Type-C Tanks Market

Increasing Number of Shipbuilding Contracts for New Fleet Expansion is Propelling the Type-C Tanks Market Growth

The rising trend of using LNG in marine and various end-use industries has surged the number of shipbuilding contracts and ventures for new fleet expansion. For instance, in 2023, GTT received two purchase orders for the tank design of three novel LNG carriers. The first two LNG carriers will be developed by the Korean shipyard HD Hyundai Heavy Industries for a European ship-owner. The third LNG carrier is to be built by the Hanwha Ocean for an Asian ship-owner. To cite another instance, in 2022, ADNOC Logistics & Services signed a Ship Building Contract to produce two 175,000 cubic meter LNG vessels that will be operational in 2025. Type-C tanks are insulated bi-lobe, tri-lobe, and cylindrical shaped tanks that can be fully or partly pressurized, provisional on the liquefied gas to be kept. Type-C tanks, in general, are found onboard small and mid-sized LPG carriers, along with small-scale LNG carriers. Thus, the growing number and advancement in the shipbuilding contracts for new fleets are boosting the type-C tanks market.

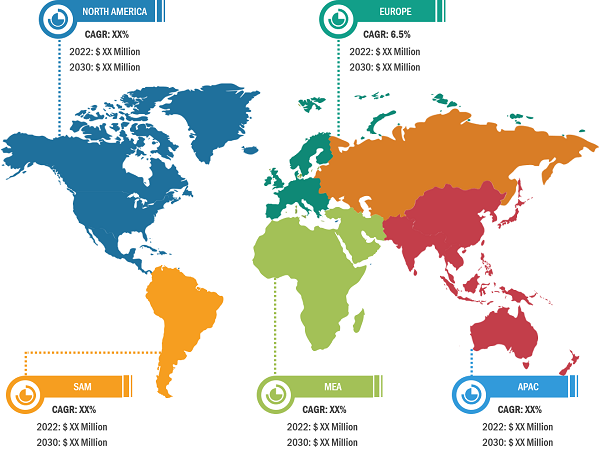

The scope of the type-C tanks market report encompasses North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, APAC dominated the overall type-c tanks market size in 2022. North America is the second-largest contributor to the global type-c tanks market, followed by Europe.

The growth of the type-C tanks market in the US is ascribed to a significant rise in dry natural gas production in the country, particularly due to advancements in horizontal drilling and hydraulic fracturing techniques. These techniques have revolutionized the extraction of natural gas from shale, sandstone, carbonate, and other tight geologic formations. In 2022, the dry natural gas production in the US reached a record high of ~36.35 trillion cubic feet (Tcf), with an average daily production of ~96.60 billion cubic feet. This production level was ~13% higher than the total natural gas consumption recorded in the US, indicating that domestic production fulfills the local demand. As the US continues to produce more natural gas, the type-C tanks market is expected to benefit from the need to process and optimize the transportation and storage of the abundant resource.

Type-C tanks play a crucial role in natural gas processing and various other applications. They are used to recover valuable natural gas liquids (NGL) from the gas stream and liquefy natural gas for transportation and storage.

Advancements in horizontal drilling and hydraulic fracturing techniques have unlocked vast reserves of natural gas in shale formations. These formations contain significant volumes of natural gas that can be extracted using production techniques such as directional drilling and hydraulic fracturing. The increased production of oil and gas from shale formations and other tight formations contributes to the overall growth of US dry natural gas production and creates opportunities for the type-C tanks market expansion.

Alberta, Canada’s largest oil and natural gas producer, also plays a significant role in the oil and gas industry. This province accounts for ~80% of the total oil production of the country, with vast deposits of both resources, including the oil sands in the northern area of the province. Approximately 22% of the total estimated revenue of the Government of Alberta came from the oil & gas sector in the fiscal year 2021–2022. Capital spending in oil sands reached US$ 7.3 billion in 2020, and the provincial government has received payments totaling US$ 66 billion over the last 10 years. Alberta recorded ~437,000 barrels of conventional oil production per day in 2019, while 2.84 million barrels of oil per day were produced from oil sands in 2021. Also, Canada produced ~5.75 billion cubic feet per day of natural gases in 2021. Natural gas production in Alberta reached ~10.1 billion cubic feet (bcf) per day in 2021. Hence, the increasing production of natural gas and the growing oil & gas industry in Canada drives the demand for type-C tank products.

Québec has abundant undeveloped natural gas resources, particularly in the southern flank of the St. Lawrence River, within the province’s portion of the Utica shale formation. Thus, the development of natural gas resources presents a growth opportunity for the type-C tanks market in Québec. Additionally, Québec is home to refineries that process oil for Canadian businesses and companies providing goods and services to the oil sands industry. Thus, the diversity of oil & natural gas industries across Canadian provinces is expected to contribute to the type-C tanks market growth in the country. As Canada continues to produce oil and natural gas, the demand for type-C tanks to ensure maximum safety in transportation is likely to increase.

Type-C Tanks Market Analysis: Application Overview

Based on application, the type-C tanks market is bifurcated into cargo tanks and fuel tanks. A fuel tank is a container impermeable to natural gas with adequate volume to store fuel to operate the engine for a required period. The shape, size, and material of a fuel tank are concluded by its application and type of stored fuel (CNG or LNG). The size of a fuel tank is limited by the weight permitted and the space accessible on a vehicle. Coatings for fuel tanks must inhibit contamination of the fuel by other materials or corrosion products in the coatings. They must also avoid corrosion damage to the tank. The coatings ought to be resistive to aromatic or aliphatic petroleum products. To stock up LNG, the cylindrical fuel tanks are fabricated of two metallic layers with a vacuum insulation layer in between. The inner cylinder is directly exposed to the cryogenic temperature of about −162 °C, at which natural gas stays in a liquid state. The inner layer ought to be fabricated of low-temperature and corrosion-resistant materials—aluminum, titanium, or stainless steel. The outer layer of the tank can be finished using less costly materials, such as carbon steel, but is ideally made of the same substance as the inner layer. The outer layer does not immediately contact LNG but is still hostile to the freezing temperature and is subjected to LNG accidentally owing to spillage and leakage. Besides, utilizing the same material aids to ease the design to tackle thermal contraction and expansion, and lowers the inventory and manufacturing budget.

Type-C Tanks Market: Competitive Landscape and Key Developments

MAN Energy Solutions SE, GAS and HEAT S.p.A.; China International Marine Containers; CSSC CHENGXI(TAIZHOU); Watts Energy; C-LNG Solutions Pte. Ltd; Gloryholder Liquefied Gas Machinery (DL) Co.; Ltd, Dongsung FineTec; Arıtaş, Cryonorm System B.V; Cryostar, Furuise Europe; LAPESA GRUPO EMPRESARIAL; Chart Industries; and Corban Energy Group are among the key players covered in the type-C tanks market report. The market report includes growth prospects owing to the current type-C tanks market trends and their foreseeable impact. Inorganic and organic strategies are highly adopted by companies in the type-C tanks market. The companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.