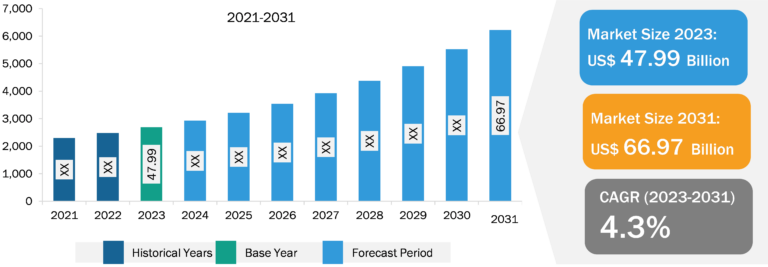

Helicopter Emergency Medical Services Market

The helicopter emergency medical services market is moderately fragmented, with the presence of a large number of players operating across different regions. The need for air ambulance services is mainly driven by higher demand during emergency medical cases, where patients are required to be transferred to another suitable location for their medical treatment. Various authorities across different regions have been taking initiatives to establish an air ambulance infrastructure across their respective locations.

Several state governments across different countries have also been investing heavily in the construction of new helipads or runways to provide a better service for emergency medical needs. For instance, in July 2023, the state government of Maharashtra, India, announced its plans to establish 16 new helipads specifically for air ambulances on the Mumbai-Nagpur Samruddhi Expressway. In April 2023, RED Health (a Hyderabad-based startup) introduced air ambulance services for more than 550 cities across India. In May 2021, the US-based helicopter transport services provider Blade’s Indian subsidiary launched its air ambulance services due to an increase in demand caused by the COVID-19 pandemic. The COVID-19 pandemic also boosted the demand for air ambulance services across different regions due to the rise in the number of medical transportation emergencies. This further pushed new companies to come forward and contribute to the betterment of medical ecosystems across different countries. Several new companies in the air ambulance market have received good recognition in terms of the support they have provided during the COVID-19 emergencies. Currently, the majority of such companies have started to provide air ambulance services for non-COVID emergency cases, which is driving the growth of the air ambulance market across different regions.

Geographically, the scope of the helicopter emergency medical services market report is primarily divided into North America (the US, Canada, and Mexico), Europe (Russia, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), and Rest of the World (Middle East & Africa and South America). In terms of revenue, North America, Europe, and Asia Pacific are leading regions, followed by the Middle East & Africa and South America. The US, China, France, the UK, and Brazil are among the major countries contributing to the helicopter emergency medical services market growth.

Global Medical Response, Inc.; Air Methods; Tohoku Air Service, Inc., Babcock International Group Plc; Heliservice International GmbH; PHI Air Medical; CareFlight; Helijet International Inc.; STARS; and Ornge are among the major helicopter emergency medical service providers. The companies are focusing on helicopter emergency medical services to cater to the requirements of hospitals and other care centers for helping patients in need of emergency medical support. The majority of the companies have been focusing on improving their medical service offerings to remain competitive in the market. For instance, in 2024, Air Evac Lifeteam, a subsidiary of Global Medical Response, inaugurated an emergency air medical transport base in Texas. The base has Bell 407 GXI aircraft to respond to time-critical emergency missions in South Texas. In 2024, Ambulance Victoria extended its contract with Babcock to continue providing air ambulance operations in Victoria, Australia. AirMed International is a leading air ambulance and air medical transport service provider. The company strategizes its business policy to deliver a convenient medical transport experience globally. Neonatal services, critical care air ambulance services, diabetes mellitus air medical services, bariatric patient services, and geriatric patient services are among the major service offerings that fall under the helicopter emergency medical services scope.

Rising Prevalence of Chronic Diseases Steering Market Growth

The growing occurrence of chronic diseases among the geriatric population, women of reproductive age, and children is driving the demand for proper healthcare facilities that consist of helicopter emergency medical services for transportation to hospitals or immediate medical support. Care centers and rehabilitation centers are offering chronic disease management services. In chronic care management services, patients can select premium facilities such as helicopter ambulance services to reduce travel time to hospitals. In addition, with the help of emergency helicopter medical services, patients also get immediate medical support, which increases the chances of lifesaving. Helicopters used for medical services are sometimes equipped with basic to advanced medical support systems or devices, and they bring doctors or caregivers to the patient who needs immediate attention.

