Shrink and Stretch Sleeve Label Market

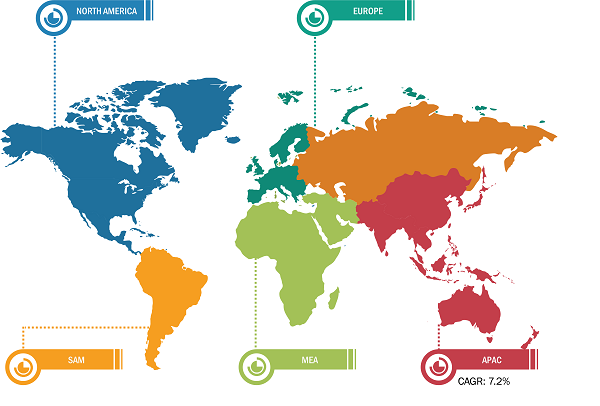

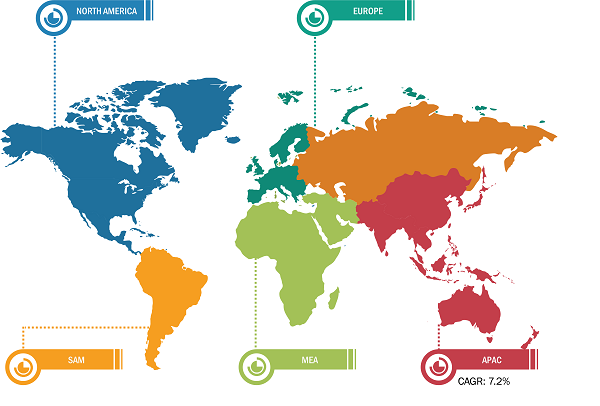

In 2022, Asia Pacific dominated the global shrink and stretch sleeve label market. The food packaging sector in Asia Pacific is large and highly fragmented. The convenience food market in the region is growing steadily and transforming the Asian food industry. The evolution of convenience retail markets in the Asia Pacific, including supermarkets, independent convenience stores, forecourt sites, discounters, and bakeries, has driven the stretch and shrink-sleeve label market. As part of the new developments in Asia Pacific, consumers prefer convenient food products and packaged food items for immediate consumption, and distributors work to meet their demands. Asia Pacific’s status as a popular tourist destination and people’s desire to consume outside food boost sales of packaged food products in the region. In addition, consumers in the region prefer online shopping due to their actual packaging. Thus, many manufacturers in industries such as dairy, alcoholic drinks, and other beverages have increased the use of beverage metal cans. Many international players have a strong position in the carbonated soft drinks segment. Hence, the strong presence of the beverages industry in Asia Pacific propels the demand for stretch and shrink-sleeve labels across the region.

Growing Demand for Sleeve Labels from the Food and beverage Industry Drives Shrink and Stretch Sleeve Label Market Growth

Shrink and stretch sleeve labels provide 360-degree coverage for vibrant and visually appealing graphics. The labels allow brands to differentiate their products through creative packaging designs and label shapes. These labels are tamper-evident and ensure the integrity of packaged products. The food & beverage industry is highly competitive, and shelf appeal plays a significant role in food and beverage demand. Portable and single-serve packaging are gaining popularity in the industry. Brands use shrink and stretch sleeve labels to create packaging solutions that cater to changing consumer lifestyles. The food & beverage industry is also exploring environment-friendly packaging solutions.

The food & beverage industry is characterized by constant innovation and the introduction of new products. The demand for convenience food and beverage products is also growing rapidly. In 2022, Danone Yogi Sip launched a range of limited-edition bottles with sustainable packaging printed with a flexo solvent press. The company procured polyethylene terephthalate sleeves from the label supplier, MCC (the US). The sleeve has a double-lane micro perforation strip for easy removal of the sleeve from the bottle. According to the French Ministry of Agriculture’s Statistics Department, the French wine production is estimated as 46 million hectoliters in 2023. The growing production and sales of alcoholic beverages drive the demand for shrink and stretch sleeve labels across the world. The demand for dairy products, sparkling water, jams and jellies, soft drinks, seltzers, and ready-to-drink cocktails is on the rise in Global. Shrink and stretch sleeve labels are used for labeling on bottles, cans, and other packaging materials.

Shrink and Stretch Sleeve Label Market: Segmental Overview

Based on material, the market is segmented into polyvinyl chloride, polystyrene, polyethylene terephthalate, polyethylene, and others. Polyvinyl chloride is a versatile thermoplastic polymer known for its clarity, flexibility, and cost-effectiveness. It is often preferred for its ability to efficiently conform to the shape of packaging when heat is applied during the shrinking process. It offers a substantial shrink ratio. In the case of stretch sleeve labels, polyvinyl chloride is employed for its flexibility and durability. Based on product type, the market is bifurcated into shrink sleeves and stretch sleeves. Shrink sleeves are made from flexible plastic material that shrinks tightly to the contours of the packaging when exposed to heat. Shrink sleeves are typically made from materials such as polyvinyl chloride, polyethylene terephthalate, or other plastic films. Based on printing technology, the market is segmented into flexographic, digital printing, rotogravure printing, and others. Flexographic printing technology is known for its high-quality printing and cost-effectiveness. Therefore, the technology is a preferred choice for shrink and stretch sleeve label manufacturing. It is a repeatable process suitable for high-volume label production and adapts to various film types and thicknesses commonly used in sleeve production. Based on the end-use industry, the market is segmented into food and beverages, pharmaceuticals, chemicals, consumer goods, personal care and cosmetics, automotive and transportation, and others. Stretch and shrink-sleeve labels play a crucial role in the food & beverages industry, serving both functional and marketing purposes. Stretch and shrink-sleeve labels are widely used in food and beverage products such as juices, energy drinks, and alcoholic beverages. The protective seal of these labels prevents food and beverage products from being opened intentionally or unintentionally.

Impact of COVID-19 Pandemic on Shrink and Stretch Sleeve Label Market

Before the COVID-19 pandemic, many countries reported economic growth. Shrink and stretch sleeve label manufacturers invested in research to develop advanced technology and improve production efficiency. Major market players also focused on geographic expansion through merger and acquisition strategies to cater to a broad customer base. The chemicals & materials industry announced a slowdown of manufacturing operations and shutdown, as well as projected a slump in shrink and stretch sleeve label sales after the emergence of the COVID-19 outbreak. Thus, major companies involved in shrink and stretch sleeve label production faced the hardest hit during the initial phase of the pandemic due to sudden government restrictions on the manufacturing of nonessential commodities. In 2021, several chemicals & materials companies began recovering from the losses incurred in 2020 with the revival of production operations. Manufacturers were permitted to operate at full capacities, which helped them cope with the demand and supply gap. With economies reviving their operations, the demand for shrink and stretch sleeve labels started rising across the world as the industry resumed its operations at full capacity.

Shrink and Stretch Sleeve Label Market: Competitive Landscape and Key Developments

CCL Industries Inc., Huhtamaki Oyj, Berry Global Group Inc., Amcor Plc, Coveris Management GmbH, Stratus Packaging SAS, KP Holding GmbH & Co KG, Fuji Seal International Inc, Oerlemans Plastics BV, Maca Srl are a few players operating in the global shrink and stretch sleeve label market. Players operating in the global shrink and stretch sleeve label market focus on providing high-quality products to fulfill customer demand.