Frozen Potato Market

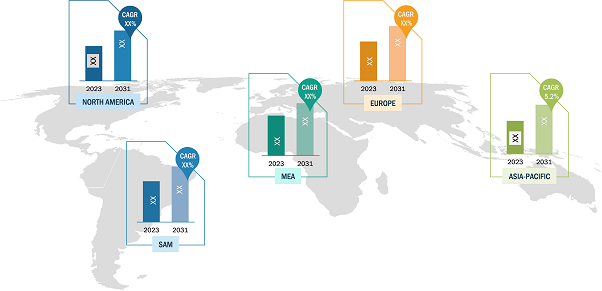

In 2023, North America dominated the frozen potato market. The region is one of the major markets for frozen potatoes due to the presence of a well-established food processing industry, rising trends of takeaway, dine-in, and on-the-go consumption, and string retail as well as the foodservice sector. The demand for frozen potatoes in North America has surged owing to the increasing consumption of convenience food due to a busy lifestyle and hectic work schedule. The high purchasing power of consumers results in rising demand for premium frozen potato products. Further, frozen potatoes, such as French fries, are highly popular among the young population in the US, and this trend offers new opportunities for market growth in the country. Advancements in food processing and supply chain management have helped in the procurement of frozen potatoes across food units. With the surging demand for frozen potatoes, many manufacturers in the food and beverage industry are incorporating frozen potatoes into their food products. This is expected to bolster the growth of the frozen potato market in the region.

There is a surge in the demand for frozen food due to the rising purchasing power and growing consumer preference toward ready-to-eat convenience food items. The preference for ready-to-eat, microwavable, and ready-to-prepare food products is rising significantly as they are highly suitable for on-the-go consumption and require minimal preparation time. The number of dual-income families is rising substantially in developed countries, such as the US, China, Germany, and the UK. People find it hard to manage work as well as household chores due to lack of time. Therefore, they prefer to eat out or consume ready-to-eat products that require minimal preparation and cooking efforts. In addition, the number of single or two-person households are growing in various developed nations such as the US, Canada, and some European countries such as the UK and Germany. According to the 2020 Current Population Survey, there were 36.1 million single-person households in the US, accounting for 28% of all households. As a result of the growing number of one or two-person families, the demand for ready-to-eat, portion-controlled foods has risen. The rising consumption of convenience food is driving the demand for frozen potato products. Frozen potato satisfies this need of consumers and is readily available in retail outlets or stores as well as various fast-food chains, hotels, and quick-service restaurants. Foods such as French fries and wedges are becoming increasingly popular globally, particularly among children and youth, which is catalyzing the frozen potato market growth.

Increasing Demand from Asia Pacific to Provide Lucrative Opportunities to Frozen Potato Market Players

Emerging economies in Asia Pacific are contributing to the growth of the frozen potato market and are providing a huge growth opportunity. China and India are one of the leading markets in the region. Many food companies and food service outlets have expanded their selling and distribution of frozen hash browns, French fries, wedges, and many more frozen potato products in the region. The rise in the quick service restaurants and food service outlets in Asia Pacific has been one of the major opportunities for the frozen potato market to grow in the region. The lifestyle of consumers in Asia Pacific countries is changing, and people are moving to a busy and hectic lifestyle. There has been an increase in the per capita disposable income, employment of women, and a shift from rural to urban areas, which, in turn, has led to an increase in the demand for convenient and ready-to-eat food. Another factor is the rise in the purchasing power of consumers in the lower and middle-level countries of Asia Pacific.

Frozen Potato Market: Segmental Overview

Based on end use, the frozen potato market is segmented into residential and commercial. There has been a significant increase in the consumption of frozen potato products across the residential sector. Frozen potatoes are considered a convenient food and are used in the household sector due to less preparation time and ease of cooking. Factors such as changing lifestyles and increasing population of working women globally have triggered the consumption of ready-to-cook foods such as frozen potato products. Benefits apart from easier preparation methods, higher shelf life has also boosted the demand for frozen potato products among household consumers. Further, the widescale availability of frozen potato products in supermarkets and hypermarkets, along with the popularity of online retail, will further enhance the frozen potato product sales among residential end users. High per capita consumption of frozen potato products in the US and European countries will further boost the frozen potato demand among the residential end users, thereby driving the frozen potato market growth.

Frozen Potato Market: Competitive Landscape

Bart’s Potato Company, Aviko B.V., Agristo NV, Lamb Weston Holdings Inc, Mccain, Farm Frites International B.V., Greenyard, Himalaya Food International Ltd, J.R. Simplot Company, and The Kraft Heinz Co., Agrarfrost GmbH & Co KG, Rairandev Golden Fries Pty Ltd, Albert Bartlett & Sons (Airdrie) Ltd, Godrej Agrovet Ltd, Kipco Damaco NV, are among the key players operating in the global frozen potato market. These players adopt merger & acquisition, collaboration, and partnership strategies to expand their footprints across various geographies and cater to a larger customer base. In 2022, Lamb Weston Holdings, Inc. entered into an agreement to purchase the remaining equity interests in its European joint venture Meijer Frozen Foods. The key players in the market also launch innovative products to attract a large number of consumers. For instance, in 2019, Lamb Weston Holdings, Inc introduced waffled hash browns.