Encapsulated Gaskets and Seals Market

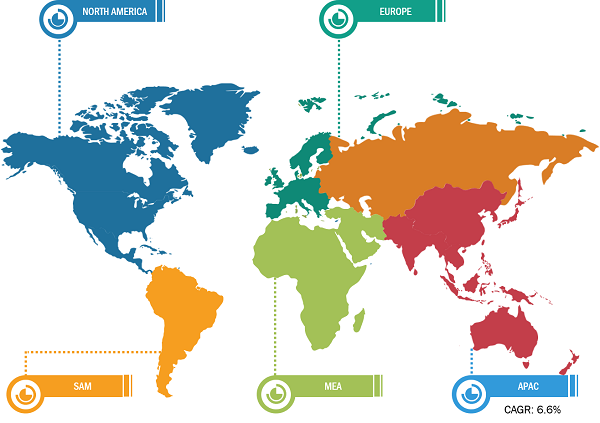

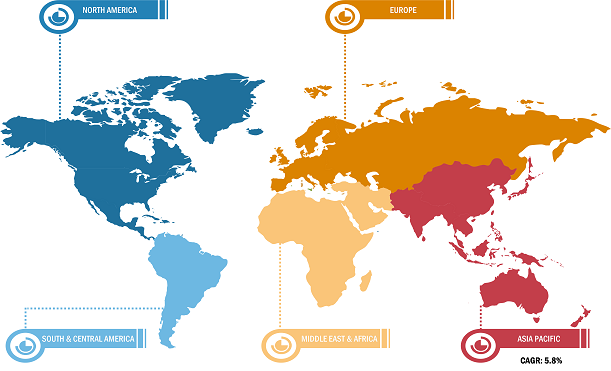

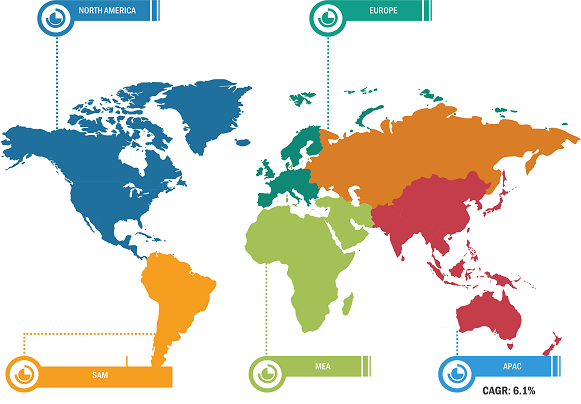

In 2022, Asia Pacific accounted for the largest portion of the global encapsulated gaskets and seals market share. The market in Asia Pacific has been propelled by burgeoning manufacturing sector, increasing industrialization, and rising emphasis on advanced sealing solutions. As countries in Asia Pacific continue to develop their infrastructures, the demand for reliable sealing components, such as encapsulated gaskets and seals, has surged across diverse applications, including automotive, electronics, and chemical processing. The Asia Pacific market is very dynamic, with various manufacturers introducing innovative encapsulated gaskets and seal solutions to address specific industry challenges. For instance, in response to the automotive sector’s demand for high-performance and durable sealing solutions, several companies have unveiled encapsulated gaskets and seals designed to withstand extreme temperatures and aggressive chemicals, and ensure long-term reliability in critical automotive components, is expected to bring new encapsulated gaskets and seals market trends in the coming years.

Increasing Demand from End-Use Industries Propels Encapsulated Gaskets and Seals Market Growth

Automated systems enhance efficiency, reduce production time, and minimize errors in application processes. The integration of smart sensors allows real-time monitoring of various parameters during the gasket application process. This includes monitoring material dispensing, production, and quality control, leading to improved product consistency and reliability. Precision manufacturing, machining, and molding technologies for the production of encapsulated gaskets and seals offer tight tolerances and improved dimensional accuracy. Advanced machining, such as Computer Numerical Control (CNC), enables the creation of intricate and complex designs. This precision in manufacturing is essential for producing gaskets with specific shapes and profiles tailored to the requirements of diverse industrial applications. Nanomaterials and robotics & automation, are some of the novel manufacturing technologies facilitating the expansion of the encapsulated gaskets and seals market share. Precision manufacturing facilities are designed to have quick changeover capabilities, allowing for the rapid transition between gasket specifications. Integrating technologies such as CNC systems, sensors, and high-precision actuators offers exceptional accuracy and precision. Thus, advancements in manufacturing technologies are among the factors contributing to the growing encapsulated gaskets and seals market size.

