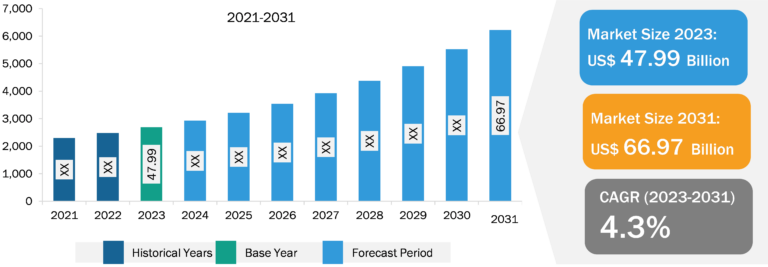

Tonic Water Market

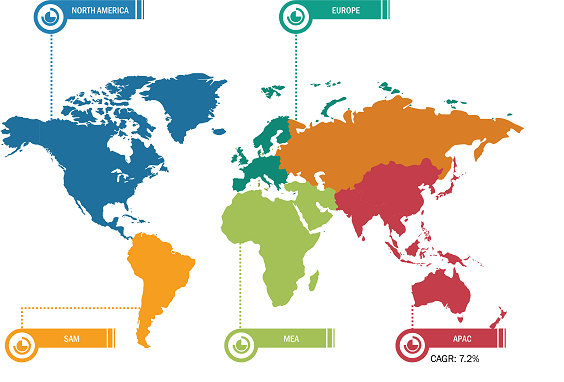

In 2023, Europe held the largest share of the tonic water market. Gin is among the most popular spirits with a rich history in European countries, and it is often paired harmoniously with tonic water. Germany, the UK, Spain, France, and Belgium are among the most gin-consuming countries in Europe. The demand for tonic water in this region can be attributed to the increasing consumption of gin, and surging preference for premium and artisanal products. Further, the increasing popularity of gin and tonic as a versatile and trendy cocktail choice has spurred the demand for tonic water in the region. The expansion of the hospitality industry, and the emergence of new dining and drinking establishments have further propelled the demand for tonic water in the region.

Changing consumer preferences and tastes have been driving the demand for gin across the world. With people exploring and indulging in the diverse flavors of gin, the requirement for complementary mixers to enhance their drinking experience also surges. Tonic water, with its bitter yet refreshing taste, serves as a perfect companion to gin. Thus, a rise in gin’s popularity has led to a corresponding increase in the consumption of tonic water. Further, craft gin is gaining significant popularity across the world. As gin enthusiasts become more discerning of the flavor profiles of their spirits, they seek high-quality mixers to elevate their cocktails. Artisanal and small-batch brands have started focusing on catering to the demand for premium tonic water, offering a wide range of botanical-infused and flavored tonic water that complements the nuanced characteristics of craft gin. Moreover, consumers are willing to pay premium prices for superior products that enhance their drinking experience.

Proliferation of E-Commerce to Create Opportunities for Tonic Water Market

With the increasing popularity of online shopping, particularly in the food & beverages sector, tonic water brands can leverage e-commerce platforms to expand their market presence and reach an extended consumer base. By establishing the online presence, these brands can directly connect with consumers, offering a seamless shopping experience along with convenient delivery options, which is especially appealing to busy urban residents. The launch of a dedicated online platform specifically offering alcoholic beverages and mixers creates growth opportunities for the tonic water market players. In July 2022, A1 Cuisines, a company that owns and manufactures the Malaki brand of tonic water, announced the launch of BeverageCart, India’s first mobile app-based beverage platform. The app aims to aid the smooth delivery of beverages to retailers, hotels, restaurants, and caterers, thereby fulfilling wholesale online orders. Such platforms provide a curated selection of premium tonic water brands, offering consumers a one-stop shop for their cocktail needs.

Tonic Water Market: Segmental Overview

Based on type, the tonic water market is divided into plain and flavored. The flavored segment held a larger share of the market in 2023. Flavored tonic water consists of carbonated water, sugar/sweetener, quinine, and different flavoring ingredients such as extracts of elderflower, citrus peels, herbs, berries, lemongrass, and hibiscus that enhance the flavor and aroma of tonic water. Consumers prefer premium flavored tonic water in their drinks. They are also willing to pay higher prices for such products to experiment with newer varieties of gins and cocktails. Therefore, manufacturers develop new flavored tonic water varieties that meet the changing taste preferences of consumers..

The tonic water market, based on category, is segmented into low/no sugar and regular. The regular segment held a larger share of the market in 2023. Regular tonic water contains sugar as a sweetener and thus exhibits a higher calorific value. As regular tonic waters are affordable and readily available across supermarket shelves and local retail stores, the off-trade demand for regular tonic water is considerably higher. However, consumers are highly concerned about the high sugar content in their drinks, and they prefer substituting regular tonic water with low-calorie tonic water. This factor can significantly hinder the growth of the market for the regular segment in the coming years.

The tonic water market, based on end use, is segmented into on-trade and off-trade. The off-trade segment held a larger share of the market in 2023. Off-trade refers to sell of drinks and beverages through retail channels such as supermarkets and hypermarkets, wine stores, liquor stores, and online liquor shops. The off-trade demand for tonic water surges significantly with the rise in DIY (i.e., do-it-yourself) cocktail culture. Also, the increasing trend of house parties drives off-trade tonic water sales. The booming e-commerce industry further propels the demand for tonic water through online stores such as Walmart.com, Amazon.com, and quick-commerce platforms. Tonic water manufacturers are also focusing on developing direct-to-consumer (D2C) platforms that ensure product authenticity and help them save additional costs incurred across the value chain.

Tonic Water Market: Competitive Landscape and Key Developments

The Coca-Cola Co, Fevertree Drinks Plc, Three Cents Co, Thomas Henry GmbH, Q Tonic LLC, East Imperial Beverage Corp, Fentimans Ltd, Britvic Plc, Bickford & Sons Ltd, and White Rock Beverages Ltd are among the prominent players profiled in the tonic water market report. These market players focus on providing high-quality products to fulfill customer demand. They are also adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations to maintain a competitive edge in the market.