Sewer Machine Market

The key stakeholders in the sewer machine market are manufacturers, rental service providers, and end users. The manufacturer offers various types of sewer machines to its customers. The manufacturers are highly focused on expanding their customer base by offering innovative sewage cleaning machines. The key players in the sewer machine market are Vactor Manufacturing, Van-con Inc., GapVax Inc., and RIVARD, among others. End users of the sewer machine market procure these types of machinery directly from the manufacturers, or they choose rental service providers. End users in the sewer machine market include municipalities and contractors. Some of the rental service providers operating in the sewer machine market ecosystem include Jack Doheny Companies; Joe Johnson Equipment; and United Rentals, Inc.

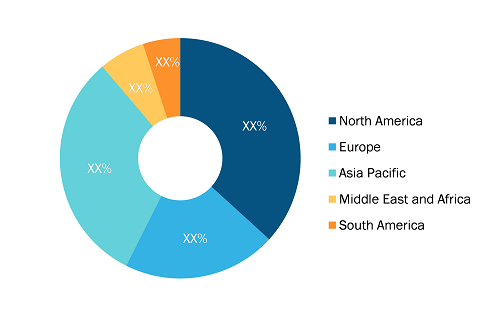

The scope of the sewer machine market report includes North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America). In terms of revenue, North America accounted for the largest sewer machine market share in 2022. Europe is the second-largest contributor to the global sewer machine market size, followed by APAC. The government of Canada has initiated programs such as New Building Canada Plan (NBCP), the Affordable Housing Initiative (AHI), and Made in Canada, which are anticipated to support the growth of the construction market in Canada. The government also unveiled the country’s first-ever National Housing Policy in 2017—a 10-year US$ 40-billion initiative to help Canadians find housing that meets their needs and can afford it. Furthermore, the government has recognized wastewater as one of the major threats to the quality of Canadian waters. The wastewater utilities fail to meet the requirements of the increasing population due to aging systems and the considerably small size of the sewage treatment systems. Several systems are poorly managed and are operated by inexperienced staff. For instance, Toronto initiated a wastewater system project worth US$ 3 billion, intended to stop raw sewage from leaking during the rainy season. As per the Toronto Water Department official, the project is likely to be completed by 2038; until then, the city has to fund itself. If the federal government and province agree to help, then it would get completed by 2030. Thus, to avoid such challenges, the government should focus on spending on sewer machines; such investments would help provide clean sanitation facilities.

Increasing Government Spending on Procurement of Sewer Cleaning Machines Drives Sewer Machine Market Growth

The rising investment of different governments for the procurement of sewer cleaning machines is among the major factors supporting the sewer machine market growth across different regions. With the rise in urbanization across emerging countries, the adoption of new types of machinery, such as sewage cleaners, drain management machines, and other required equipment, is also rising. Governments across emerging economies have been pushing their respective investment limits to support their municipal departments with better equipment that also allows them to keep their respective cities cleaner. Some of the major procurements of sewer machines are mentioned below:

- In August 2023, Chennai’s (in India) water and sewerage agency (which has 537 sewer machines wherein 220 machines are more than 8 years old) has requested the state administration for the procurement of 66 new sewer machines worth US$ 6.6 million.

- In September 2023, the National Safai Karamcharis Finance and Development Corporation (NSFKDC) of Puducherry granted approval to Public Works Department (PWD) in order to extend loan for procuring mechanized sewer cleaning machines under the Swachhta Udyami Yojana (SUY) scheme.

- In July 2023, the Gatesville City Council in the US (Texas) announced its approval for the purchase of a trailer-mounted sewer machine worth US$ 87,642.64.

Such procurements and initiatives have been pushing the adoption of sewer cleaning machines across different regions and are expected to generate new opportunities for sewer machine market vendors in the coming years.

Sewer Machine Market Analysis: Tanker Capacity Overview

Based on tanker capacity, the global sewer machine market is segmented into less than 500 gallon, 500‒1300 gallon, and greater than 1300 gallon. The greater than 1300 gallon segment held the largest share in the sewer machine market in 2022. Municipalities or contractors typically employ sewer machines with a capacity larger than 1300 gallons for large projects. Sewage cleaning operations use an extensive pipeline network, such as cleaning a city’s main sewer line with large tank capacity sewer machines. Tanks with a capacity of 1300 gallons require a lot of care; therefore, the cost of purchasing and maintaining them is high. As a result, their adoption is limited to large businesses. The demand for various sorts of machines lowers the procurement pricing element. The ability of a sewer machine with a capacity of more than 1300 gallons to clear a large volume of sewage in a short time attracts end users. The need for sewage machines with a capacity larger than 1300 gallons is predicted to rise in the following years, owing to ongoing procurement in APAC and MEA countries, primarily for development purposes. These factors are anticipated to drive the demand for sewage machines with a capacity larger than 1300 gallons among contractors and construction businesses during the projected period. Several regional manufacturers are emerging in various countries, enabling end users to procure sewer machines of the required capacity.

Sewer Machine Market: Competitive Landscape and Key Developments

American Jetter; Gapvax, Inc.; Gradall Industries, Inc.; Jack Doheny Companies; Rivard; Sewer Equipment Co. of America; Spartan Tool Inc.; Vac-con, Inc.; Vactor Manufacturing, Inc.; and Veolia are among the key players covered in the sewer machine market report. The sewer machine market report includes growth prospects owing to the current market trends and their foreseeable impact during the forecast period.