Encapsulated Gaskets and Seals Market: Segmental Overview

Based on material, the encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest share of the market in 2022, and the Teflon segment is expected to record the highest CAGR from 2022 to 2030. Teflon, a brand name for polytetrafluoroethylene (PTFE), holds a prominent position in the encapsulated gaskets and seals market due to its unique set of properties. Renowned for its non-stick nature, exceptional chemical resistance, and low friction characteristics, Teflon has become a sought-after material for applications where stringent sealing requirements are paramount. Its remarkable resistance to a wide range of chemicals, including corrosive substances and solvents, makes it an ideal choice for industries such as chemical processing and petrochemicals, where exposure to aggressive fluids is common. Moreover, Teflon’s non-stick properties reduce the likelihood of material buildup on the seals, ensuring consistent performance over time. The low coefficient of friction associated with Teflon facilitates ease of installation and enhances the efficiency of dynamic sealing applications. Its ability to operate effectively at both high and low temperatures adds to its versatility, making it suitable for diverse industrial settings. The encapsulation of Teflon further augments its durability, providing an additional layer of protection against wear and tear. All these factors are driving the Teflon segment growth in the encapsulated gaskets and seals market.

Based on end use, the encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022. Encapsulated gaskets and seals play a pivotal role in the oil & gas industry, where harsh operating conditions demand robust sealing solutions to ensure the integrity of equipment and prevent leakage. These specialized gaskets find extensive use in various components, such as valves and flanges, throughout the industry’s infrastructure, contributing to safety, reliability, and efficiency. In oil and gas exploration and production, encapsulated gaskets and seals are utilized in wellhead equipment, valves, flanges, and other critical connections. Their ability to withstand extreme temperatures, high pressures, and exposure to corrosive fluids makes them essential for maintaining effective seals in these challenging environments. Whether in offshore platforms or onshore facilities, these gaskets help prevent leaks that could lead to equipment failure or environmental hazards. Due to all these factors, the oil and gas segment dominates the encapsulated gaskets and seals market.

Impact of COVID-19 Pandemic on Encapsulated Gaskets and Seals Market

Before the COVID-19 pandemic, the encapsulated gaskets and seals market was mainly driven by the increasing use of these gaskets and seals in oil & gas, automotive, chemical, and pharmaceutical industries. However, due to the pandemic, governments of various countries across the globe imposed country-wide lockdowns that directly impacted the growth of the industrial sector. The shutdown of production facilities negatively impacted the encapsulated gaskets and seals market growth in 2020. The disruptions in the supply chain of these gaskets and seals resulted in increased costs in different regions. However, with the ease of lockdown measures, various industries regained momentum, which increased the demand for these gaskets and seals. Further, many economies began reviving with the resumption of operations in different sectors in 2021. As a result, the encapsulated gaskets and seals market is growing with the rise in demand from various sectors.

Encapsulated Gaskets and Seals Market: Competitive Landscape and Key Developments

Trelleborg AB, Marco Rubber & Plastics LLC, Gasco Inc, VH Polymers, AS Aston Seals SPA, Seal & Design Inc, MCM SPA, Polymax Ltd, Vulcan Engineering Ltd, and ROW Inc are among the key players profiled in the global encapsulated gaskets and seals market report. The market players focus on providing high-quality products to fulfill customer demand.

Key Developments

- In December 2023, Trelleborg AB, through its business area Trelleborg Sealing Solutions, has acquired MNE Group. MNE Group is a South Korean company that primarily focuses on manufacturing high-performance specialty seals for both the aftermarket and OE manufacturers of semiconductor production equipment.

- In January 2023, Seal & Design, Inc. acquired Rochester-based Chamberlin Rubber Company, a supplier of mass transit, industrial elastomers, and HVAC products.

- In November 2021, SAS Industries announced the acquisition of Specialty Rubber Corp, owing to which it significantly expanded its footprint in the gasket manufacturing industry.