Endoscopy Device Market

Endoscopy is a minimally invasive surgical procedure employed to visualize internal organs of the human body; it is also used in operations performed on various organs. The procedure is performed with the help of a small flexible tube known as an endoscope. This tube is attached to a camera, enabling a clear view of the organ to be observed. Based on the area to be examined, various types of scopes are available; a few of these are arthroscopes, bronchoscopes, laparoscopes, and hysteroscopes. Various other devices and instruments are used in an endoscopy procedure for better visualization, sterilization, and enhanced-quality imaging.

Report Segmentation and Scope:

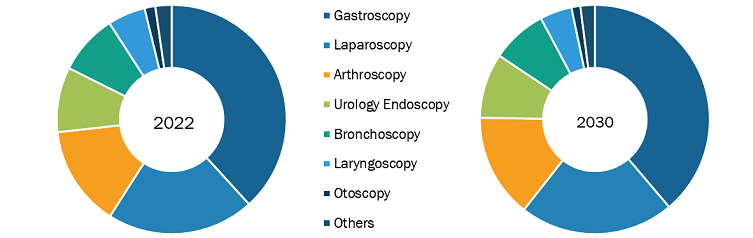

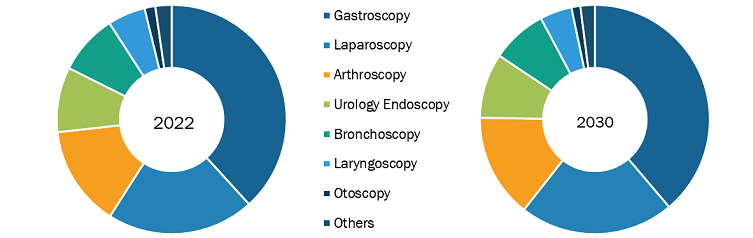

The “global endoscopy device market” is segmented on the basis of product, application, and end user. Based on product, the market is segmented into endoscopes, visualization systems, accessories, and other endoscopy devices. The market for the endoscopes segment is further subsegmented into flexible endoscopes, rigid endoscopes, robot-assisted endoscopes, and capsule endoscopes. Visualization systems segment is subsegmented as wireless displays and monitors, light sources, video processors, endoscopic cameras, video recorders, video converters, carts, transmitters and receivers, camera heads, and other instruments. The endoscopy device market for the other endoscopy devices segment is further segmented as electronic instruments and mechanical instruments. The market for the accessories segment is subsegmented into cleaning brushes, overtubes, surgical dissectors, light cables, fluid flushing devices, needle holders/needle forceps, mouthpieces, biopsy valves, and others. By application, the endoscopy device market is segmented into gastroscopy, laparoscopy, arthroscopy, otoscopy, urology endoscopy, bronchoscopy, laryngoscopy, and other applications. The market, based on end user, is segmented into hospitals, ambulatory surgical centers, and others.

Use of Artificial Intelligence to Be Upcoming Trend in Endoscopy Device Market

The application of artificial intelligence (AI) in gastrointestinal (GI) endoscopy is drawing huge attention owing to its potential to improve the quality of endoscopy at all levels, alongside reducing or nullifying human errors and bringing higher accuracy, consistency, and speed. AI has the advantage of ruling out or limiting inter-operator variability. It can compensate for the limited experience of beginner endoscopists and the errors of the most experienced endoscopists. In November 2019, AI Medical Service Inc., one of the early developers of real-time AI-enabled endoscopy devices, secured Breakthrough Device Designation from the US FDA for its AI programs that analyze endoscopy images for potential diagnosis of gastric cancer.

Over the past four decades, the incidence of esophageal adenocarcinoma (EAC) has risen rapidly due to the increasing prevalence of overweight. AI assistance shows promising results in terms of improving the detection and diagnosis of esophageal adenocarcinoma (EAC), thus reducing the mortality and morbidity associated with a poor prognosis after the diagnosis of this malignancy at an advanced stage.

Recently, a few AI-driven endoscopy products have been approved for their usage worldwide. For instance, Ibex Medical Analytics developed the world’s first AI platform to diagnose cancer. Its AI algorithms analyze the images of biopsies, followed by locating them and grading the tumor. These results help pathologists diagnose gastric cancer accurately. In June 2021, the US FDA granted Breakthrough Device Designation to Ibex’s Galen platform, which expedited the clinical review and regulatory approval of this platform. Galen Gastric is an integrated diagnostics and quality control solution that supports pathologists in the detection of gastric cancer, dysplasia, H. pylori infection, and other important clinical findings. In April 2021, Medtronic plc won a de novo clearance from the FDA for the GI Genius intelligent endoscopy module. GI Genius is a computer-aided detection (CADe) system that uses AI to highlight regions of the colon suspected to have visual attributes indicative of different types of mucosal abnormalities.

