Scleral Lens Market

Scleral lenses are a category of contact lens which designed to cover the cornea and the eye’s sclera. These lenses are generally larger in comparison to traditional contact lenses. Due to this large size, scleral lenses provide a stable and comfortable fit for those with corneal irregularities or those who suffer from diseases that cause dry eye syndrome. Scleral lenses are rigid gas-permeable (RGP) lenses. Scleral lenses are moderately firmer than soft contact lenses and have the same benefits that RGP lenses commonly have over soft lenses. They are more durable, easier to handle, provide crisper vision, and have less risk of complications.

Report Segmentation and Scope:

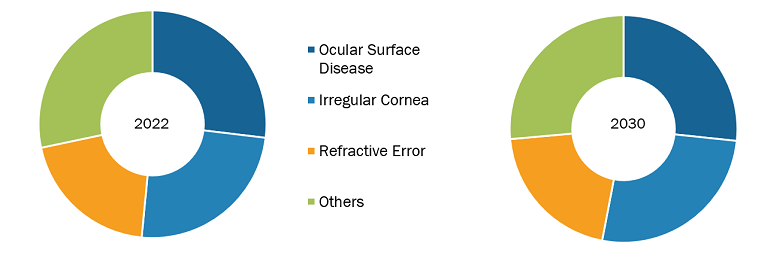

The “global scleral lens market” is segmented based on type, application, and end user. Based on product, the market is segmented into corneo-scleral and semi-scleral lenses, mini-scleral lenses, and large scleral lenses. The market is segmented by application into ocular surface disease, irregular cornea, refractive error, and others. By end user, the market is segmented into hospitals, eye clinics, and others.

Eye care practitioners are prescribing scleral lenses (SL) with advanced LZ designs to be the global scleral lens market trend.

The increasing prescription of scleral lenses (SLs) with advanced LZ designs is anticipated to be a trend in the global scleral lens market. Eye care practitioners increasingly prescribe scleral lenses (SLs) with advanced landing zone (LZ) designs. The Scleral Lenses in Current Ophthalmic Practice Evaluation study team designed an online survey for eye specialists attending a specialty contact lens meeting. The survey was conducted from November 8, 2019, to March 31, 2020. Demographic data and information on lens diameters, LZ designs, components of routine SL evaluation, and recommended care products were collected. According to the survey results, 715 participants responded to at least one survey component of interest. Most lenses prescribed (63%) were 16 mm or more in diameter. Lenses with toric LZs were the most repeatedly prescribed (48%), followed by spherical (40%), quadrant-specific (8%), and image-based or impression-based designs (3%). Most participants (61%) recommended hydrogen peroxide products for lens care. Nonpreserved saline in a single-use vial was frequently recommended to fill the lens bowl before application. Intraocular pressure was measured during SL evaluation by 45% of participants; 38% of participants routinely measured corneal thickness.

Most eye specialists recommend single-use vials of nonpreserved saline and hydrogen peroxide-based disinfection systems for application and lens care. As per the report, with differences in components of routine SL evaluations, clinicians may benefit from reaching a consensus on crucial components of SL evaluation.

Rising Incidence of Dry Eye Driving Scleral Lens Market

The incidence of dry eye is rising among the population, especially in developed nations. Dry eye is caused by multiple factors that result in discomfort, irritation, and visual disturbance. For instance, in April 2020, according to a study “National Health and Wellness Survey” conducted in the US, ~16.4 million people were diagnosed with dry eye. The data also stated that the prevalence has increased by 2.7% among people aged 18−34. Additionally, the prevalence was 18.6% among older people. Based on sex, the prevalence percentage was higher in women (8.8%) than in men (4.5%).

