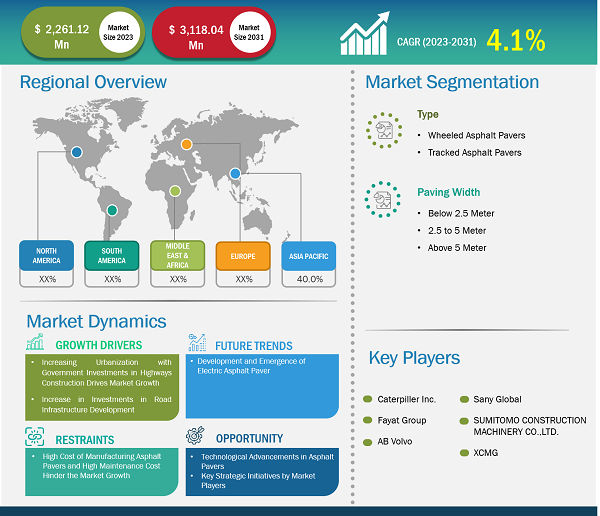

Asphalt Paver Market

Development and Emergence of Electric Asphalt Paver to Emerge as Asphalt Paver Market Trend in Future

The construction industry, associated with noise, emissions, and environmental impact, is undergoing a shift toward sustainability and a lower carbon footprint in response to the global call for greener building practices. Electric asphalt pavers can offer various benefits, such as reduced carbon emissions, reduced noise, and low maintenance costs. Several key companies in the market are engaged in the development of electric asphalt pavers. In April 2023, LeeBoy developed and introduced the first electric asphalt paver, named 8520C E-Paver, as a prototype model. This product is developed by the use of General Motors’s (GM’s) electric drive system. The prototype model runs on a 48-kWh battery and 150 kW electric drive motor.

In October 2022, Dynapac, the renowned construction equipment developer, announced the launch of SD1800W e with the electric drive system consisting of a highly efficient 3-phase permanent magnet synchronous motor. Hence, such initiatives toward the development of electric asphalt pavers are expected to be the key future trends in the asphalt paver market during the forecast period.

The scope of the global asphalt paver market report entails North America, Europe, Asia Pacific, and the Rest of World. Germany, France, Russia, Italy, and the UK are among the major countries in the market in Europe. These countries are known for their strong focus on the development of the construction sector in Europe. Developed economies in Europe are emphasizing the use of advanced construction equipment to boost operational efficiency and precision. Several European nations have set elaborate targets for expanding highways and ports to boost the country’s connectivity. The European Investment Bank offered US$ 1.3 billion in financing to Autostrade per l’Italia SpA to upgrade ∼ 3,000 km of Italian motorways. At least US$ 867 million of the EIB funds are generated by InvestEU for the development of the construction sector. The Council of Ministers implemented the Poland Government’s National Road Construction Programme in December 2022, which includes the construction of ∼ 2,500 km of new motorways, roads, and expressways. The program is likely to fund over US$ 74 billion by 2033 for these construction works. Thus, a significantly preoccupied construction sector in Europe generates a huge demand for asphalt paver machines, which bolsters the asphalt paver market size.

In 2023, Fayat Group collaborated with VINCI Construction to carry forward a low-carbon roadworks project by utilizing electric equipment. In 2023, the Ammann Group collaborated with Volvo Construction Equipment (Volvo CE) and signed an agreement to acquire Volvo CE’s global ABG Paver Business, including its ABG facility in Hameln, Germany. Thus, the notable presence of asphalt paver manufacturers and their efforts toward product innovation are steering the growth of the asphalt pavers market in Europe.

