASF SE and Moleaer formed a strategic partnership to enhance copper recovery in the mining industry. The partnership will leverage BASF SE’s LixTRA leaching aid and Moleaer’s nanobubble technology, aiming to double global copper demand by 2035.

- In October 2023, Clariant’s Oil and Mining Services opened a state-of-the-art Eagle Ford Technology, Sales & Operations Center in San Antonio, TX, focusing on North American oilfield services.

- In December 2021, Solvay expanded its Mount Pleasant facility in Tennessee due to increasing demand for its ACORGA and ACORGA OPT copper solvent extraction products. The copper market is expected to grow, particularly in the construction, infrastructure, manufacturing, and automotive segments.

- In December 2022, Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL) demerged its fertilizer and mining chemicals business in a move described as a strategic shift from commodity to specialty. The proposed corporate restructuring is expected to help create strong independent business platforms within the larger DFPCL brand umbrella.

- In December 2021, Solvay launched an exclusive digital knowledge hub, the Mining Chemicals Handbook, which provides 24/7 access to relevant mining chemical application information.