As AI continues to evolve, it holds promise for enhancing diagnostic precision, procedural efficiency, and patient-centered care with the help of endoscopy systems. Hence, the use of AI in gastroenterology is likely to emerge as a new trend in the global endoscopy device market in the near future.

Increasing Prevalence of Cancer Bolsters Endoscopy Device Market

An increase in the prevalence of cancer plays a significant role in driving the demand for endoscopy devices. These devices are used as vital tools for diagnosis (such as biopsy), treatment, and monitoring during cancer treatments. Endoscopy procedures enable the early detection and diagnosis of various types of cancers, including esophageal, pancreatic, colorectal, and stomach cancer. Through the use of endoscopes and imaging technologies, healthcare providers can visualize the internal structures of organs to identify abnormalities, lesions, and early-stage tumors, thereby facilitating timely intervention and improved treatment outcomes.

According to Globocan 2020, a total of 19.29 million cancer cases were reported in the world in 2020, and the number is expected to reach 30.23 million by 2040. In 2019, the World Health Organization (WHO) mentioned cancer as the first leading cause of death in people of age less than 70 years in 183 countries. Furthermore, it was ranked fourth among the leading causes of mortality in the population of all age groups in 123 countries worldwide. As per the data published by the WHO in March 2021, different cancer types caused ~10 million deaths in 2020.

Most Prevalent Forms of Cancers in the World, 2020

| Cancer | Case Count (Million) |

| Lung Cancer | 2.21 |

| Breast Cancer | 2.26 |

| Colorectal Cancer | 1.93 |

| Prostate Cancer | 1.41 |

| Skin Cancer | 1.20 |

| Stomach Cancer | 1.09 |

Source: World Health Organization and the Insight Partners Analysis

As the burden of cancer continues to rise across the world, the adoption of endoscopy in cancer diagnostics and care becomes increasingly vital. Thus, the ongoing developments in endoscopic techniques are aimed at addressing the complexities that influence cancer intervention. Thus, the rising prevalence of cancer fuels the adoption of endoscopy devices globally.

Endoscopy Device Market: Competitive Landscape and Key Developments

Boston Scientific Corp, Medtronic Plc, Stryker Corp, Johnson & Johnson, Karl Storz SE & Co KG, Olympus Corp, Ambu AS, Conmed Corp, B Braun SE, and PENTAX Medical are among the leading companies in the endoscopy device market. These companies opt for product innovation strategies to meet growing customer demands, which allows them to maintain their brand name in the endoscopy device market.

A few of the recent developments in the global endoscopy device market are mentioned below.

1. In February 2023, Boston Scientific Corp announced that the FDA has approved its LithoVue Elite Single-Use Digital Flexible Ureteroscope System. It is the first ureteroscope system can monitor intrarenal pressure in real-time during ureteroscopy procedures. The LithoVue Elite Single-Use Digital Flexible Ureteroscope System comprises of StoneSmart Connect Console that has upgraded the device to offer upgraded image quality, control features, and streamlined integration.

2. In September 2023, Ambu expanded its gastroenterology portfolio with the announcement of the Ambu aScope Gastro Large and Ambu aBox 2, two new larger-sized gastroscopy solutions that will be available in Europe. In addition to being the first gastroscope in the world with a 4.2 mm operating channel, which enables gastroenterologists to achieve strong suction performance during procedures in the ICU and endoscopy unit, the Ambu aScope Gastro Large is also the first endoscope ever manufactured of bioplastic materials.

3. In September 2022, Medtronic plc announced that the US Food and Drug Administration has approved the Nexpowder endoscopic hemostasis system. The hemostasis system is supplied worldwide by Medtronic and is separately developed by NEXTBIOMEDICAL CO., LTD (Korea). Using a catheter with patented powder-coating technology, a noncontact, nonthermal, and nontraumatic hemostatic powder is sprayed to operate the Nexpowder system

4. In September 2023, Stryker Corp announced the launch of the 1788 platform, which is the next generation of minimally invasive surgical cameras. The camera platform is enhanced with upgraded technology to be used in advanced surgery across multiple specialties. The camera provides a vibrant image with balanced lighting that improves visualization of blood flow and critical anatomy and can visualize multiple optical imaging agents.