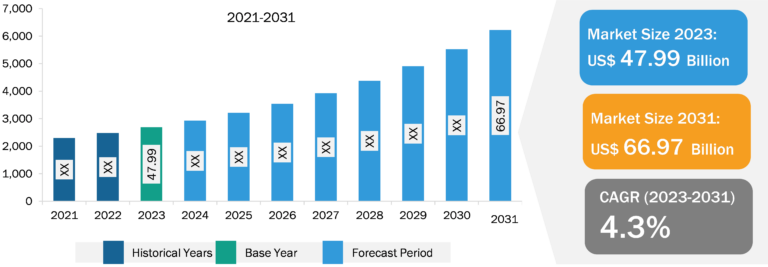

High-Speed Engine Market

Aging Commercial Fleet To Create Lucrative Opportunities for Market Growth During Forecast Period

In almost all countries, the majority of the commercial ship fleet has aged. As per the data published by the United Nations in 2023, the average age of the ships globally was 22.2 years, and more than half of the ships are older than 15 years. In addition, as per the data provided by the US Bureau of Transportation in 2021, there were approximately 27,000 vessels in the US that are more than 15 years old. Further, as per the data provided by the Braemer in 2023, approximately 1.8% and 1.5% of the total ships worldwide are projected to retire by 2024 and 2025, respectively. As the fleet is aging rapidly, the demand for new ships is projected to increase to replace the aged and retired ships, which is expected to increase the demand for high-speed engines. According to the data published by The Baltic and International Maritime Council (BIMCO) in January 2024, 478 container ships are already scheduled for delivery in 2024 with a combined capacity of 3.0 million TEU. Thus, with the aging of the commercial fleet, the need for replacing the commercial fleet will increase, which is anticipated to create lucrative opportunities for the high-speed engine market growth during the forecast period.

Raw material suppliers, component manufacturers, and end users are among the major stakeholders in the high-speed engine market ecosystem. A wide range of raw materials is required in the manufacturing of a high-speed engine, which results in a large number of raw material suppliers competing with each other. A few of the prominent raw materials that are required in the manufacturing of high-speed engines are iron, aluminum, and steel. Prominent raw material manufacturers include Rio Tinto, Vale, BHP Group, All Metal Services Ltd., Gould Alloys Ltd., and Progressive Alloys Ltd, among others. Component manufacturers hold a potential share of the high-speed engine supply chain. The manufacturers procure raw materials from the preferred suppliers through direct or indirect sales channels to produce high-speed engines. They also ensure that their products comply with domestic and international regulatory standards. Key high-speed engine manufacturers include AB Volvo; Caterpillar Inc.; Cummins Inc.; MAN Energy Solutions SE; Mitsubishi Heavy Industries Ltd; Rolls-Royce Holdings Plc; Weichai Heavy Machinery Co., Ltd.; Yanmar Holdings Co., Ltd.; and Doosan Infracore Co Ltd.

End users are the final category of stakeholders contributing to the high-speed engine market value. Gas processing facilities, power generation, and marine are the major end users of high-speed engines. In addition, the railway sector is also one of the notable end users of these systems.

High-Speed Engine Market: Regional Overview

North America is the second-largest contributor to the global high-speed engine market, followed by Europe. This is owing to the rise in demand for high-speed engines from marine, power generation, and oil and gas applications in the region. The US accounts for the majority of the share in the North America high-speed engine market. As the US is one of the top developed economies across the globe, the demand for energy is more compared to other countries in North America. According to the data published by the US government in 2022, the energy demand increased by 2.5% from 2021. However, in the coming years, the demand is anticipated to increase by 4.7%, owing to the expansion of the manufacturing industry and a surge in the number of data centers across the country. Moreover, trading activities in Canada are growing significantly; for instance, as per the data published by the Government of Canada in 2023, cargo volume carried through the Port of Vancouver increased by 6% in 2023, with terminal operators and supply chain partners handling a record 150.4 million metric ton (MMT) of commerce. The rise in such trading activities has fueled the need for vessels in the country. This increased demand for vessels is directly affecting the requirement for high-speed engines for power generation applications in cargo vessels.

The high-speed engine industry in the US is mainly driven by marine transportation. As per the data published by the US Bureau of Transportation in May 2021, waterborne shipping in the US transported more tonnage (~1.5 billion short ton, valued at more than US$ 1.5 trillion) of trade goods than any other method of transportation in 2020. The maritime sector dominated both imports and exports. The majority of US imports are high-value, lightweight cargo sent in cargo containers, whereas low-value, heavy cargo shipped in bulk makes up a large portion of exports. These statistics show a high dependency on marine transportation in the logistics & transportation sector across the US. Thus, the need for cargo vessels has increased in the country. In February 2023, American Commercial Barge Line (ACBL), a notable maritime transportation service provider, placed an order for two vessels: an EPA Tier 4 retractable towboat and an 11,000 horsepower (HP) class towboat.

High-Speed Engine Market, by Speed: Overview

The 1,500–1,800 rpm segment is projected to dominate the high-speed engine market during the forecast period. One of the primary factors supporting this growth is the wide range of product offerings by manufacturers. Companies such as AB Volvo, Caterpillar, Cummins, Man Energy, Mitsubishi, Rolls Royce, and Wartsila offer a variety of engine options in the 1,500–1,800 rpm category engine owing to the high demand for these engines in the marine and power industries. On the other hand, the growing demand for engines offering above 1,800 rpm from the power generation industry is projected to generate lucrative opportunities for the market growth during the forecast period.

High-Speed Engine Market: Competitive Landscape and Key Developments

AB Volvo; Caterpillar Inc.; Cummins Inc.; MAN Energy Solutions SE; Mitsubishi Heavy Industries Ltd; Rolls-Royce Holdings Plc; Weichai Heavy Machinery Co., Ltd.; Yanmar Holdings Co., Ltd.; and Doosan Infracore Co Ltd are among the key players profiled in the high-speed engine market report, which includes growth prospects owing to the current market dynamics and their foreseeable impact during the forecast period.

Inorganic strategies such as mergers and acquisitions are highly adopted by companies in the high-speed engine market. The market initiative is a strategy adopted by companies to expand their footprint across the world and to meet the growing customer demand. The market players present in the high-speed engine market are mainly focusing on product and service enhancements by integrating advanced features and technologies into their offerings.