Flexible Electronics Market

In today’s fast-paced world, consumer electronics have become integral to everyone’s lives. From smartphones to wearable devices, the demand for smaller and more powerful gadgets continues to rise. As consumer electronics continue to shrink in size, traditional technologies struggle to keep up with the demand for compact and long-lasting power sources. Flexible electronic devices such as flexible displays, flexible batteries, and flexible memories have emerged as a solution to this problem. These flexible electronics can stretch and bend, which makes them more appropriate for use than conventional rigid boards. Also, they are suitable for applications where weight is an important factor because they are usually lighter than their rigid counterparts. In some circumstances, flexible devices are more durable than rigid ones since many flexible materials are strong and resistant to mechanical stress. In addition, flex circuits enable more product design customization because they can be made to fit particular form factors. Hence, due to all the above benefits, the demand for flexible devices is increasing, boosting the flexible electronics market growth.

Furthermore, due to the rising demand for miniaturization, researchers are exploring new materials and designs to enhance energy storage capacity while reducing the size of these batteries, which is raising the demand for flexible thin film and printed batteries with higher energy densities and improved cycle life. The applications of these flexible batteries extend beyond smartphones and wearable devices. They are also utilized in various medical devices for health monitoring, such as heart rate monitors, sleep trackers, and glucose sensors, which are discreet and comfortable for prolonged wear. These energy storage solutions are revolutionizing industries and enabling the development of innovative products that were once unimaginable. Thus, the flexible electronics market trends include the growing miniaturization of electronic devices.

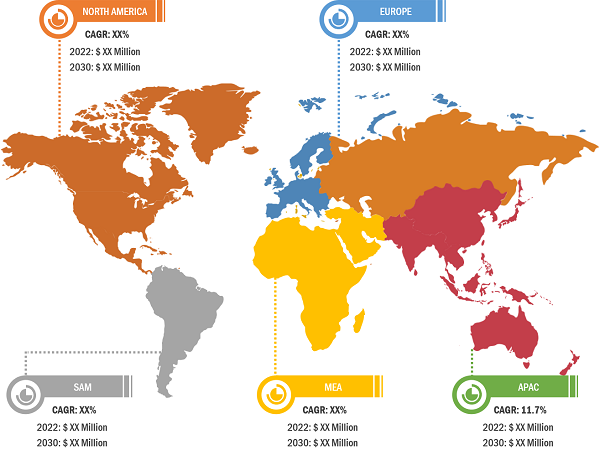

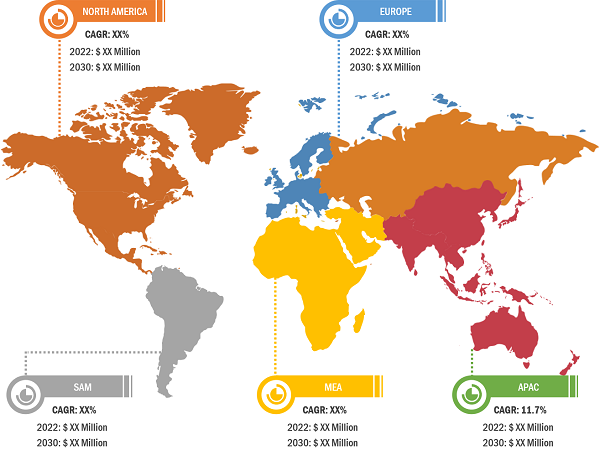

China Holds Largest Flexible Electronics Market Share in Asia Pacific

China is the world’s largest manufacturing hub; it produces ~36% of the world’s electronics, which includes smartphones, computers, cloud servers, and telecom infrastructure. In addition, with approximately one-fifth of the world’s population, China is the second-largest final consumption market after the US for electronic devices. Also, the growing export of tablets, smartphones, drones, and other electronic products is raising the demand for flexible electronic devices such as displays, batteries, sensors, and memories. Furthermore, the country is one of the largest EV manufacturers in the world. The country has a robust manufacturing base for EVs. According to the International Council on Clean Transportation (ICCT) report, the country’s fleet of electric buses is more than 400,000. Also, Shenzhen, China’s industrial city, has fully electrified its fleet. In addition, in the main manufacturing plant of BYD in China, an electric car is assembled every 90 seconds. Also, in February 2022, Volkswagen announced its plan to build 1 million EVs every year in China from 2023. Thus, such growing adoption and production of EVs are expected to fuel the flexible electronics market growth in China during the forecast period.

Flexible Electronics Market Analysis: Segmental Overview

Based on components, the market is categorized into display, battery, sensors, memory, and others. The display segment held the largest flexible electronics market share in 2022, whereas the battery segment is anticipated to record the highest CAGR during 2022–2030. In terms of application, the market is categorized into consumer electronics, automotive, healthcare, industrial, and others. The consumer electronics segment held the largest market share in 2022. However, the automotive segment is anticipated to record a higher CAGR during 2022–2030.

Flexible Electronics Market: Competitive Landscape and Key Developments

Samsung Electronics Co Ltd, LG Electronics, SRI International (PARC), Enfucell Flexible Electronics Ltd, Imprint Energy, Blue Spark Technologies Inc, E Ink Holdings Inc, GENERAL ELECTRIC, AUO Corporation, and MFLEX. a DSBJ Company are among the key players profiled in the flexible electronics market report. Several other major players were also studied and analyzed in the flexible electronics market report to get a holistic view of the market and its ecosystem. The report provides detailed market insights to help major players strategize their growth. As per the company press releases, below are a few recent key developments:

- In June 2023, OKI Electric Cable, the OKI Group’s electric cable company, announced the development of two new types of environment-proof FPC (flexible printed circuit) products capable of use under harsh conditions, including the conditions found in high-temperature and high-pressure steam environments: a heat-proof FPC and a high-pressure steam-proof FPC. These products are capable of being used in 200℃ high-temperature environments and equipment requiring high-pressure steam sterilization.

- In February 2022, imec, a world-leading research and innovation hub in nanoelectronics and digital technologies, KU Leuven, and PragmatIC Semiconductor, a world leader in flexible electronics, present the fastest 8-bit microprocessor in 0.8µm metal-oxide flexible technology capable of running real-time complex assembly code, at the 2022 International Solid-State Circuits Conference (2022 ISSCC). The microprocessor was implemented with a unique digital design flow that allowed the creation of a new standard cell library for metal-oxide thin-film technologies—relevant for designing a broad range of loT applications.

- In June 2021, Royole announced the launch of the Royole RoKit, an open-platform, flexible electronics development kit. RoKit combines flexible display and sensor technologies with programmable hardware into a developer-friendly, all-in-one flexible electronics development kit for product designers and application developers to discover and leverage the power of flexible technologies.

- In May 2021, Samsung showcased its various prototypes, including a double-folding OLED panel at the Display Week 2021. This double-folding OLED panel can be used like a smartphone, and when unfolded, the screen has a maximum size of 7.2 inches. Samsung also showcased a Slidable OLED display that extends horizontally. In addition, Samsung also unveiled a 17-inch foldable panel with a 4:3 aspect ratio when unfolded.