According to the Hauptverband Deutsche Bauindustrie (HDB), a German construction industry association, the construction industry is anticipated to contribute substantially to Germany’s GDP in the coming years. The expansion of this industry is majorly credited to a surge in commercial infrastructure construction projects, including highways and bridges, which can be attributed to the fact that this country is one of the key tourist destinations in Europe. In 2023, Germany’s Deutsche Bahn started the construction of the 88 km railway between Germany and Denmark. In March 2024, the German government announced that it is set to provide ~US$ 325 million in expansion of its North Sea port of Cuxhaven, with funds of ~US$ 100 million. Nonetheless, Germany has been witnessing a constant decline in terms of construction spending, mainly due to weak economic growth along with higher financing and construction costs. German construction spending is likely to witness a decline of nearly 4.2% in 2024. Despite this decline, the construction sector in Germany is expected to witness a growth of more than ~3% by 2025, which would continue to provide conducive conditions for asphalt paver providers in the coming years.

Asphalt Paver Market Analysis: Paving Width Overview

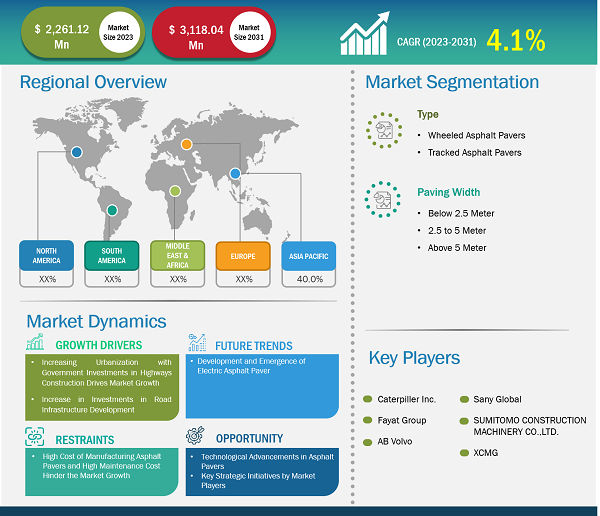

The preference for asphalt is rising owing to its advantages in rehabilitation or reconstruction work. Asphalt road construction requires less time than concrete pavement roads. They have smooth surfaces and reasonable replacement cost. The rise in demand for asphalt pavers in intercity roads and highway construction applications drives the asphalt paver market size. By paving width, asphalt paver market is segmented into below 2.5 meter, 2.5 meter to 5 meter, and above 5 meters.

The above 5-meter segment held the largest asphalt paver market share in 2023. Asphalt pavers with a width above 5 meters are increasingly used in large construction projects of interstates, highways, expressways, superhighways, and others. Asphalt pavers having a width above 4 meters are expected to witness high demand owing to the rise in building and construction of national highways, expressways, and others across the globe. The increase in the adoption of asphalt paving machines in the developing and developed regions, including Asia Pacific, the Middle East & Africa, and South America, bolsters the asphalt paver market growth for the above 5-meter segment.

The 2.5 meters to 5 meters segment held the second largest asphalt paver market share in 2023 and is anticipated to maintain its dominance from 2023 to 2031. Several asphalt pavers are currently being developed in the range of 2.5 meter to 5 meter that use electric power instead of diesel power and have the potential to reduce carbon emissions. A number of asphalt paving companies are currently working on prototypes. In the Netherlands, test road sections have already been paved. Electric asphalt pavers offer the advantage of lower noise and exhaust emissions for use in urban areas. Also, emission regulations have become stringent in Europe and North America. Paver companies plan to offer solutions to contractors who face restrictions on the use of diesel equipment. In addition, the new machines are expected to benefit contractors carrying out underground car park work or road tunnel installation. In November 2023, LeeBoy collaborated with Portable Electric for the development of advanced electric asphalt pavers. Such initiatives by the key market players fuel the asphalt paver market growth.

Asphalt Paver Market: Competitive Landscape and Key Developments

AB Volvo, Astec Industries Inc., Caterpillar Inc., Sany Heavy Industry Co Ltd., Sumitomo Corp., S.P Enterprise, XCMG Construction Machinery Co Ltd., Deere & Co, FAYAT GROUP, and Leeboy are among the key players covered in the asphalt paver market report. Companies in the market mainly focus on product and service enhancements by integrating advanced features and technologies into their offerings.