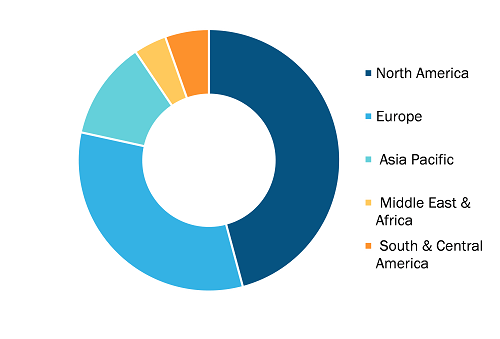

The incidence of dry eye is the highest among the European and Asia Pacific populations. The Middle East & Africa also have an increasing prevalence of dry eye due to chronic health conditions and environmental conditions. According to an article published in 2019 by the Department of Research, King Khaled Eye Specialist Hospital, Riyadh, Saudi Arabia, the incidence of dry eye is high among women. The primary cause of dry eye is the medication for glaucoma.

Scleral lenses are designed to vault over the cornea and gently rest on the sclera. Scleral lenses create a dome-shaped reservoir of fluid between the lens and cornea. This tear-filled chamber can provide a barrier that functions as a protective layer for the eye to help keep the eyes hydrated and prevent dryness-related damage.

Scleral lenses are manufactured from a gas-permeable material that enables oxygen to flow freely to the eye, which is important for keeping eyes healthy and comfortable. Scleral lenses can also be part of dry eye treatment. Patients can use them with artificial tears or optometrist-recommended solutions such as intense pulsed light (IPL) treatment to unblock meibomian glands. Thus, the increasing prevalence of dry eye is expected to drive the scleral lens market.

Scleral Lens Market: Competitive Landscape and Key Developments

Art Optical Contact Lens Inc., Euclid Systems, Bausch & Lomb, Cooper Vision, Acculens, Solotica, ABB Optical Group, EssilorLuxottica, Optact International Ltd., and Valley Contax Inc. are among the leading companies operating in the scleral lens market. These companies opt for product innovation strategies to meet growing customer demands, which allows them to maintain their brand name in the scleral lens market.

A few recent developments in the global scleral lens market are mentioned below.

- In October 2023, Alcon launched TOTAL30 Multifocal globally. Alcon’s TOTAL30 Multifocal lenses are specially positioned in the market, presenting Alcon’s premium Water Gradient innovation at a more accessible price point than monthly lenses. The lenses have begun to roll out in the United States and select international markets.

- In February 2023, Visionary Optics launched Europa Tangent, a new scleral lens that provides a three-zone step system for optimal fitting and customizable design. According to the company, the new lens enables eye care providers to adjust parameters in the limbal, central, and landing zones without affecting other fit factors.

- In November 2022, Carter Ledyard’s client CooperVision, Inc. acquired SynergEyes, Inc. SynergEyes offers a wide range of specialty contact lenses that include proprietary hybrid lenses, complementing Onefit scleral lenses of CooperVision. The acquisition extends CooperVision’s extensive product and service range to create a complete portfolio for treating irregular cornea and keratoconus.

- In June 2022, CooperVision announced the acquisition of EnsEyes, a supplier of orthokeratology and scleral contact lenses. The acquisition of EnsEyes will help CooperVision accelerate the growth of specialty lens adoption across the Nordic markets.

- In January 2022, SynergEyes, Inc., a leading specialty contact lens technology company, launched three innovative products for the SynergEyes VS scleral lens: SynergEyes VS Multifocal, Aberration Control, and Limbal Clearance Factor options.

- In August 2022, CooperVision Specialty Eye Care launched Beyond the Limbus (BTL), a new series of workshops focused on scleral lens consultation, fitting, and practice management. The BTL dual-tracked series offers intermediate-to-advanced training to step up the scleral lens game and basic training for support staff and eye care professionals (ECPs) not exposed to scleral contact lenses. The workshops are available to ECPs in the US and Canada, aiming to enhance ECP confidence with the Onefit family of scleral contact lenses.

- In June 2022, Euclid Vision Corp., specializing in advanced myopia and orthokeratology management, acquired Visionary Optics, the pioneer of scleral contact lenses. The companies will maintain their brands in the union. They will collaborate on future projects highlighting core professional education missions, partnerships with eye care professionals, and product innovation. This union opens exciting opportunities for innovation and cross-company collaboration.