As per the survey conducted by the Institute for Health Metrics and Evaluation, the global diabetes prevalence rate was ~6.1% in 2023, making diabetes one of the major causes of disability and death. At the regional level, the highest rate was ~9.3% in the Middle East and North Africa, and that number is projected to increase to ~16.8% by 2050. The rate in the Caribbean and Latin America is anticipated to increase to ~11.3% by 2050. Approximately 17.9 million people deceased from cardiovascular diseases in 2019, representing ~32% of all global mortalities. Out of these deaths, ~85% were due to stroke and heart attack, as per a study presented by the World Health Organization. There has been a growth in heart attack casualties over the past few years.

Helicopter Emergency Medical Services Market Analysis: Helicopter Type Overview

Based on helicopter type, the global helicopter emergency medical services market is divided into light helicopter and medium & heavy helicopter. Among these, the light helicopter segment accounted for a larger market share in 2023. The demand for light helicopters has recently witnessed growth in the medical service sector. For instance, in February 2024, HealthNet Aeromedical Services announced the expansion of its all-Airbus fleet by adding four H135 helicopters. The helicopters are anticipated to be used to serve patients across the state of West Virginia. In addition, in February 2024, DRF Luftrettung and Airbus Helicopters announced orders for up to 10 H145 helicopters. The deal is a part of DRF Luftrettung’s strategies to improve emergency medical services continuously. In 2024, India is anticipated to launch its first Helicopter Emergency Medical Service (HEMS) in Uttarakhand. The HEMS will be stationed at AIIMS in Rishikesh and will airlift accident victims within a 150 km radius of the medical facility. In March 2023, WellSpan Health launched its air medical service in Lancaster County with the procurement of a single-engine light helicopter from Air Methods. In addition, in March 2023, Norwegian Air Ambulance expanded its Airbus H145 helicopter fleet. These helicopters are one of the top-selling light twin-engine helicopters. The procurement of light helicopters for medical services by private hospitals and government agencies is anticipated to boost the growth of the helicopter emergency medical services market over the forecast period.

Helicopter Emergency Medical Services Market Analysis: Application Overview

Based on application, the global helicopter emergency medical services market is divided into medical aid and transportation. Among these, the transportation segment is growing at a rapid pace owing to the increasing adoption of air ambulance services to offer critical care for patients. The rising demand for commercial helicopters for transportation purposes is anticipated to propel the growth of the helicopter emergency medical services market over the forecast period. Helicopter emergency medical services increase the probability of survival for highly injured patients. For instance, in 2023, UNM Hospital initiated the construction of a new helipad on the critical care tower with the purpose of improving lifesaving services across New Mexico, Arizona, and Colorado. Similarly, in 2023, Penn State Health Life Lion Critical Care Transport procured a new helicopter for its lifesaving fleet and launched a critical care transport base on the Penn State Health Lancaster Medical Center campus. Thus, the rise in initiatives by hospitals to procure helicopters to transport patients to care centers is projected to boost the growth of the helicopter emergency medical services market for the transportation segment in the coming years.

Helicopter Emergency Medical Services Market Analysis: End Use Overview

Based on end use, the helicopter emergency medical services market is segmented into commercial and government and emergency response. Private hospitals are taking several initiatives to procure commercial helicopters to transport patients to care centers on time. In addition, the growing focus of governments on establishing emergency helicopter services for better management of casualties in war zones and remote locations is acting as the major driver for the market.

Helicopter Emergency Medical Services Market: Competitive Landscape and Key Developments

Global Medical Response, Inc.; Air Methods; Tohoku Air Service, Inc., Babcock International Group Plc; Heliservice International GmbH; PHI Air Medical; CareFlight; Helijet International Inc.; STARS; and Ornge are among the key players profiled in the helicopter emergency medical services market report. In addition, several other important market participants have been studied and analyzed during the study to get a holistic view of the helicopter emergency medical services market and its ecosystem. New product innovations, joint ventures for product innovation, and geographical expansion are among the key business strategies followed by the market players. As per company press releases, below are a few recent key developments:

Year News Country

March 2024 Global Medical Response, Inc.’s Air Evac Lifeteam (Air Evac) team announced a new emergency air medical service transportation basement in Texas. The base consists of a Bell 407 GXI helicopter and trained staff with Air Evac pilots, flight nurses, and flight paramedic crew members made available in Uvalde, South Texas. The company has a highly trained and experienced crew to respond to time-critical emergency requests in South Texas, US. North America

February 2024 Saudia Technic (née Saudia Aerospace Engineering Industries), one of Saudi Arabia’s leading aerospace companies, partnered with United Rotorcraft to launch one of the region’s most comprehensive Part 145 helicopter MROs. Both the two companies held a formal signing ceremony at Heli-Expo 2024. MEA