Alfalfa Hay Market

Alfalfa hay is widely used as a protein and energy source for livestock animals, especially cattle, sheep and lambs, turkey, chicken, equine, and small pet animals such as rabbits, guinea pigs, and hamsters. Alfalfa, also known as lucerne, is a leguminous plant from the pea family. It has a high concentration of vitamins A, C, D, E, K, and B. Alfalfa hay is also a rich source of calcium, protein, and minerals. Ruminant feed, equine feed, poultry feed, and pet food are a few of the common applications of alfalfa hay. Adding alfalfa hay to animal diets helps meet their daily nutritional requirements and boosts their performance. The alfalfa hay market report emphasizes the key driving factors such as health benefits associated with alfalfa hay and increasing scales of livestock production.

Based on application, the alfalfa hay market is segmented into ruminant feed, equine feed, poultry feed, and others. In terms of revenue, the ruminant feed segment dominated the alfalfa hay market share in 2022. The equine feed segment is expected to register the highest CAGR during 2022–2030. Alfalfa hay is renowned for its high protein content, which is essential for muscle development, maintenance, and repair mechanisms in equines, particularly for those reared for demanding activities such as racing or show jumping. Additionally, its rich calcium content promotes bone development and strength, and skeletal integrity in horses, which is crucial for soundness and performance. Its digestible fiber content supports healthy digestion and gut function, reducing the risk of colic and other digestive disorders. For example, offering alfalfa hay as part of a balanced diet can help prevent ulcers in horses that are prone to gastric issues; this can be attributed to the hay’s buffering effect on stomach acids. As horse owners increasingly prioritize nutrition to enhance performance, health, and longevity in their equine companions, the demand for alfalfa hay in the equine feed industry continues to surge.

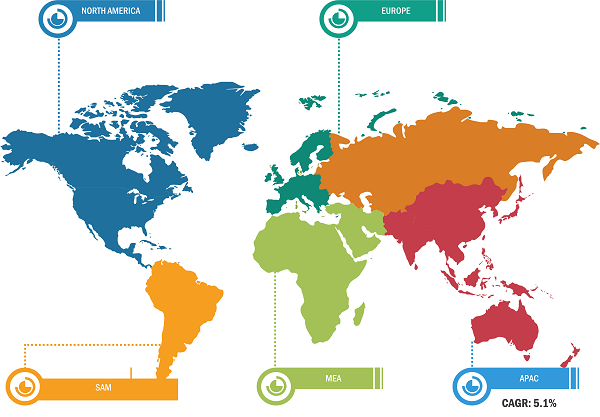

Asia Pacific is projected to register the fastest CAGR from 2022 to 2030. It is the world’s largest producer of animal feed. The region is home to some of the major livestock/animal farming countries. India houses the largest livestock population. Thus, there is huge potential for alfalfa hay in India. However, the country reports low alfalfa consumption due to limited production of alfalfa, the presence of an unorganized market, and minimal awareness about this feed component. Asia Pacific accounts for the largest human population among all the key regions in the world; it is home to ~60% of the global population. This reflects a prominent demand for meat and dairy products, leading the region to large-scale livestock production and subsequently propelling the need for animal feed. Further, the increasing consumption of poultry and pork as sources of protein—coupled with the changing food habits of the middle-class population and increasing inclination toward more plentiful and affordable protein products—boosts the demand for animal feed products, thereby benefiting the alfalfa hay market. Thus, the alfalfa hay market growth is positively impacted by the growing livestock industry and the subsequently increasing scales of animal feed production.

Preference for Organic Alfalfa Hay to Contribute to the Growing Alfalfa Hay Market Size

Organic alfalfa hay is produced without synthetic fertilizers, pesticides, or genetically modified organisms (GMOs), adhering to strict standards and regulations. Thus, dairy farms, the poultry sector, and animal husbandry have shifted their focus to purchasing high-quality organic feed, such as organic alfalfa hay. In addition, organic alfalfa hay opens up export opportunities for producers looking to access international markets with stringent organic certification requirements. Countries such as Japan, Europe, and the US have established organic certification programs and import regulations for organic agricultural products. By obtaining organic certification for their alfalfa hay, farmers can access these lucrative export markets and capitalize on the growing global demand for organic feed options.

Conventional feed often contains high quantities of chemicals that hamper meat quality. Long-term consumption of such meat products may result in various health disorders in consumers. Thus, consumers often find organic and natural products as healthier alternatives. As a result of the inclination toward organic products, manufacturers invest heavily in products produced with organic counterparts.

Alfalfa Hay Market: Segmental Overview

Based on type, the alfalfa hay market is segmented into alfalfa hay bales, alfalfa hay pellets, alfalfa hay cubes, and others. The alfalfa hay bales segment dominated the alfalfa hay market share in 2022. The alfalfa hay pellets segment is projected to register a significant CAGR from 2022 to 2030. Hay pellets are a compressed form of alfalfa hay, created by grinding and compressing the hay into small, dense pellets. These pellets offer several advantages over traditional baled alfalfa hay, including reduced storage space requirements, decreased dust and waste, and improved ease of handling and transportation. These practical benefits and convenience in feeding livestock contribute to the demand for alfalfa. Moreover, alfalfa hay pellets have a longer shelf life than baled hay, making them a preferred option for farmers seeking to stockpile feed for extended periods. The pellets’ consistent nutrient content and palatability make them an attractive choice for livestock owners looking to ensure a balanced diet for their animals. With increasing emphasis on efficiency and convenience in modern agricultural practices, alfalfa hay pellets are witnessing a growing demand across the global livestock industries.

Alfalfa Hay Market: Competitive Landscape and Key Developments

The alfalfa hay market analysis is carried out by identifying and evaluating key players in the market across different regions. Green Prairie International Inc, Douliere Hay France SAS, SL Follen Co, Anderson Hay & Grain Co Inc, Standlee Premium Products LLC, M&C Hay LLC, The Gombos Co LLC, Al Dahra Holding LLC, Ward Rugh Inc, and Alfalfa Monegros SL are a few companies profiled in the alfalfa hay market report. Players operating in the market focus on providing high-quality ingredients at affordable prices to fulfill customer demand.

Key Developments

- In October 2021, Al Dahra Holding opened 5 new plants for animal feed in Serbia, Romania, and Bulgaria in an attempt to expand its operations globally. The new plants included 12 production lines capable of producing 500,000 tons of clover per year and more than 15 different types of feed and concentrated grains.